In the escalating battle for control of the technology hub used by registered investment advisors, Fidelity Investments has a new weapon that may turn the tides.

The Boston custodian revealed plans for what they are calling the “Total Advisor Platform” on Wednesday at the T3 Conference. By 2017, Total Advisor Platform will provide Fidelity advisors, broker-dealers, banks and family offices with a single technology platform to access Fidelity’s proprietary tools, third party vendors and data from multiple custodians.

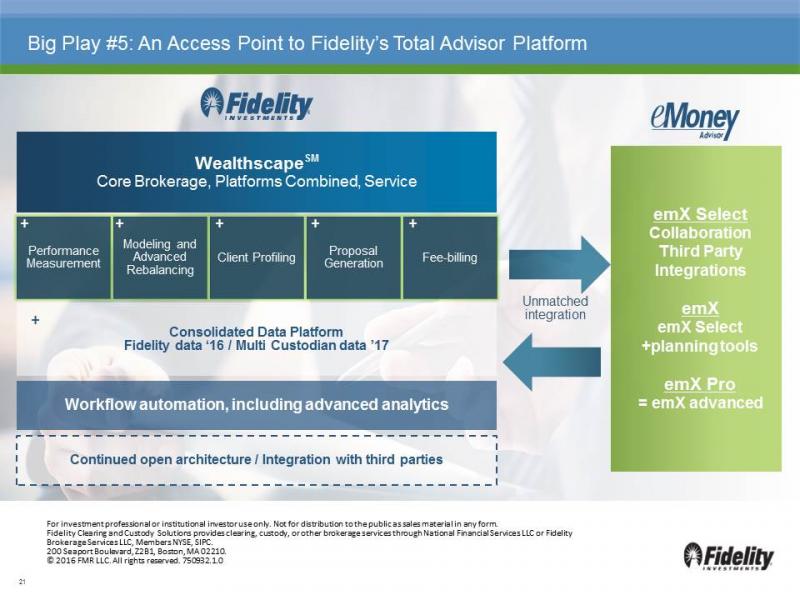

By combining WealthCentral and Streetscape, Fidelity’s existing workstations for RIAs and broker-dealers, the newly formed Wealthscape will provide a uniform platform across Fidelity's business to access trading, client profiles or any other digital tool an advisor should need.

The company next wants to integrate Wealthscape with eMoney’s emX Select dashboard to give more Fidelity advisors the ability to offer financial planning. In his keynote address at T3, Fidelity senior vice president and head of platform technology Edward O’Brien said the move is in recognition that the real value for the wealth management industry is shifting from investing to financial planning.

The integration will let advisors go straight from financial planning to account opening, funding and trading without having to log-in to a separate tool.

Additionally, emX’s integration capabilities will give Fidelity advisors access to third party vendors: Albridge, Envestnet, HiddenLevers, Morningstar, Orion and Redtail. This not only gives advisors more choice besides Fidelity’s proprietary technology bundle, it also supports advisors who custody assets at multiple firms.

Fidelity also plans to continue to build more of it own portfolio management tools, including, including proposal generation, modeling, advanced rebalancing, performance reporting and fee billing. Tom McCarthy, senior vice president for product development at Fidelity, said these features will be mostly built in-house, but some may be acquired.

A new consolidated, multi-custodian data platform will support these tools. The idea is to provide richer analytics and a single view of all client accounts, regardless of where they are held, without inconsistent and confused data. The company said all Fidelity data will be available in in Wealthscape in 2016, and access to multi-custodian accounts in one view is coming in 2017.

Finally, Wealthscape will be supported by automated workflows to streamline time-consuming activities like client on-boarding and creating presentations for client meetings. Fidelity also plans to offer e-signatures and digital file uploads for clients.

The biggest question among T3 attendees was if Fidelity could actually pull this off within in the timeframe they indicated.

Tim Welsh, the president of Nexus Advisors, said if anyone can do it, it is Fidelity.

“They definitely have the horse power and the resources to pull of this grand vision,” Welsh said. “I think they can.”