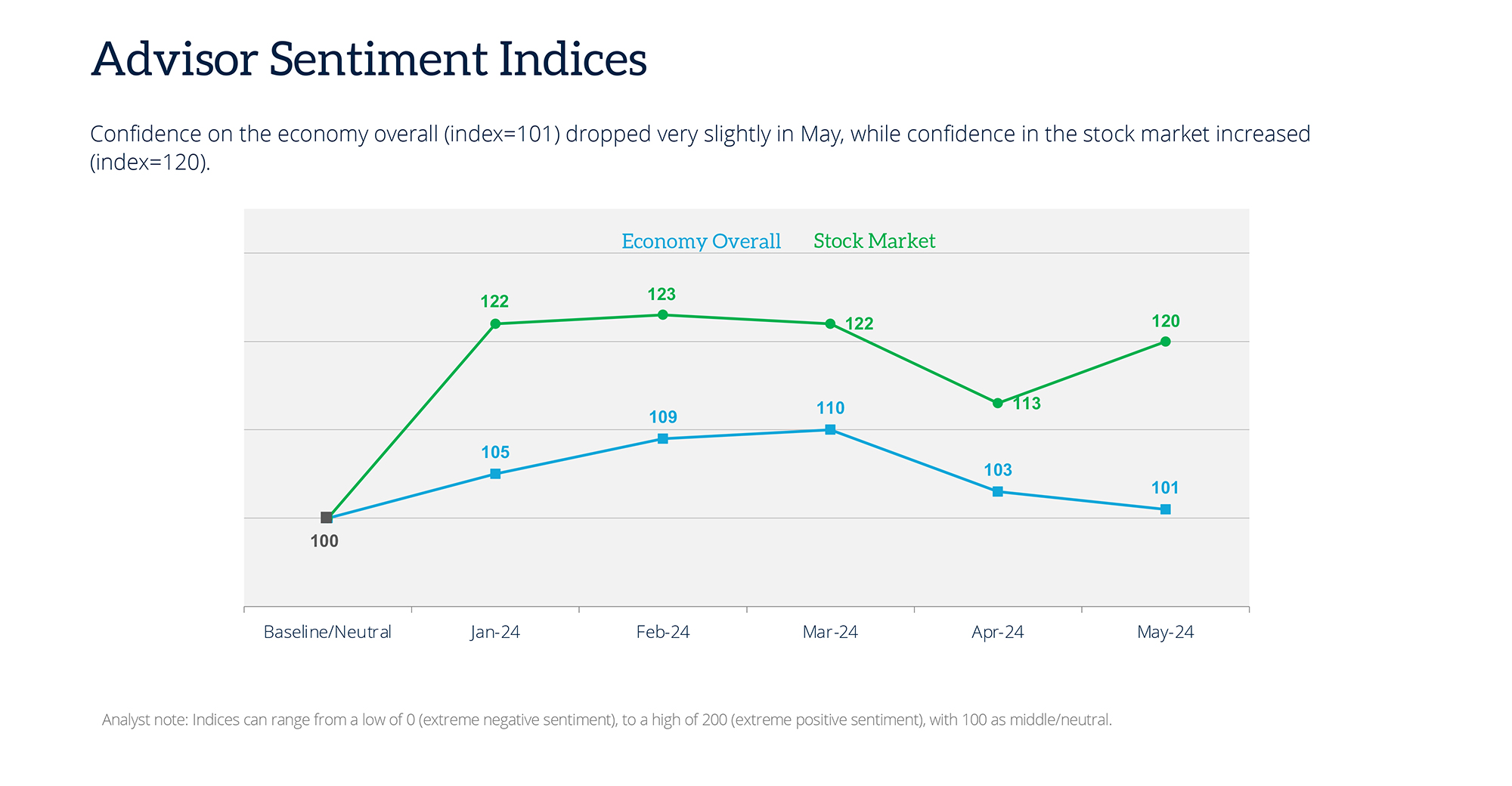

According to the most recent readings from WealthManagement.com's Advisor Sentiment Index, advisors are feeling a growing disconnect between the stock market and the overall economy.

