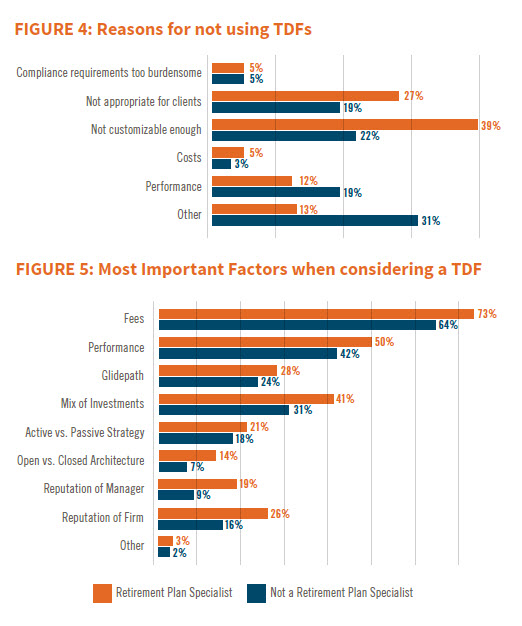

To uncover why just over half of plan specialists are still hesitant to use target-date funds, we asked survey participants about the major questions and concerns they—and their clients—had about these funds.

According to advisors specializing in retirement plans, the leading factor discouraging them from using TDFs was the lack of customization available. That complaint is understandable: While most off-the-shelf TDFs provide an appropriate array of solutions for the average investor, investors with more unique needs may need more complex options. For instance, these investors might benefit from  access to a wider range of asset classes, external fund managers, and individually-tailored glide paths available only through custom funds. As the demand for those advanced features has increased, so has the number of options available in the custom TDF space. It stands to reason that the trend will continue.

access to a wider range of asset classes, external fund managers, and individually-tailored glide paths available only through custom funds. As the demand for those advanced features has increased, so has the number of options available in the custom TDF space. It stands to reason that the trend will continue.

However, plan specialists interested in custom TDF options for their clients should be prepared for an increased fiduciary responsibility that can accompany those types of funds. More complex solutions—including the use of alternative investments in the underlying funds and the inclusion of an active, outside investment manager—can result in more scrutiny from regulators and require additional oversight on the part of the advisor.

Read more about addressing client concerns and evaluating the benefits of TDFs in the full report.