By Kate Smith and Brandon Kochkodin

(Bloomberg) --The most active bets among the largest U.S. college endowments in the first quarter were exchange-traded funds, underscoring a move toward cheap and passive investment strategies.

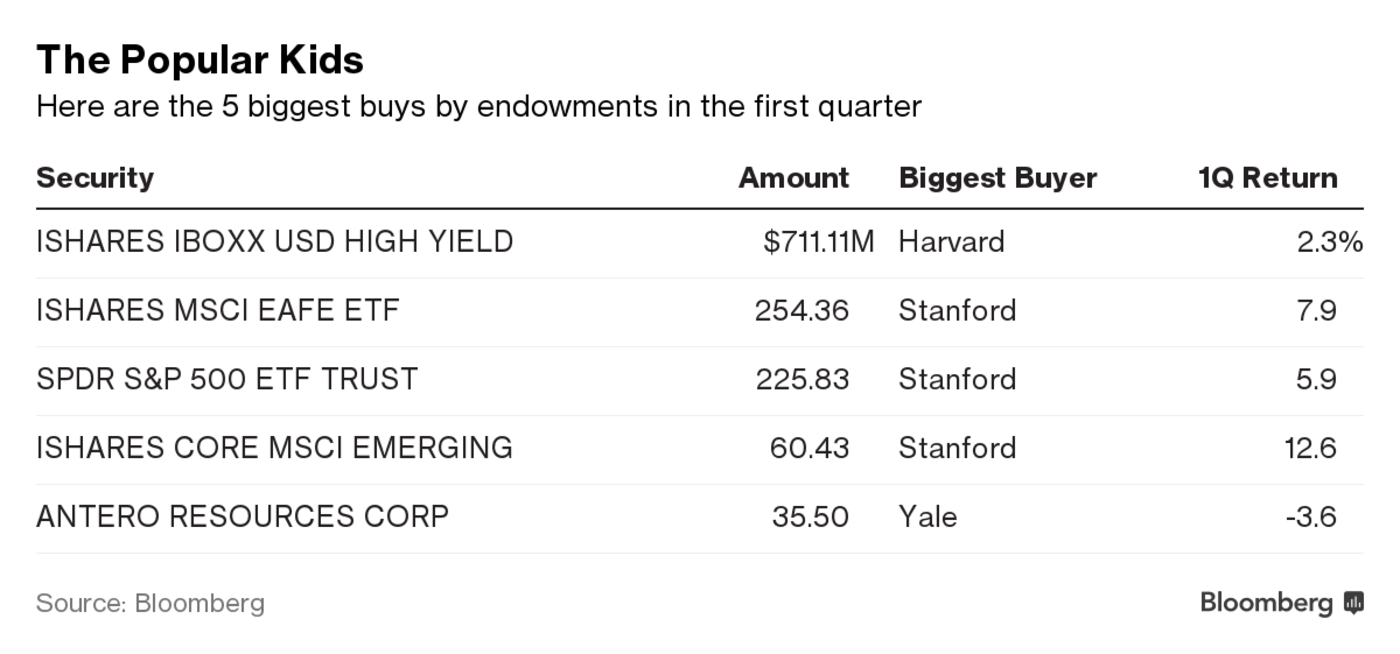

Four of the five largest public purchases were ETFs, accounting for over $1.2 billion traded, according to data compiled by Bloomberg. The biggest bet was on iShares iBoxx High Yield Corporate Bond ETF, with Harvard University’s endowment leading the way. The Ivy League school added to its position, making it the fund’s biggest publicly traded holding.

In an interview in Bloomberg Markets magazine’s April/May issue, Blackrock Inc. Chief Executive Officer Larry Fink said he believes active managers heavily use ETFs. Harvard, Yale and Stanford endowments each have assets of more than $20 billion.

“They’re doing asset allocation,” Fink said. “It’s cheaper; it’s more efficient; you have less idiosyncratic risk than in any one stock.”

