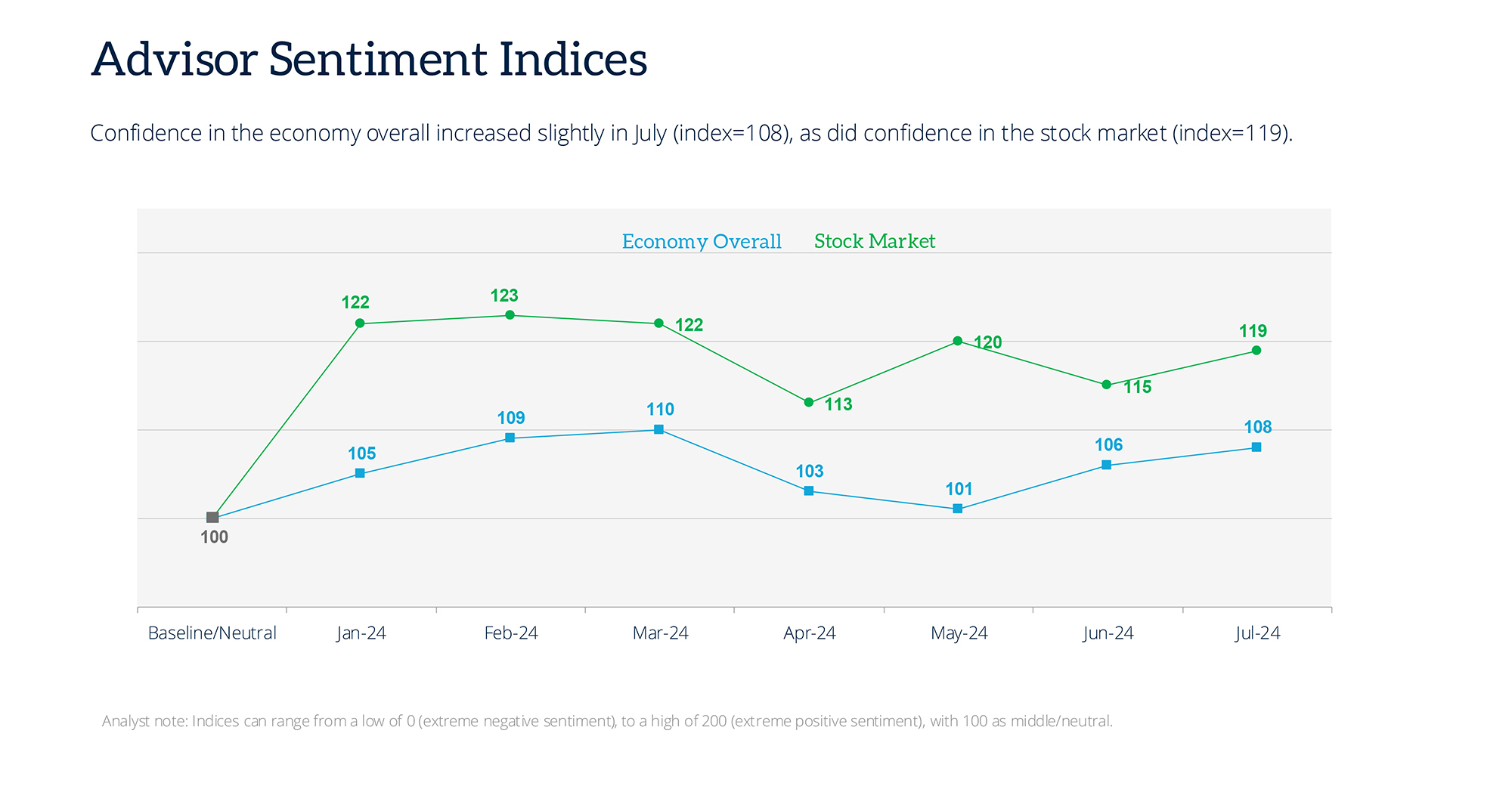

The latest monthly WealthManagement.com Advisor Sentiment Index for July indicates a slight increase in financial advisors' confidence in the overall economy and the stock market.

The Economic Confidence Index rose to 108 in July, up from 106 in June, while the Stock Market Confidence Index climbed.