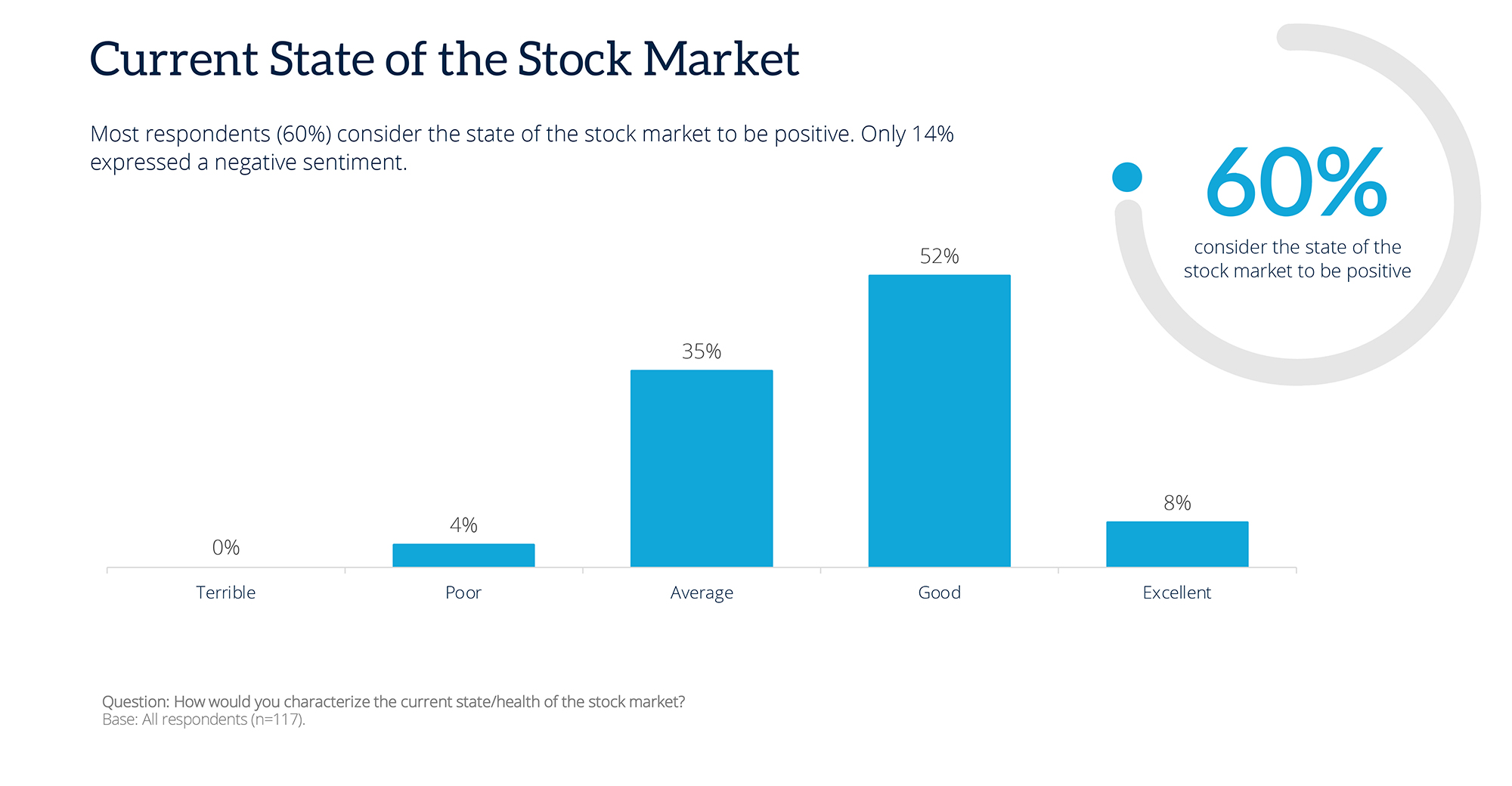

According to the monthly survey, financial advisors are feeling significantly better about the stock market than they reported the previous month. A full 60% consider the current state of the stock market to be positive, pushing the sentiment index to 120, or seven points higher than April’s reading. (A reading of 100 equals a neutral view.) That comes as the broad market, represented by the S&P 500, returned 4.8% in May, following April’s 4.2% decline.

Meanwhile, their feelings on the overall economy are considerably dimmer, with the sentiment index falling to 101, barely in positive territory and the lowest economic reading for advisors year-to-date. Last month, the sentiment on the overall economy registered at 103.

