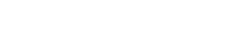

Registered investment advisors’ optimism in the U.S. economy rose for the fourth straight month in December, ending 2024 at its highest level of the year.

At the same time, faith in the health of the stock market dropped slightly, though it remains very strong at 124.

Both numbers saw large spikes upward in the wake of Donald Trump’s re-election in November. While the post-election glow for U.S. business has faded somewhat in the month following the election, registered investment advisors continue to be an optimistic group, largely seeing continued healthy markets and a strong economy both currently and in the months ahead.

Economic optimism rose 2.5% during the last month of 2024 to 120, its highest point of the year. Indices can range from a low of 0 (extreme negative sentiment) to a high of 200 (extreme positive sentiment), with 100 as middle/neutral.

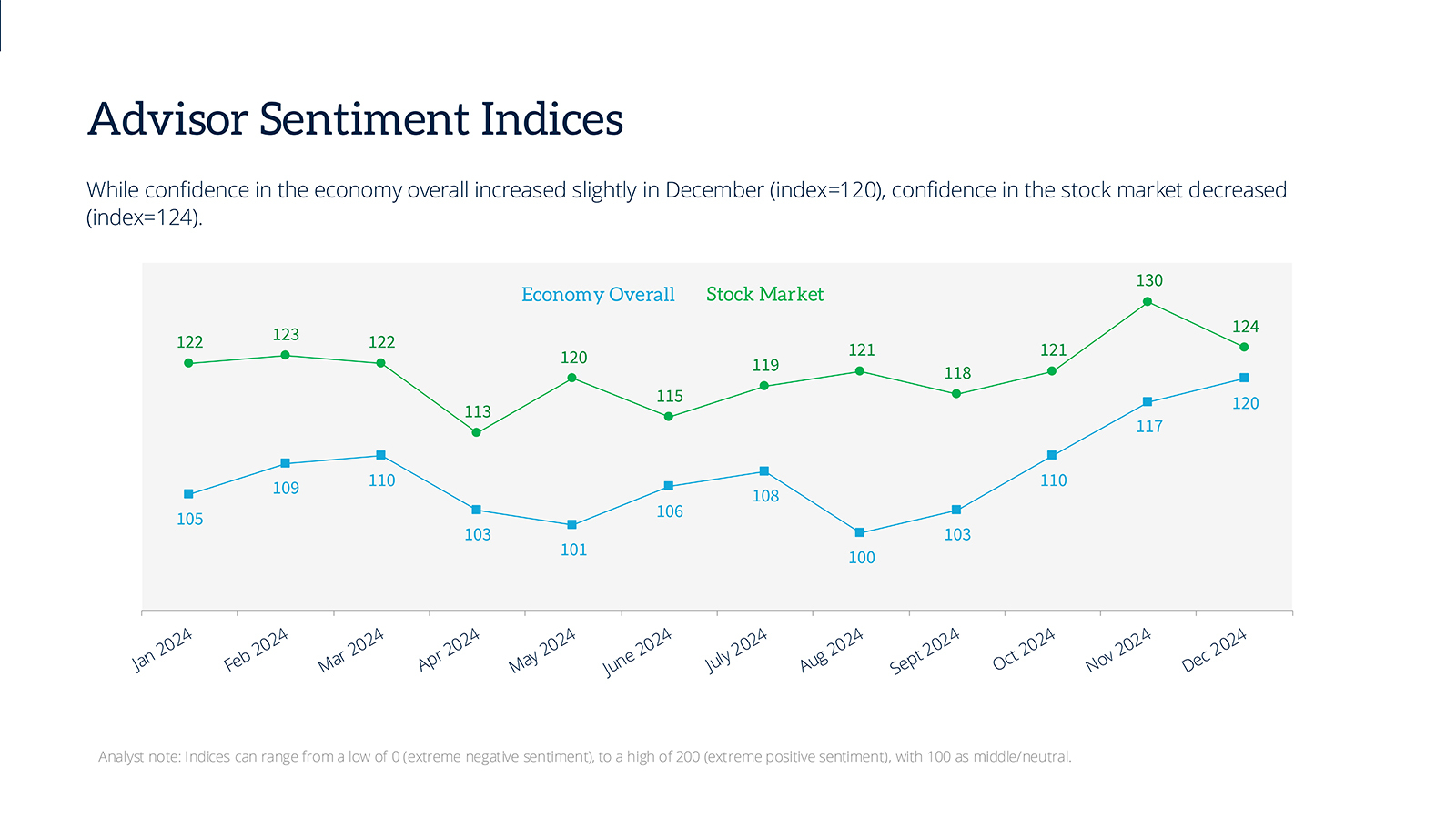

Almost six out of 10 advisors (59%) said they have an optimistic view of the economy in the U.S., characterizing it as either “good” or “excellent.”

Almost as many, 56%, hold the same view for the economy at this point next year. One-in-three, 32%, take a dimmer view and expect the economy to be “somewhat” or “much” worse than it is today.

