With a clear focus on upgrading the client experience, eMoney Advisors revealed a major overhaul of its client portal and announced that it would be unbundled from its financial planning tools.

Financial planning is still at the core of eMoney’s offering, but Drew DiMarino, eMoney’s executive vice president and head of sales, said at the Technology Tools for Today (T3) conference on Wednesday the company has heard from many advisors who want to use the client portal without including financial planning in their business model.

“eMoney thinks it’s so critical now to have the ultimate client experience, that we’re making it available to all advisors. Even the ones that don’t do financial planning. ” DiMarino said. He added that the growth of user-friendly consumer apps like Netflix, Uber and Amazon have fundamentally changed client expectations for financial services.

EMoney also thinks unbundling provides an opportunity for RIAs to grow through technology. If they start with the client portal and emX dashboard, they can more easily add financial planning to their business in the future. And by lowering the price point, eMoney hopes it will be easier for larger RIAs to deliver the product to all of their advisors.

The updated client portal, which rolls out this later month, has a new self-registration process and automated on-boarding to make it easier for clients to open their own accounts.

“Where we’re headed is if you could have people self-register and on-board themselves – if I’m an advisor I’m getting that to every single one of my clients and even prospects,” DiMarino said, adding that making advisors open each account themselves encourages them only to do so for their top clients. Self-registration, he said, will help advisors with client adoption as well as prospecting.

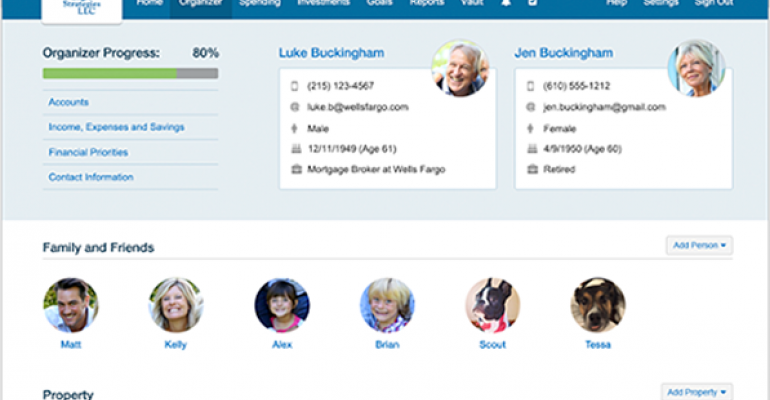

EMoney also redesigned the organizer to let advisors personalize it with photographs and a visual display of the client’s financial goals. Finally, eMoney added the ability to push tasks, alerts and news to the clients’ mobile device.

Many advisors attending T3 said they were impressed with the new look.

#T32016 @eMoneyAdvisor @DrewDiMarino new client portal - clients will LOVE this. #wow #personal #gamechanger pic.twitter.com/HUSV4zm5c7

— Thom K. Hall, CFP (@ThomKhall) February 10, 2016

Yes! Push tasks to clients on @eMoneyAdvisor. #T32016 #collaboration pic.twitter.com/kv6rYSNomy

— Arlene Donley Moss (@ArleneDMoss) February 10, 2016

Going forward, eMoney is looking to build a new simulation-based financial projecting tool to aid in prospecting efforts and increase the amount and depth of management analytics available. DiMarino also said eMoney is working with large clients to integrate with more brokerages beyond Fidelity.