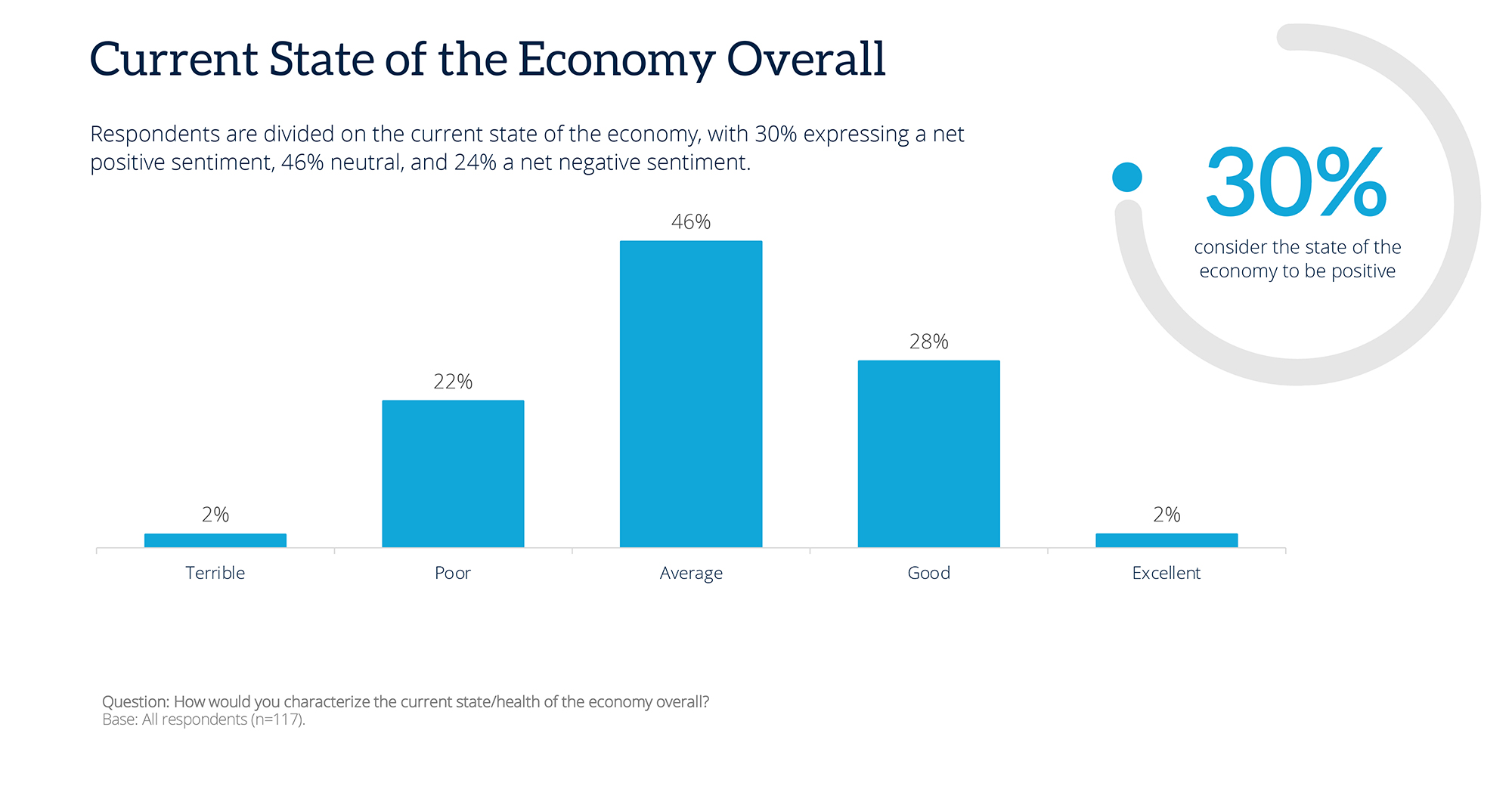

Only 30% of RIAs responding to the survey consider the state of the economy to be positive, while almost half have a neutral view. One-in-four advisors see the current state of the economy in a negative light.

