Financial advisors work hard to prevent clients from reactionary investment decision that can stray them from their long-term plan, but doom-and-gloom headlines during periods of market volatility can shake a client’s confidence.

To help advisors reinforce their message, Riskalyze introduced a new product Wednesday at the T3 conference that quickly checks to see how clients are feeling in the months between regular reviews.

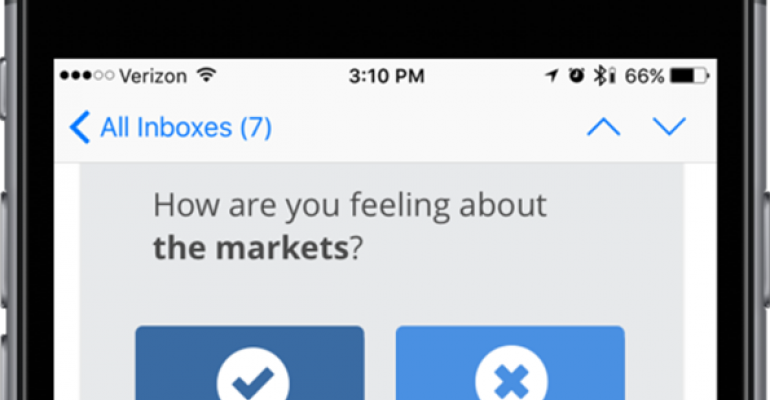

The aptly named Check-ins feature generates a monthly email that asks clients two simple questions – “how are you feeling about the markets?” and “how are you feeling about your financial future?” Clients choose between two possible answers, a positive or a negative, minimizing effort on the clients work. Depending on the answers, Check-ins delivers appropriate content created by the advisor.

The advisor gets an alert that the client checked-in and is feeling either anxious or confident. The algorithm then spaces out emails to the advisor with a regular assessment of their entire book of business without overwhelming them with the sentiments of all their clients at once.

Check-ins will be available to all Riskalyze customers in May for no additional cost.

“This is a very simple way that you can have a message for your clients who are feeling stressed, a message for your clients who are in a good place, and then update that on a once-a-month basis so everybody gets some fresh messaging throughout the year,” Riskalyze CEO Aaron Klein said. “If a client is starting to feel nervous, that is the seed of terminating their relationship with the advisor in the future. It could happen three months from now, it could happen six months from now, it could happen a year from now.”

With an advanced warning, an advisor can take action to restore a client’s confidence before they slip into what Klein calls “the valley of doom” created by 24-hour news networks.

Klein added the two questions were worded explicitly on the basis of research and he hopes Riskalyze can use the data it gathers from client responses to provide advisors insight on how clients with a certain sentiment act and behave.

“[Advisors] intensely care about making sure that [clients] are in the right place to make the right short-term decisions to support their long-term goals,” Klein said. “You never get to your 30 year goal if you make a bad short-term decision that blows it up.”

Email surveys and targeted marketing are certainly nothing new, and some doubted that advisors will take the time to create engaging content. Alan Moore, the co-founder of the XY Planning Network, said he often struggles to get advisors to create content, even if it’s as simple as one blog post per month.

“One, they’re not necessarily good at it,” Moore said. “The ability to communicate is a skill set and just asking advisors to suddenly start writing is not fair the same way asking a journalist to randomly start being a financial planner is not a fair request.”

Unless advisors have a dedicated marketing person, which few RIAs have, Moore said it’s likely that Riskalyze will need to partner with a dedicated content creation company for Check-ins to operate smoothly.

Klein said Check-ins didn’t allow for customizable content when they started developing it, but the team realized that they couldn’t dictate what the message should be without understanding the unique message and dialogue they have already established with their clients.