Financial advisors are feeling much better about the prospects of the stock market and the broader economy in the wake of Donald Trump’s presidential election victory.

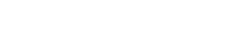

Sentiment on the stock market jumped 7.5% in the week after the election, to register at 130. (A reading of 100 equals a completely neutral view). That is the highest level of optimism around the markets since the beginning of the year.

Likewise reaching an annual high, sentiment over the health of the economy jumped almost 6% to 117.

Over half (56%) consider the current state of the economy to be “good” or “excellent.”

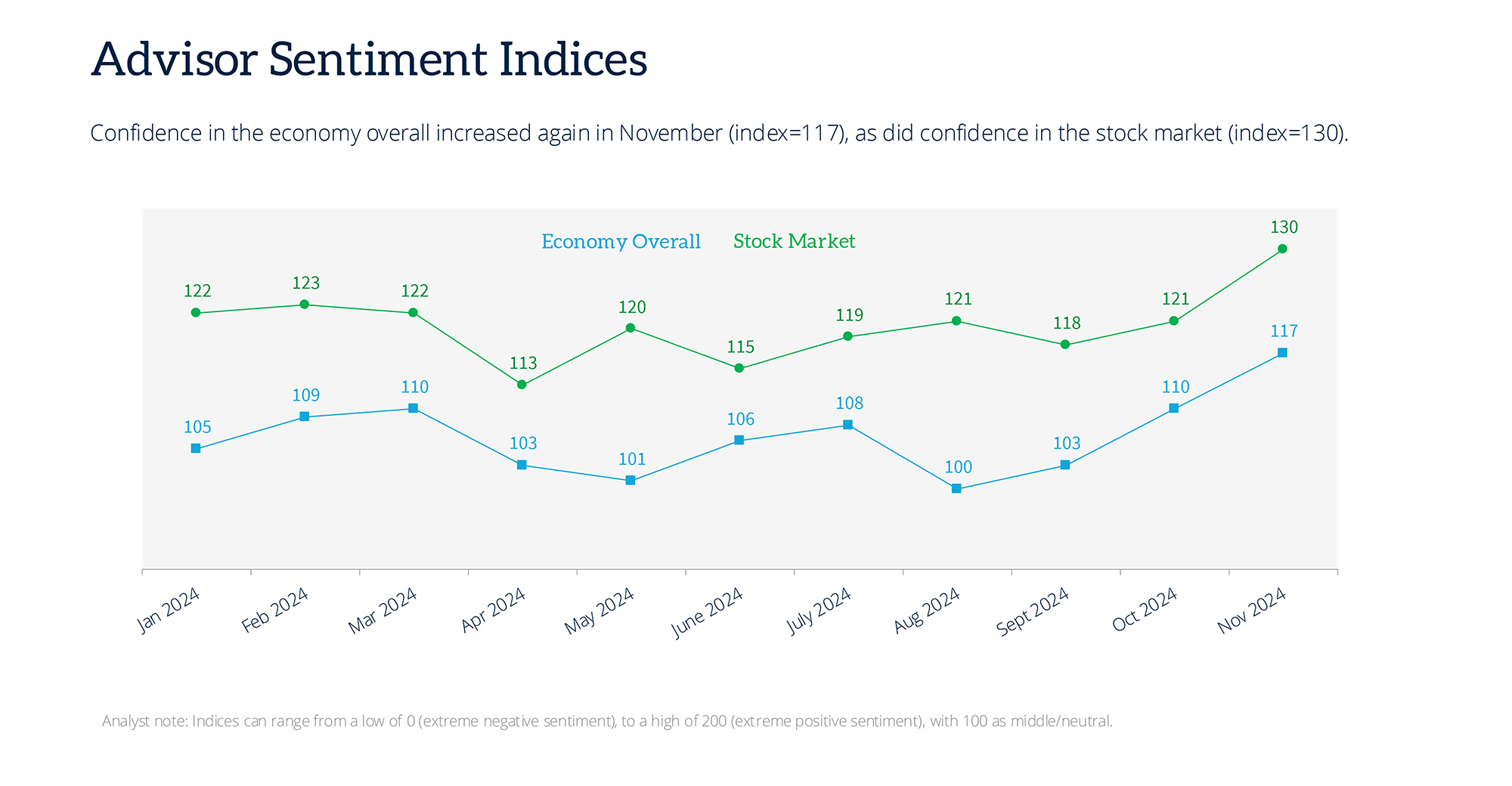

Advisors expressed a bit more muted optimism about the economy over the next six months. Forty-two percent expect an improvement, while 30% expect no change.

