Sponsored by Raymond James

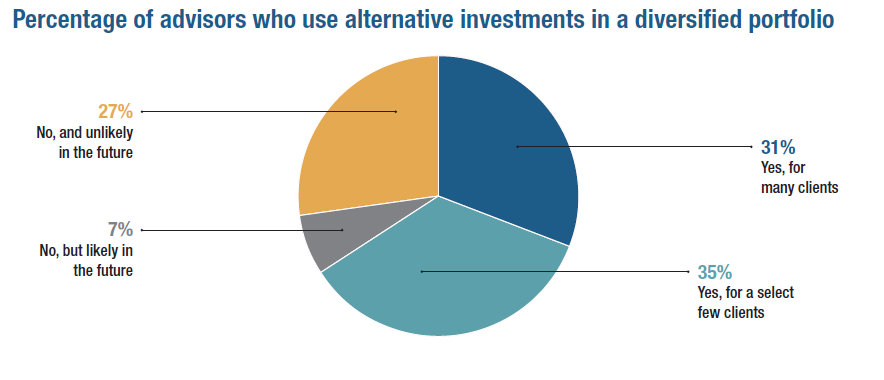

However, advisors appear split as to whether the asset class is appropriate for many of their clients (31%) or for just a select few (35%). And while most advisors (63%) are comfortable maintaining alternatives at their current level of use, they are three times more likely to expect an increase (31%) than a decrease (11%) in their use over the next three years.

Meanwhile, most RIAs (53%) expect to increase their use of ETFs over the next three years. The appeal of these investment vehicles lies primarily in their low fees (73%) and their ability to offer sector exposure (53%). Transparency (42%) was another popular characteristic. Most RIAs use ETFs as part of their core strategy (63%), although many also use them as part of a sector play (51%) and to gain exposure to a specific factor (42%).