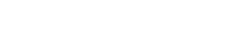

In the weeks leading up to the Nov. 5 election that would sweep Donald Trump back into office, financial advisor sentiment around both the economy and the stock market rose, nearly matching year-to-date highs, according to Wealthmanagement.com’s monthly Advisor Sentiment Index.

Sentiment over the economy climbed seven points higher to 110, indicating a broadly positive view of the health of the job market, business activity and other economic drivers. (A reading of 100 equals a completely neutral view.) The level of positive sentiment on the economy, while still more muted than feelings around the equity market, has not been higher since March of this year.

Almost half (45%) of surveyed advisors said the economy was “good” or “excellent”, with only 19% holding a contrarian view. (37% were neutral.)

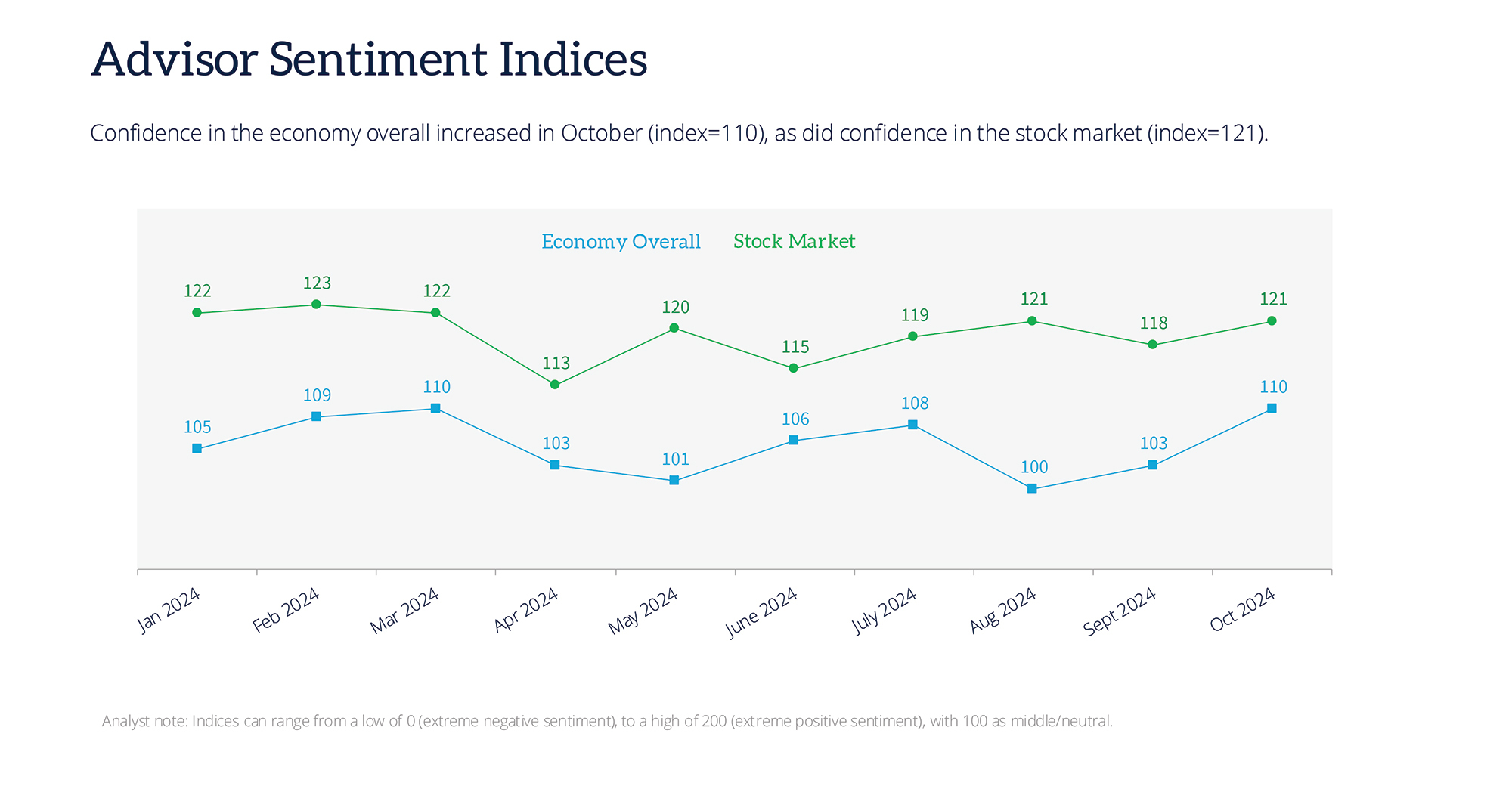

Interestingly, given the survey's recorded sentiment before the outcome of the recent election was known, more advisors predicted the health of the economy would improve over the next year. Over half (52%) believe they will hold a positive view of the economy by this time next year, compared to one-in-four (26%) who predict a more pessimistic view.