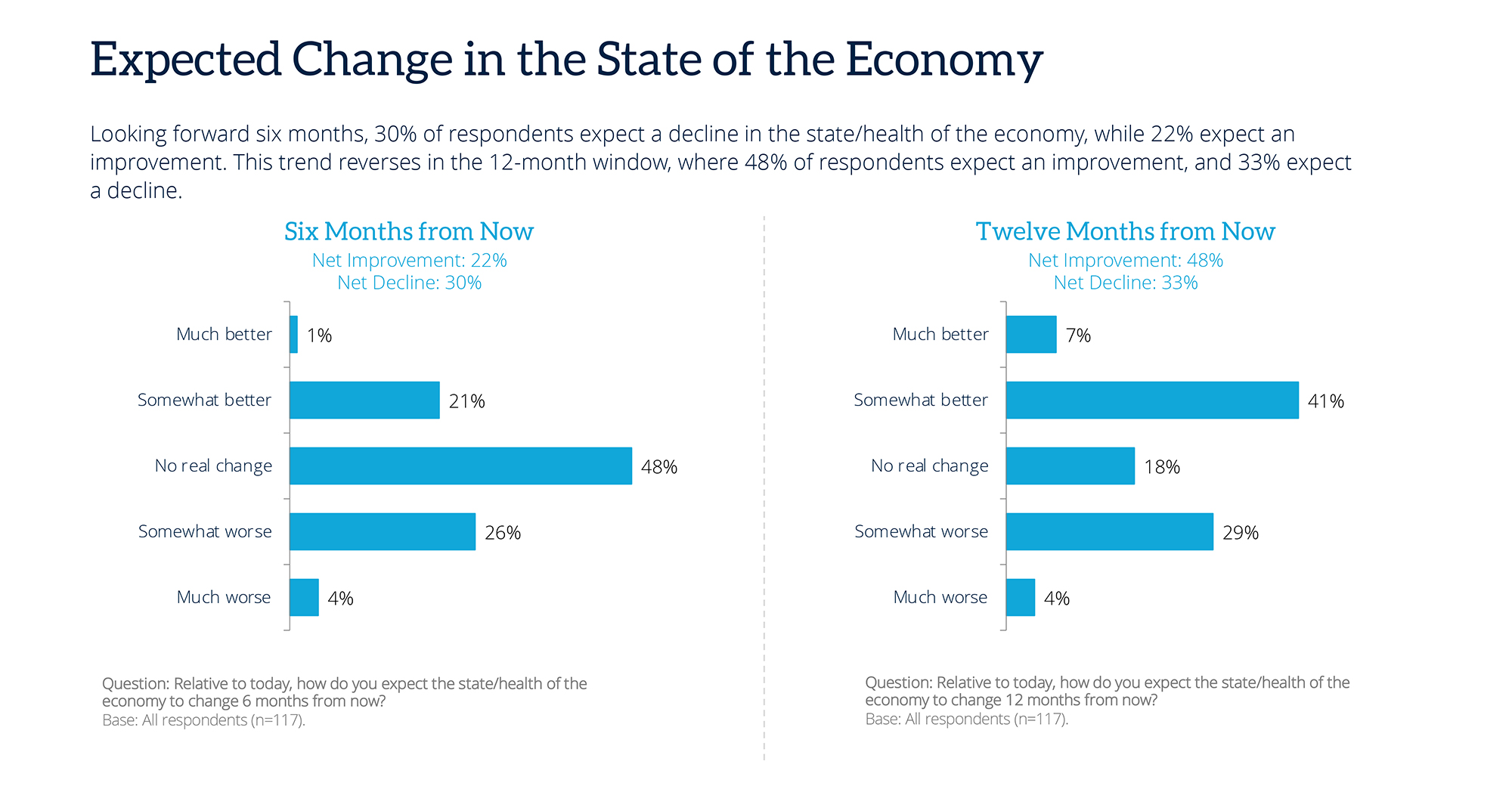

Yet despite this, advisors are largely optimistic about the economic future. While marginally more advisors expect the economy to turn slightly negative in the next six months, almost half see an improved economy one year from now.

Several advisors pointed to the upcoming presidential election as a volatility driver in the near term.

