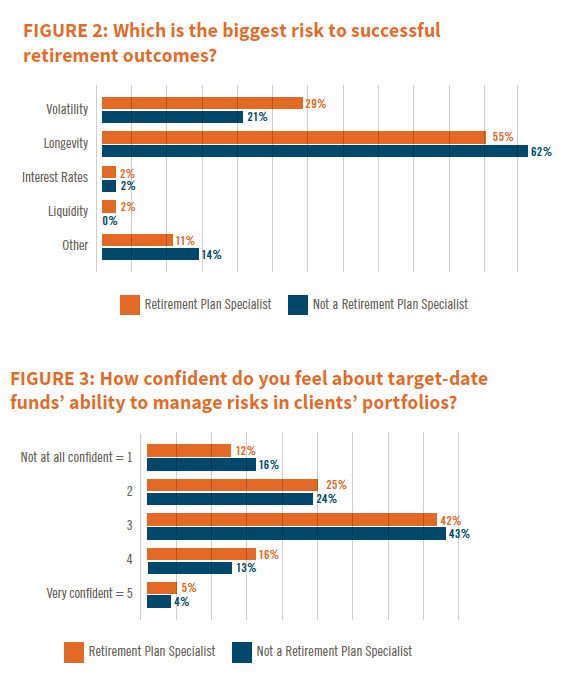

The adoption of TDFs as an investment vehicle during the past five years can be attributed in part to their ability to address the key risks facing retirement savers. According to the retirement plan specialists surveyed, the leading challenges that clients face in reaching their retirement goals are volatility risk and longevity risk—two threats that the vast majority of specialists say target-date funds are effective at managing.

To help protect against volatility, TDFs provide investors with a diversified portfolio that automatically rebalances its allocation to become more conservative over time. But even as a TDF investor enters retirement, many funds maintain some exposure to stocks, providing growth potential to protect the investor from outliving their savings. In fact, more than two-thirds of specialists surveyed recommend this type of “through retirement” glide path to their clients, maintaining greater equity exposure later into life and allowing them to use the same fund throughout the accumulation and drawdown periods.

To help protect against volatility, TDFs provide investors with a diversified portfolio that automatically rebalances its allocation to become more conservative over time. But even as a TDF investor enters retirement, many funds maintain some exposure to stocks, providing growth potential to protect the investor from outliving their savings. In fact, more than two-thirds of specialists surveyed recommend this type of “through retirement” glide path to their clients, maintaining greater equity exposure later into life and allowing them to use the same fund throughout the accumulation and drawdown periods.

Read more in the full report.