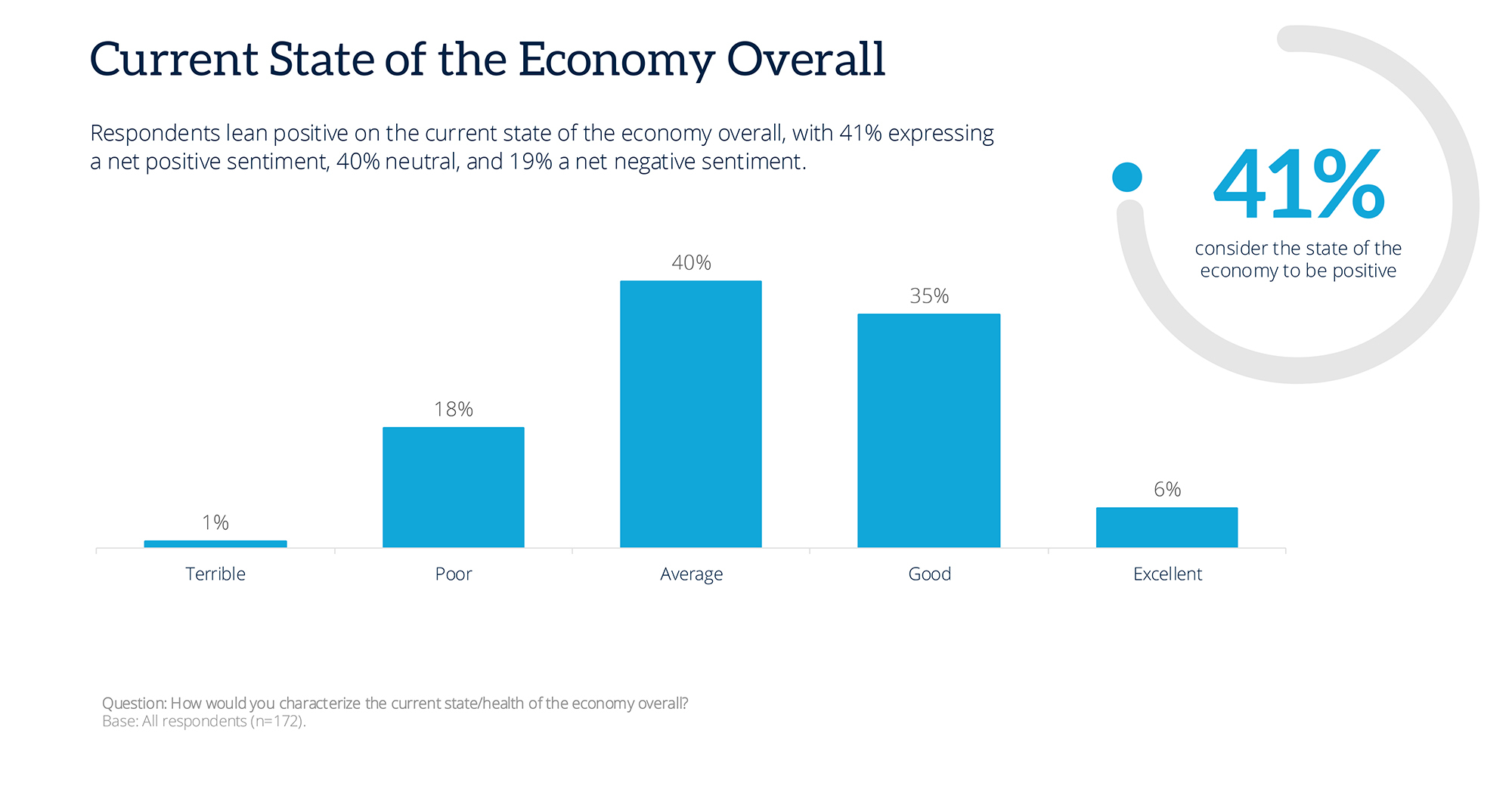

Despite this uptick in sentiment, advisors remain cautious. Only 41% of respondents view the current state of the economy positively, with 40% remaining neutral and 19% holding a negative outlook.