When asked to expand on their views, advisors seemed to base their answer in part on inflation’s trajectory. Many are worried about a re-acceleration, while others are more optimistic about its control. While the recent turn toward interest rate cuts are viewed as a stimulus, persistent cost-of-living pressures (e.g., food and energy prices) continue to strain consumers.

Advisors highlighted persistent government deficits and rising debt as warning signs muting their optimism about the economy.

Confidence in the equity markets also climbed during the month, up three points to 121. Most respondents (70%) consider the current state of the stock market to be positive. Only 6% expressed a negative sentiment.

That reflects a sustained positive view on the current state of markets among advisors held throughout much of the past year, with only a minor downturn over the summer. While the S&P 500 hovered flat for most of October, the broad equity index was up 25% year-to-date headed into the November election.

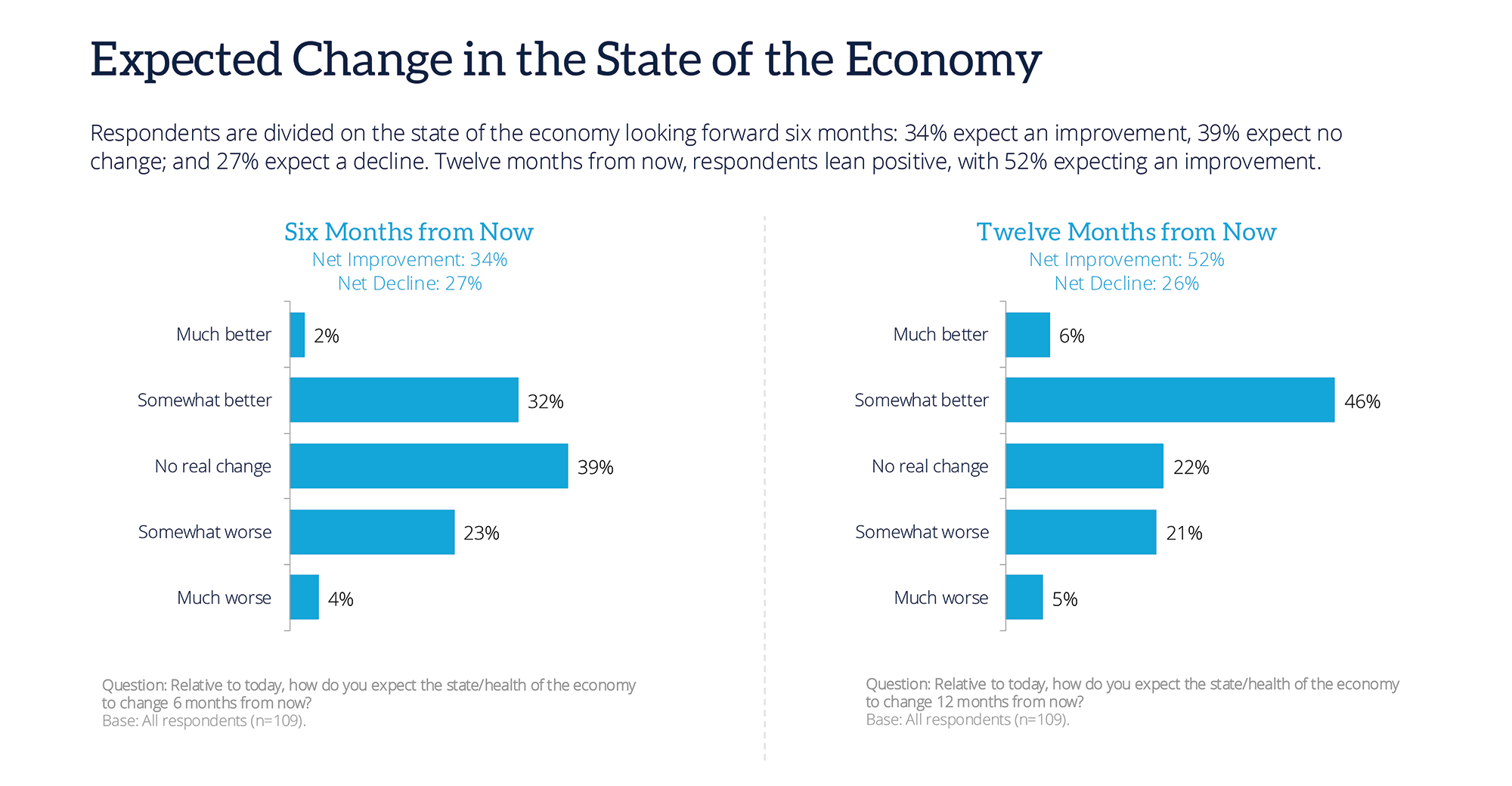

Advisors may be beginning to sense some froth in the markets, however.

Looking forward six months, respondents are divided: 34% expect an improvement in the markets, while 29% expect no change, and 37% expect a decline. They are more optimistic when looking forward 12 months, with 56% expecting an improvement.

The stock market’s resilience and high valuations spark debate. Advisors anticipate increased reliance on earnings for future performance, with warnings of overvaluation and potential corrections in 2025.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.