Stanford University made the next three most active bets, also ETFs, after iShares iBoxx High Yield. They were iShares MSCI EAFE, which focuses on developed markets excluding the U.S. and Canada; SPDR S&P 500 Trust, which tracks the index; and iShares Core MSCI Emerging Markets, which tracks companies primarily in consumer discretionary, energy, financials and information technology.

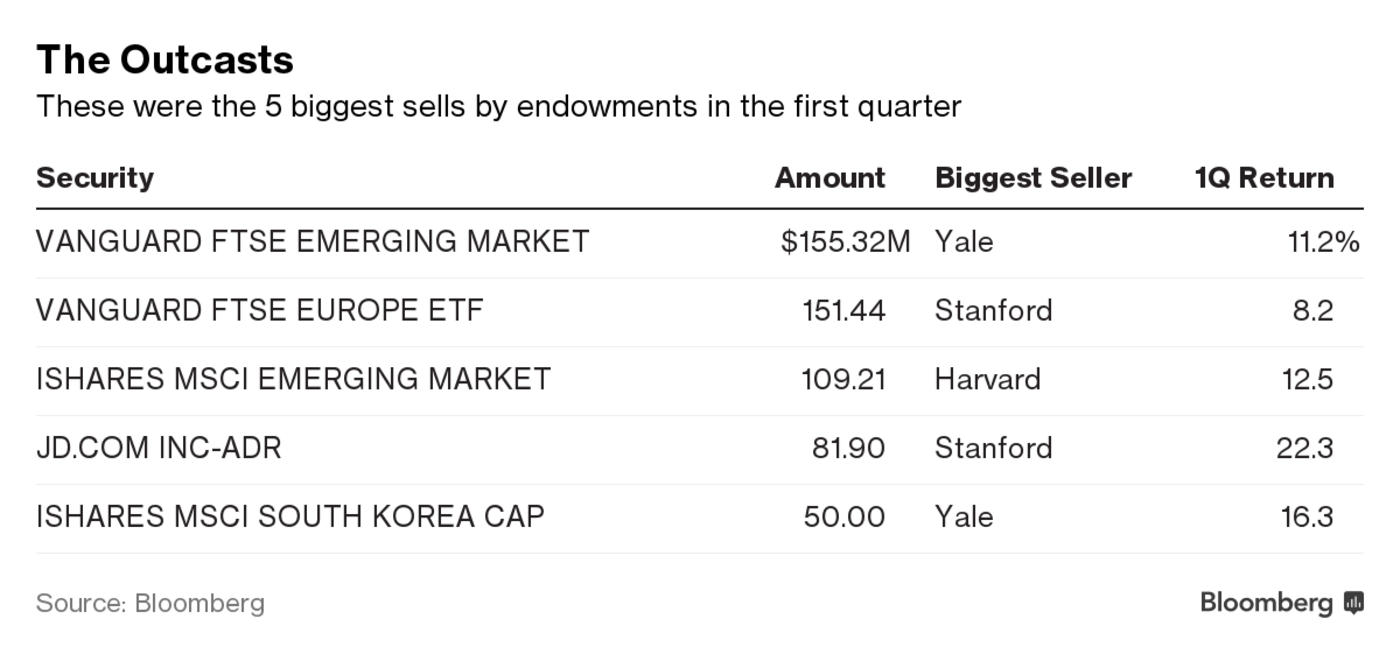

ETFs also dominated the biggest exits by endowments, with four of the top five leading the list. The largest cut was Vanguard FTSE Emerging Market, with Yale University topping the group of sellers, while Stanford sold shares of Vanguard FTSE Europe valued at $151.4 million.

Asset managers who oversee more than $100 million in the U.S. must disclose their holdings within 45 days of the end of each quarter to list those stocks as well as options and convertible bonds. The filings don’t include cash, holdings that aren’t publicly traded or assets held indirectly by outside money managers.

Emory University, Northwestern University, University of California, University of Notre Dame, University of Texas and Rice University also reported holdings in the quarter.

--With assistance from Erik Schatzker.To contact the reporters on this story: Kate Smith in New York at [email protected] ;Brandon Kochkodin in New York at [email protected] To contact the editors responsible for this story: Mary Romano at [email protected] Peter Eichenbaum