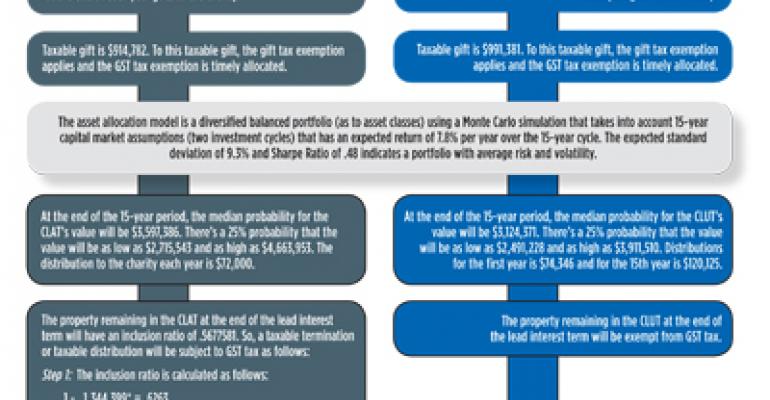

Issue: If property passes to children, a CLAT using a low Internal Revenue Code Section 7520 rate can be more transfer-tax effective than a CLUT. But the CLUT is likely to be more transfer-tax efficient than a CLAT if property passes to skip persons.

Chart Shows: Example of which to choose when a client transfers $1.8 million into a non-grantor charitable lead trust with a 15-year lead interest term.

For More Information: See Douglas Moore, “Now Is the Time To Consider A Charitable Lead Trust,” Trusts & Estates, June 2009, Charitable Giving Supplement, p. 6.

0 comments

Hide comments