Nonetheless, when asked to elaborate on their choice, many advisors expressed concern over the impact of Trump’s planned tariff hikes. Geopolitical concerns—in the form of trade wars, immigration crackdowns or shifts in global alliances—are cited as major factors that could derail current economic momentum.

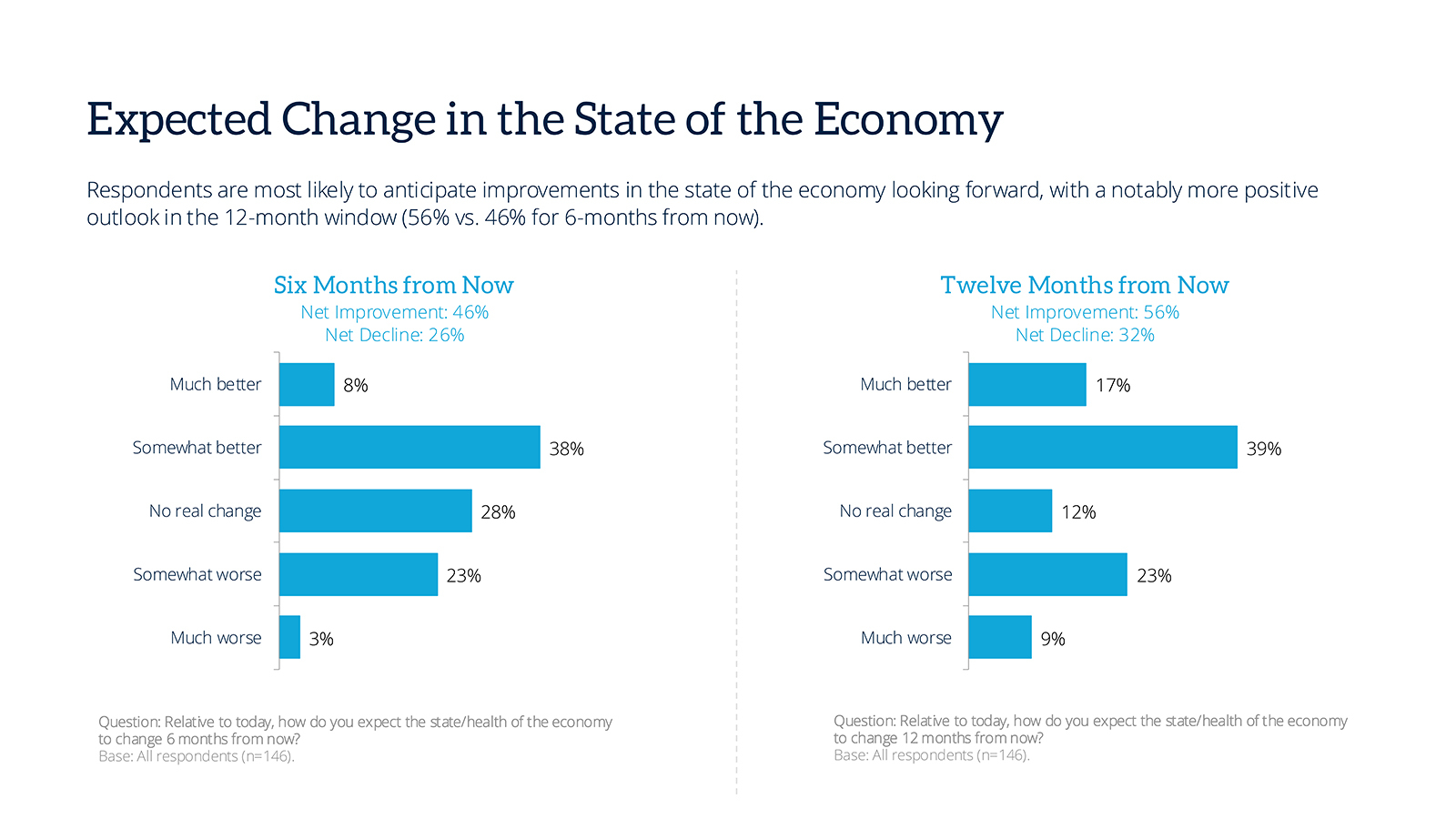

Yet advisors in December remained far more bullish on the health of the equity markets, even as that sentiment fell slightly in December. Almost three-out-of-four advisors said markets were “good” or “average.” Only 5% had a negative view.

That outlook drops as they look further out. Only half of advisors see a positive market environment in one year, while 30% see markets as becoming “worse” or “much worse.” Even fewer (44%) have a positive view in the six-month window, indicating a significant group of advisors expect market volatility to rise.

In open responses, many advisors cautioned against markets at “all-time highs” and some suggested markets were in “bubble territory,” warning that valuations—particularly among large-cap U.S. equities—are stretched. The prospect of a market correction or pullback is mentioned frequently, though few see that as a reason to exit positions entirely.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Data collected Dec. 14-25, 2024. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.