Merger and acquisition activity among RIAs remained largely consistent throughout 2014, according to Schwab Advisor Services' mid-year review.

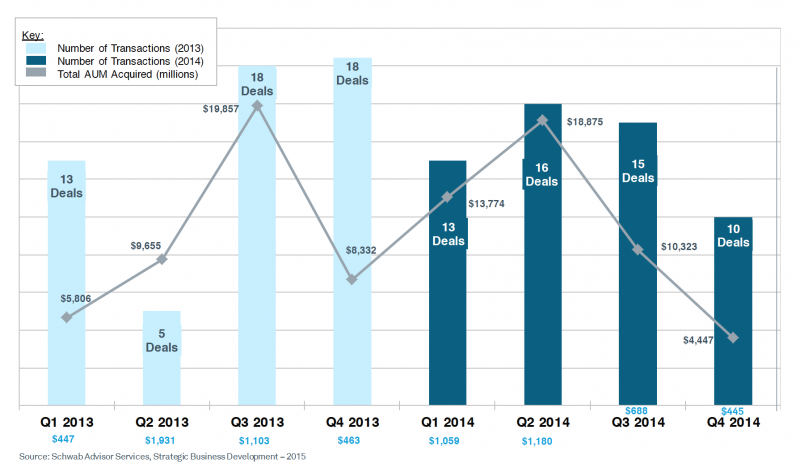

Like in 2013, last year’s M&A market wrapped up the year with 54 deals completed, totaling $47.4 billion in assets under management being transferred in the transactions. In 2013, Schwab reported the 54 deals that year consisted of about $43.7 billion in assets.

“The steady level of M&A activity we’ve seen over recent years underscores the growth and maturation of the industry,” Jonathan Beatty, senior vice president of sales and relationship management at Schwab Advisor Services, said in a statement Tuesday.

“We are seeing more firms being strategic about their growth, and while many remain focused on M&A as part of that strategy, they are being selective about opportunities and considering additional factors such as cultural and philosophical fit to ensure a merger or acquisition is beneficial and sustainable over the long term for their firm and their clients,” he added.

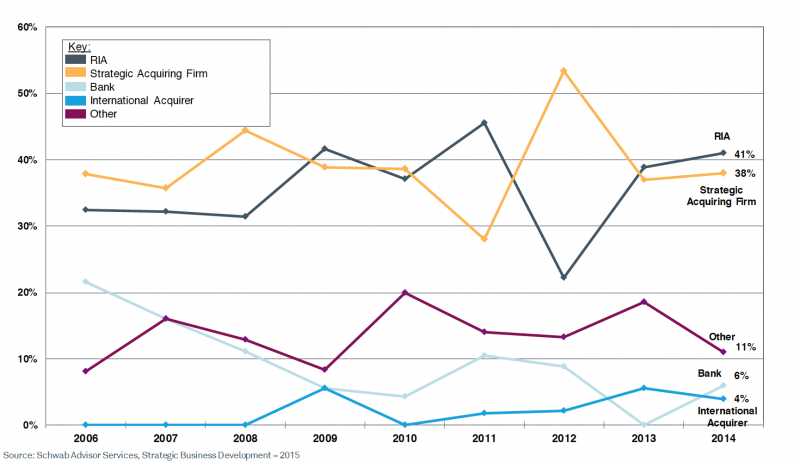

According to Schwab’s research, RIA firms continued to be the leading buyer of other RIAs, closing about 41 percent of the deals in 2014. Aggregators such as Focus Financial and United Capital, which Schwab refers to as strategic acquiring firms, closed the year with about 38 percent of total deals. Banks and international acquirers closed about 6 percent and 4 percent of the deals done in 2014, respectively.

“While many firms seek merger or acquisition opportunities as a means for growth, we haven’t seen the spike in consolidation that industry observers have predicted. Instead firms are considering valuation and completing deals that best address their goals over the long term,” Beatty said.

Schwab’s M&A research takes into account deals involving RIAs with more than $50 million in assets under management, primarily those firms focused on high-net-worth and endowment clients. The data also includes advisors-in-transition who joined an existing RIA and received equity.

But David DeVoe, founder and managing partner of DeVoe & Company, said he was surprised by Schwab’s findings. Rather than finding the number of deals remained flat between 2013 and 2014, DeVoe found there was a significant uptick in the number of deals last year. He tracked 90 deals in 2014 for RIAs with over $100 million in assets. The difference between the findings may be attributed to the fact that Schwab’s data was not intended to track all financial services industry deals.

Additionally, DeVoe predicts that 2015 will be an even bigger year in M&A activity than 2014. “We’re on a record path here,” he says, noting the number of deals in the first quarter of 2015 was double the number of deals closed during the same period of 2013 and 2014.

“We’ve all been reading the tea leaves and predicting an uptick in M&A activity, and at least in my findings, the last five quarters seem to show that anticipated momentum has arrived,” he said.