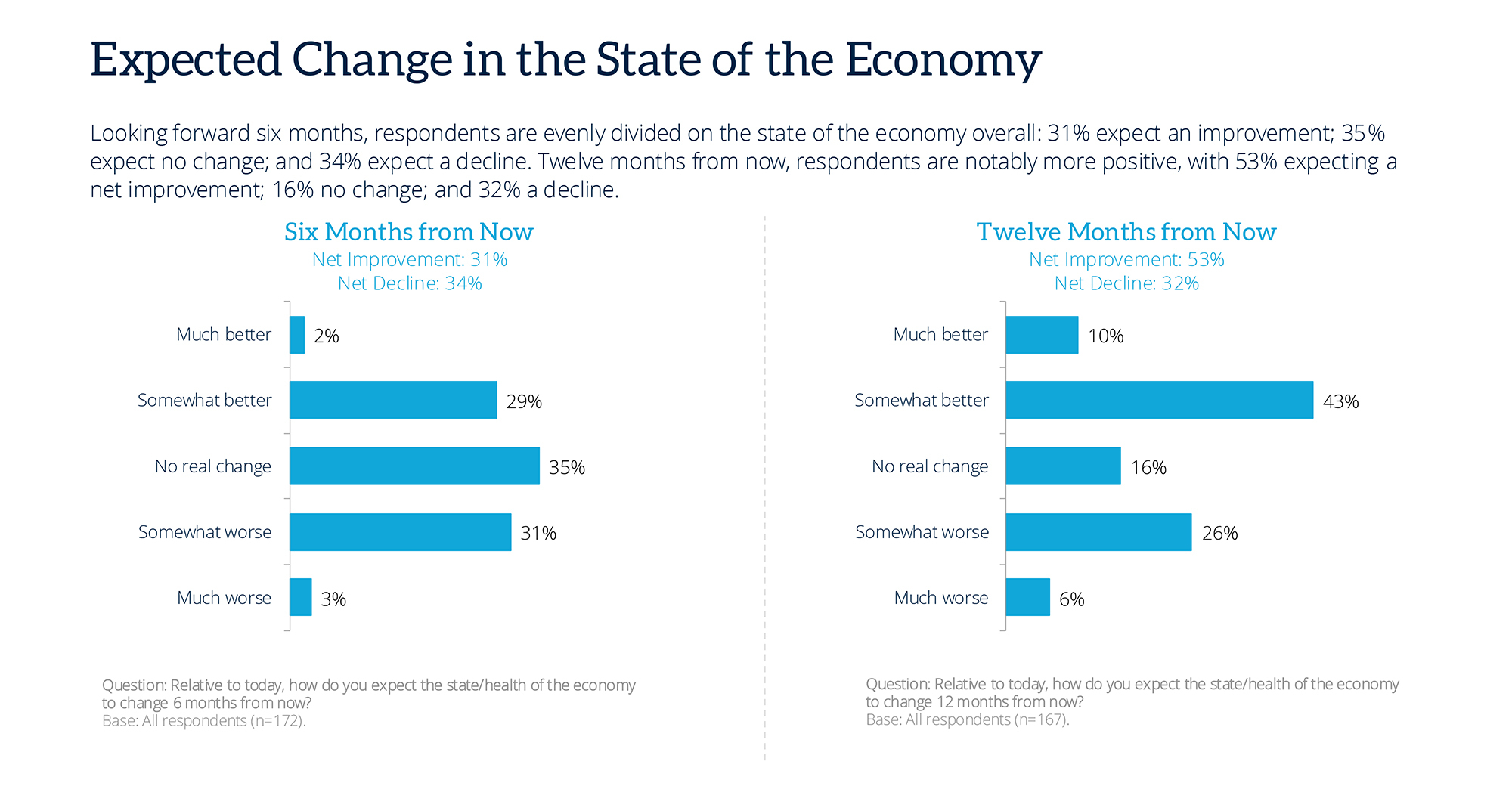

Looking ahead, expectations for economic improvement are mixed; while 31% anticipate an improvement in the next six months, 34% expect conditions to worsen. However, optimism grows over a 12-month horizon, with 53% predicting an economic upturn.

