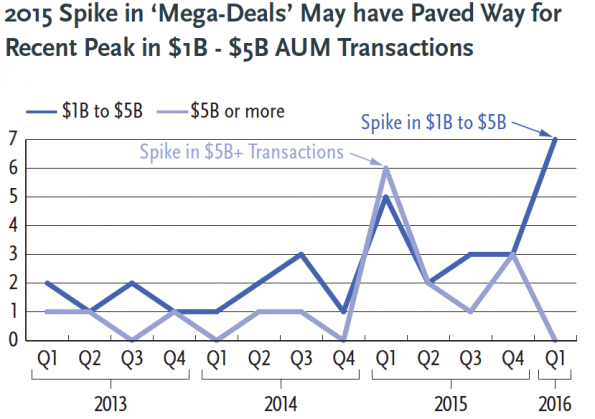

Last year, the registered investment advisory space saw a spike in “mega deals,” those over $5 billion, with 13 of these firms selling to a third party, according to DeVoe & Company.

But this year, the firms selling in record numbers are large RIAs with assets between $1 billion to $5 billion. These deals accounted for 21 percent of first quarter 2016 transactions, compared to 11 percent for the last three years.

The recent spike may have been an indirect result of last year’s surge in mega deals, said David DeVoe, founder and managing partner of the firm.

“Those $1 to $5 billion RIAs who have been contemplating a sale or in negotiations for a sale, it’s another strong data point that this could be a good decision for them,” DeVoe said. “Essentially, in many cases, their larger peers that they admire have indicated that it’s a good time to sell; they voted with their wallet.

“So I think it can create confirmation bias for some of these larger RIAs that are contemplating a sale.”

One recent example was Wealth Enhancement Group’s acquisition of HHG & Company in March, a Darien, Conn.-based RIA with $1 billion in assets. Also in March, Santa Barbara, Calif.-based Mercer Advisors merged with Houston-based Kanaly Trust, which has over $2 billion. In January, Douglas C. Lane, a $4.4 billion firm, sold to Focus Financial Partners. BNY Mellon acquired Menlo Park, Calif.-based Atherton Lane Advisers, which has about $2.7 billion in assets, in January.

Overall, the first quarter saw 33 RIA transactions, down from a record 37 deals in the first quarter of 2015. But that vastly outpaces the same periods of 2014 and 2013, which saw only 10 and 12 deals, respectively.

The average assets under management of established RIA sellers — those with between $100 million and $5 billion in assets — was significantly higher in the first quarter, DeVoe data found, likely due to the increase in large sellers. Average AUM increased to just over $1 billion during the quarter, compared to $855 million in 2015, $673 million in 2014 and $649 million in 2013.

The first quarter also saw an increased level of interest from RIA buyers, who accounted for 63 percent of transactions, up from 39 percent in 2015. Banks were involved in 15 percent of acquisitions of established RIAs during the quarter, up from 6 percent in 2015 and 5 percent in 2014. Consolidators, defined as organizations whose business model is predicated on making RIA acquisitions, have dominated M&As over the last couple of years; but this buyer group accounted for only 19 percent of deals in the first quarter, down from 42 percent last year.