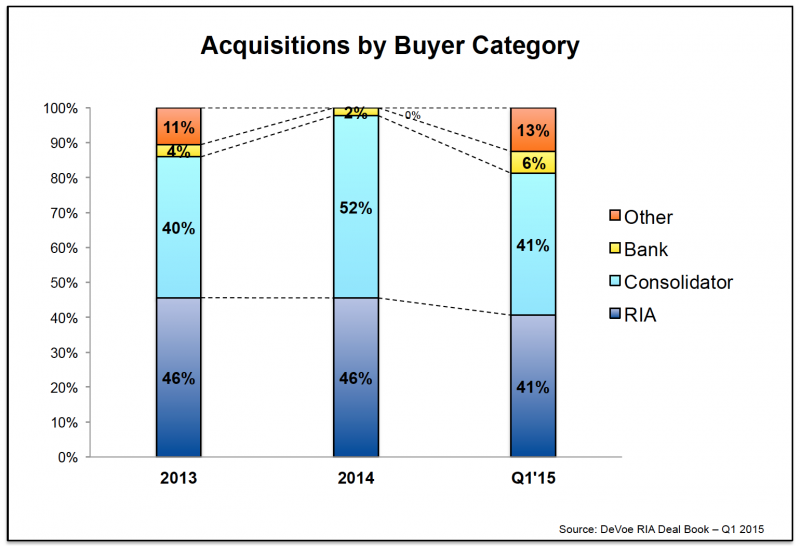

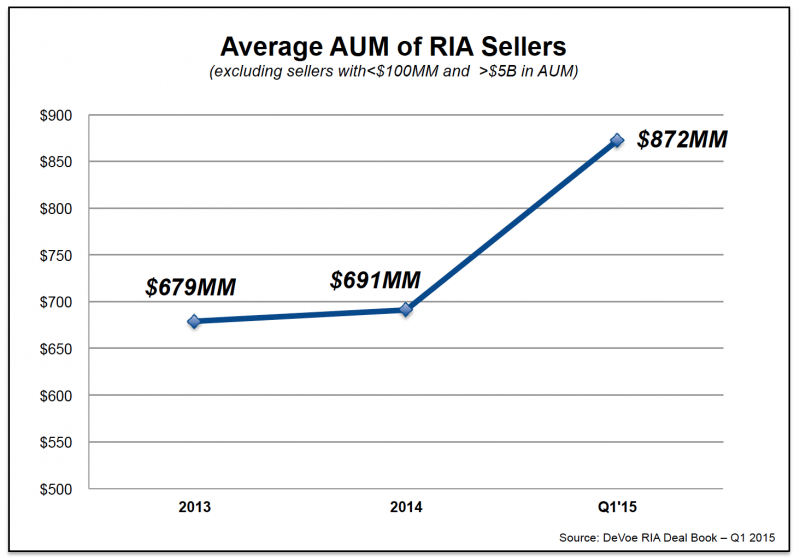

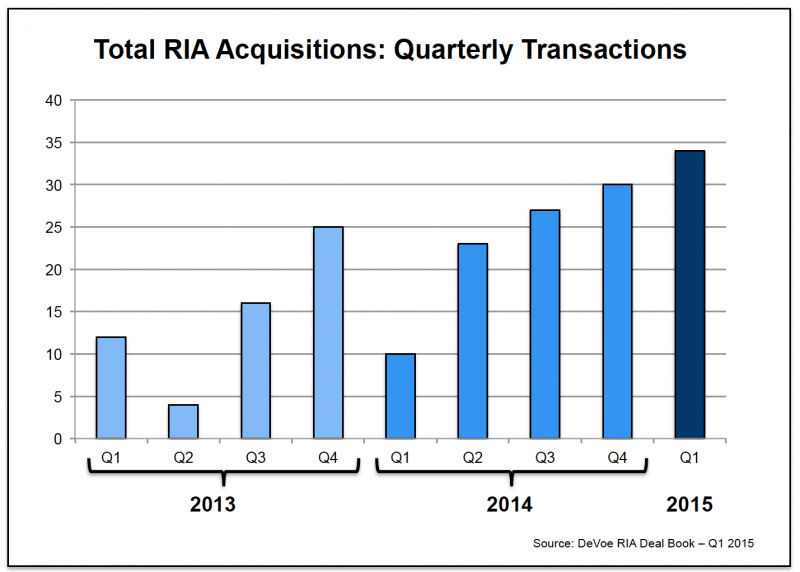

After essentially sitting on the sidelines during 2014, private equity firms and banks were again buying up RIA firms in the first quarter of 2015, executing 19 percent of the record-breaking 34 transactions recorded by DeVoe & Company. Private equity firms alone accounted for 13 percent of first quarter deals.

“Private equity has been a proponent, through acquisitions and investments, of the independent space for quite some time,” says David DeVoe, founder and managing partner of the firm. Historically, DeVoe says much of that investment in the space has taken place through the funding of consolidators, such as Focus Financial, United Capital and Hightower, who focus on growth through RIA acquisitions.

But there were a few direct investments during the first quarter by private equity firms, including Genstar Capital’s purchase of Mercer Advisors, a Santa Barbara, Calif.-based RIA with $6 billion in client assets.

Meanwhile banks were involved in about 6 percent of the first quarter deals, up from 2 percent of the deals completed throughout 2014. Overall, about $90.3 billion in assets under management changed hands during the first quarter via M&A activity, according to DeVoe’s research.

For example, in January, Beacon Trust Company acquired the MDE Group, Morristown, N.J. firm and its affiliate, Acertus Capital Management. Once the deal is completed, the combined assets under management are estimated to be $2.5 billion, Beacon said at the time of the announcement.

“I think many of us who follow RIA M&A have been anticipating and waiting for banks to re-enter the space,” DeVoe says. Going back 12 years ago, banks were the dominate acquiring force, buying 60 to 65 percent of the firms, but then they started dialing it back and it dropped off dramatically around 2008 and 2009, DeVoe says.

“Some of the transactions we’re seeing are either opportunistic or strategic—it’s a one-off transaction,” DeVoe says, adding many times in the past banks have overpaid for RIAs and then never done another. But others, like Boston Private and potentially other banks, are well positioned to strategically grow through more robust M&A activity. “It’s hard to predict the banking trend,” DeVoe cautions.

But with 82 percent of the deal market, both consolidators and RIAs themselves remain the most active buyer classes. “The continued acquisition momentum of consolidators indicates that these business models continue to resonate with advisors,” DeVoe says. “Advisors themselves demonstrated their growing sophistication of M&A, using acquisitions to achieve a variety of strategic goals beyond growth.”

DeVoe & Company’s RIA Deal Book report includes all transactions identified with over $100 million in assets under management.