They regain a more positive disposition when looking out over one year. Over half predict the economy will be better one year away. Yet few advisors hedge their bets here: Almost 40% predict a decline.

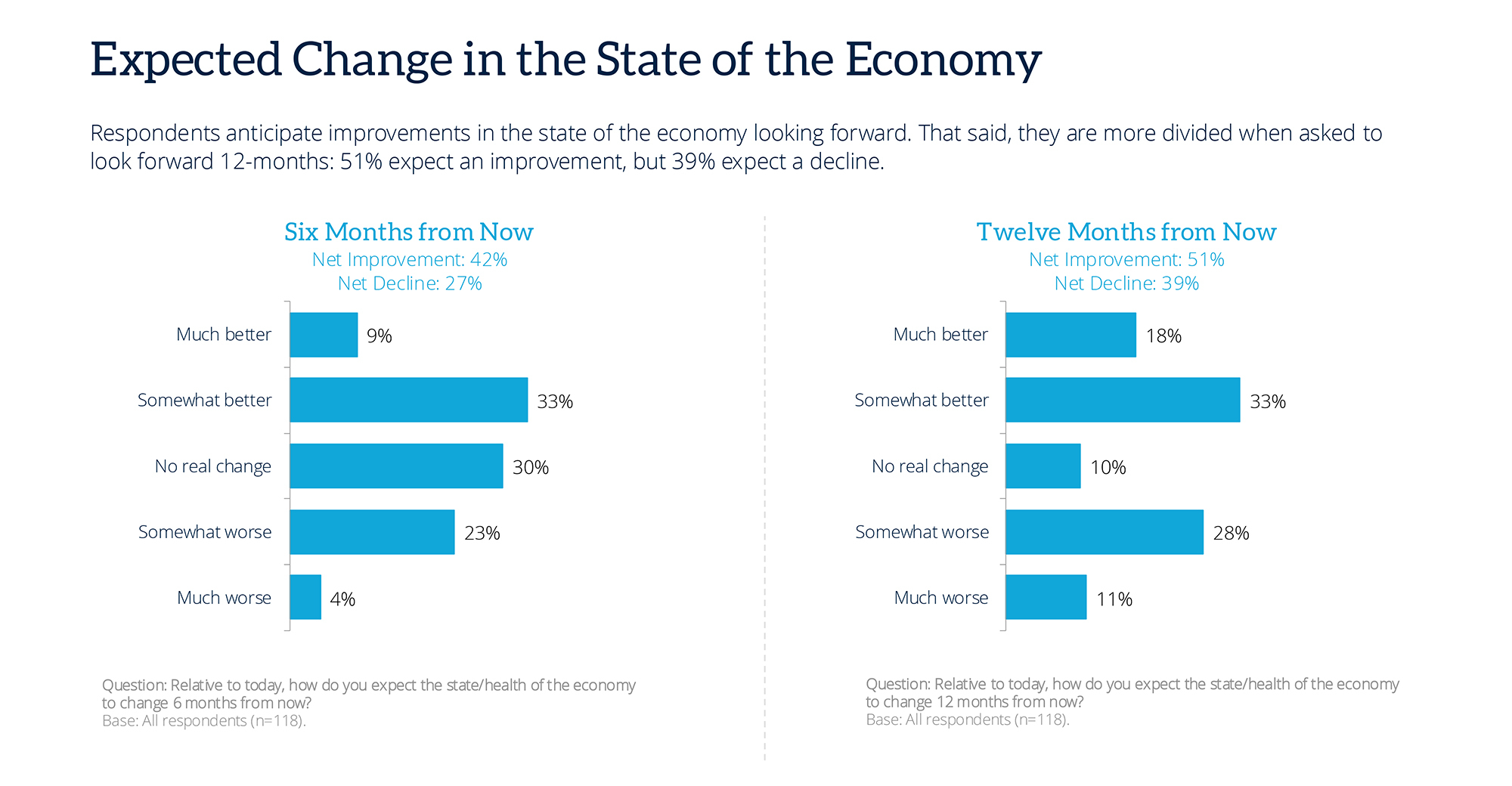

Trends are similar when asked about the stock market. Almost half (47%) say the market has room to improve over the next six months; Over half (55%) see higher market values at this time next year —yet a significant number (39%) take the opposite view and predict the health of the markets to be “somewhat worse” or “much worse.”

While it’s not clear the presidential election results are the only factor driving advisor sentiment, many of those surveyed mentioned the improved prospects for businesses and wealth creation under Trump, with a promise to lower taxes and ease regulatory burdens.

The S&P 500 rose over 5% in November. The market index largely leveled off in December.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final 10 days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.