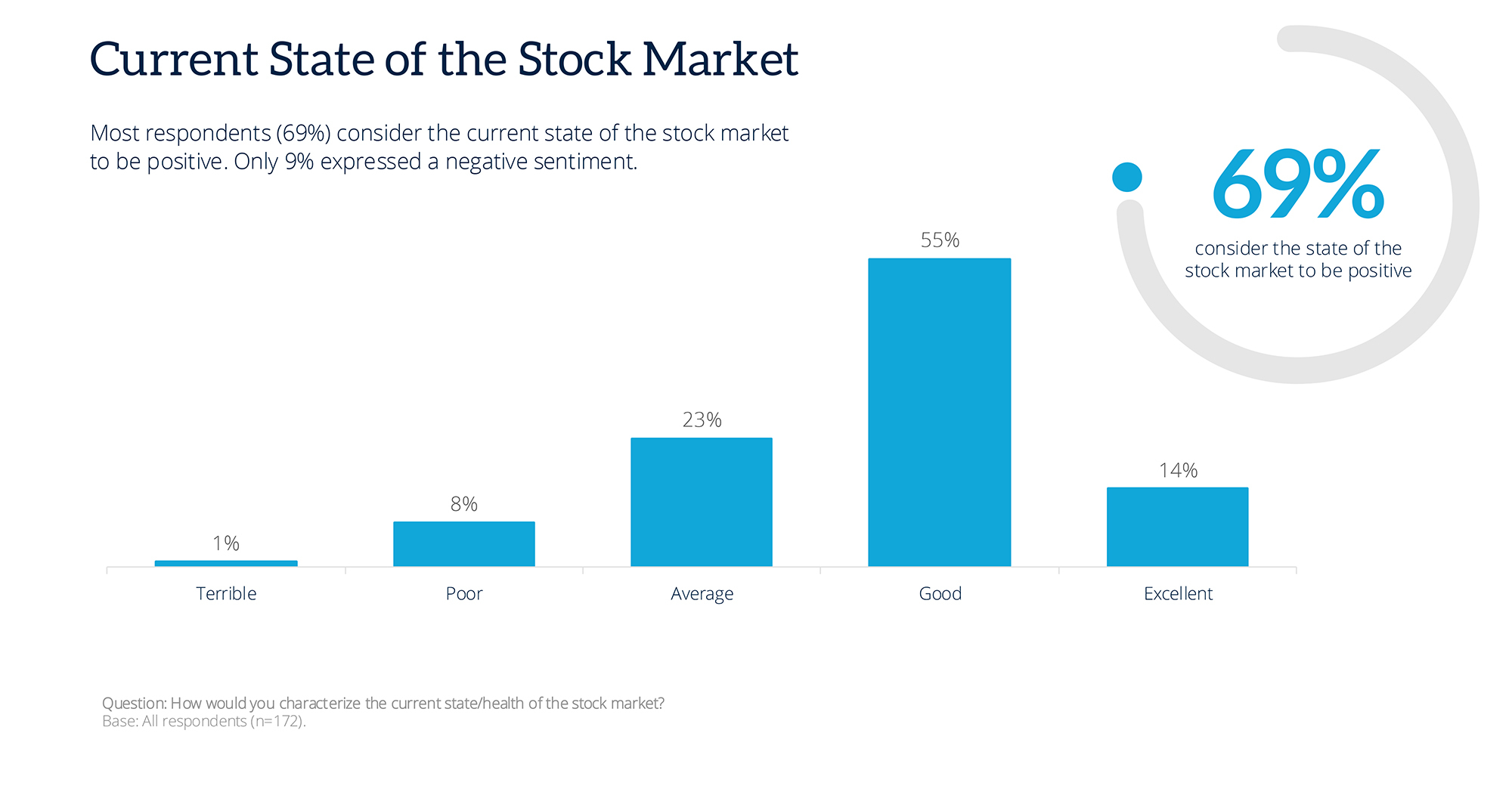

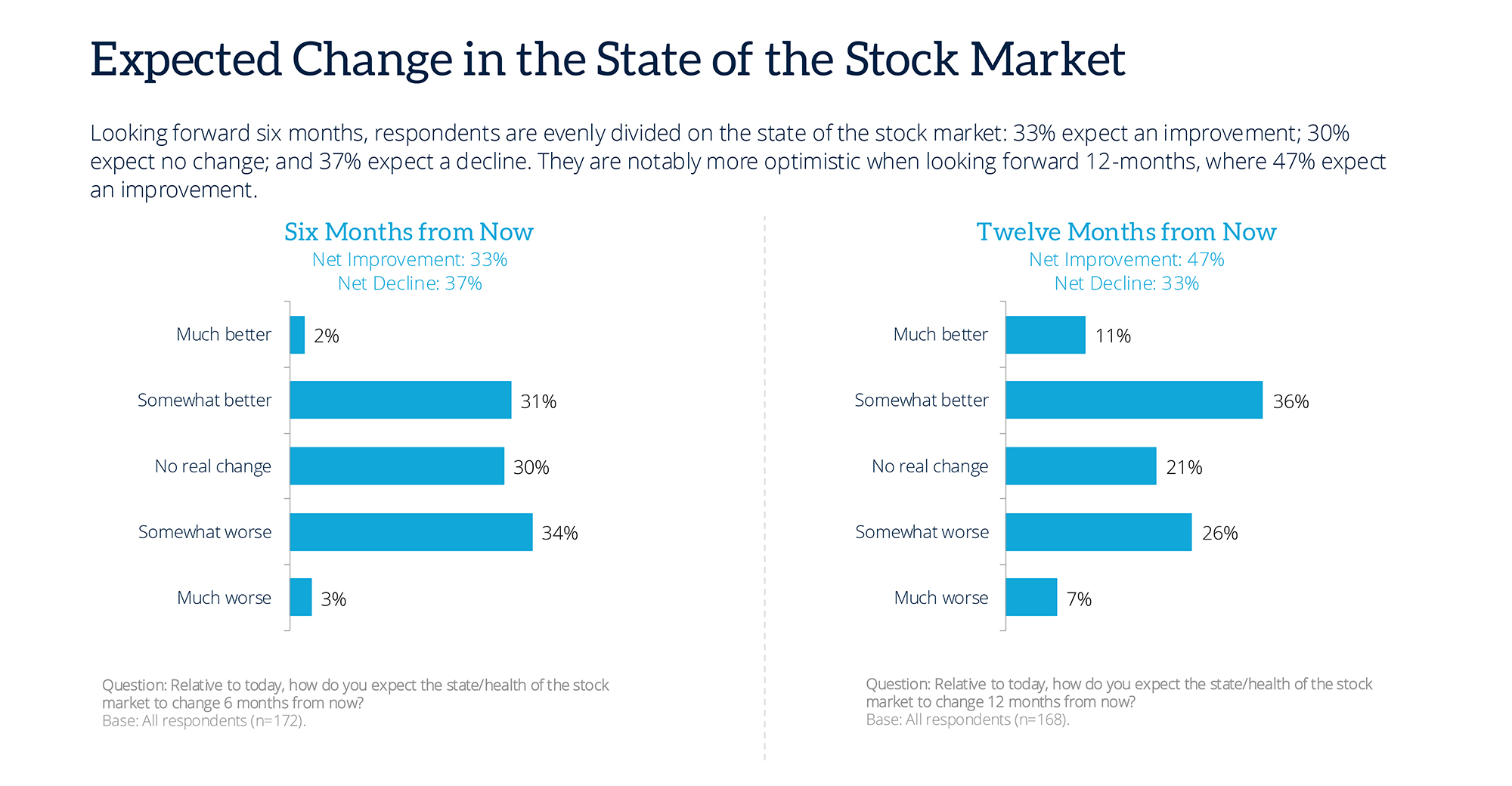

Sentiment towards the stock market is more favorable, with 69% of advisors currently rating it positively. However, expectations for the market's trajectory over the next six months are divided, with 33% expecting improvement, while 37% foresee a decline. Confidence increases over the next year, with 47% predicting a stronger market.

These findings highlight the ongoing uncertainty and mixed sentiments among financial advisors, reflecting broader concerns about the economic outlook and market stability.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.