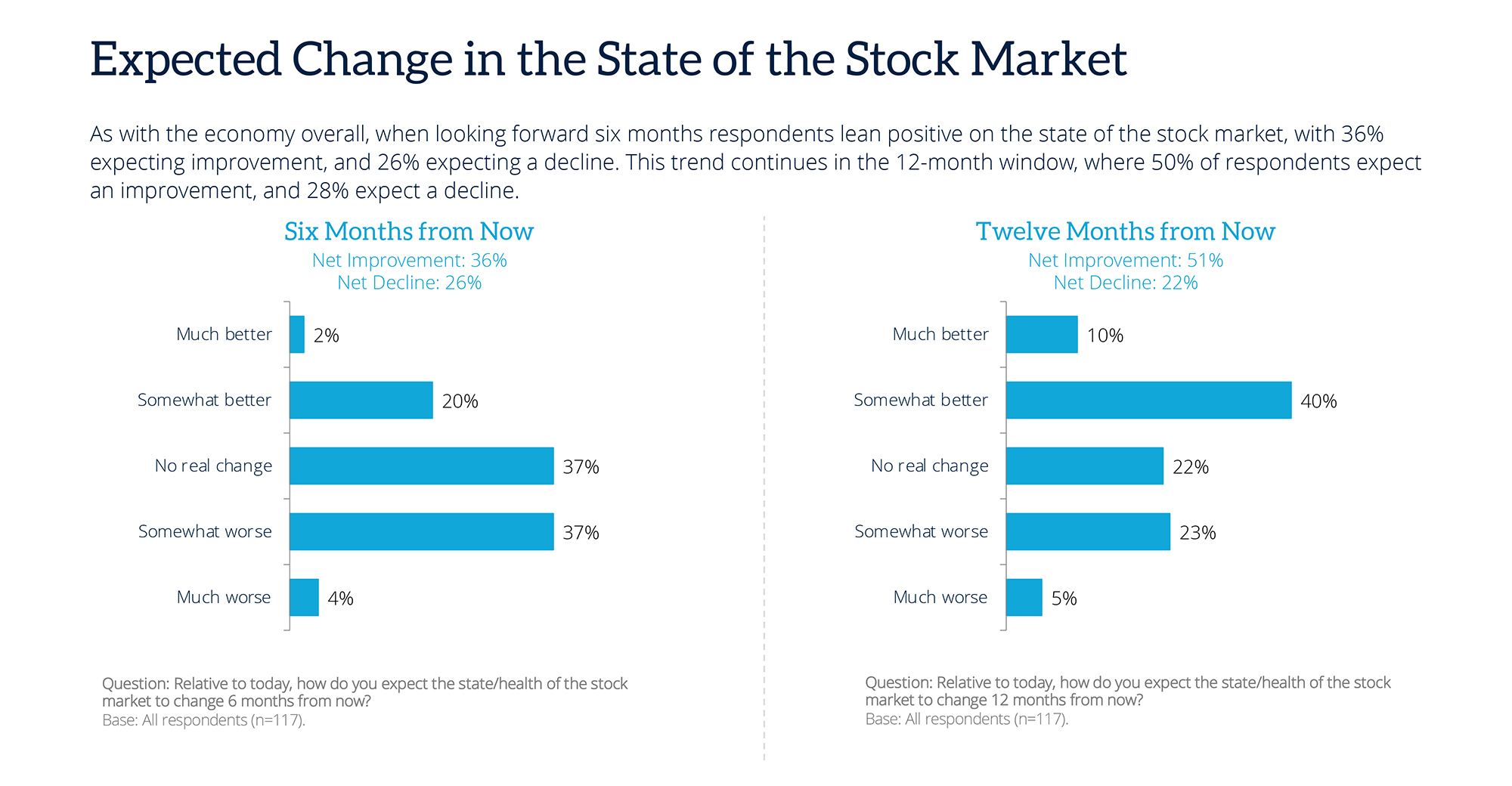

Investment advisors are decidedly more positive about the future state of the stock market, even as many say current valuations are lofty. Thirty-six percent of surveyed advisors see an improvement in the markets six months from now, while over half (51%) have a positive view of where the markets will be a year from now.

“Nothing seems to stop it, such as inflation, interest rate and wars,” said one respondent.

The Advisor Sentiment Index is a monthly reading of registered investment advisors’ views on the economy and the stock market. Advisors are asked to rate their current view of the economy and the markets, as well as their sense of the future direction of each relative to today, on a five point scale ranging from much better to much worse, relative to today.

Results are weighted and plotted on a range from 0 (extreme negative sentiment) to 200 (extreme positive sentiment), where 100 reflects a neutral rating.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.