Top 3 Predictions for 2025 From a Venture CapitalistTop 3 Predictions for 2025 From a Venture Capitalist

Hack VC's Peter Hans prognosticates about the year to come in.

January 13, 2025

Following years of regulatory overhangs, economic pressure and innovation transitioning to other parts of the world, the digital assets market seems poised for significant evolution as we enter 2025. In contrast to the hyper-FOMO post-COVID cycle of 2021, we are entering a more mature era—one buoyed by increased building and investment in infrastructure coinciding with the expectations of regulatory clarity and its accompanying tailwinds.

While digital assets have always been cyclical, there are reasons to believe this time is different. The foundational pieces are finally falling into place for the next stage of adoption, growth and institutional participation. As we enter 2025, Hack VC is anticipating the following:

1. DeFi Will Be Reignited by a Favorable Regulatory Landscape

The 2024 U.S. presidential election delivered a tangible turning point for crypto regulation and a necessary reevaluation of Web3 as a broad category. Gary Gensler is soon to be replaced as SEC chair, and his replacement is expected to be the notably pro-innovation and “crypto-mom” endorsed Paul Atkins.

It’s important to note that many of the most interesting DeFi innovations of the past couple of years remain blocked to U.S.-based participants. Additionally, there has been no clarity on what a protocol must do in order to open access to U.S. participants. SEC Commissioner and former Trump appointee Hester Peirce has been especially vocal about the dangers of Gensler’s ‘regulation by enforcement’ practices, the need for more decentralization in financial markets, and the dangers of an outstanding legislation proposal that would treat decentralized entities and node operators as regulated financial institutions. In addition to this legislation being completely dead, we anticipate leaders such as Atkins and Peirce to promote an environment characterized by regulatory transparency and not one where operators must look over their shoulders for lawsuits initiated by the SEC. Under this new leadership, we also have the potential to see the introduction of a safe harbor proposal, which Commissioner Peirce has championed in the past. These safe harbors would allow a platform to launch as a funded entity, transitioning to a more decentralized protocol over time.

This opening of the market could unlock significant capital inflows into established DeFi platforms, as well as new projects that have been isolated to more innovation-forward regimes. Increased participation and liquidity will invariably lead to increasingly improving fundamentals. Regardless of how pronounced this growth is in the near term, the reality is that U.S.-based investors have seen their access to the potential applications of DeFi restricted over the past couple of years, and our expectation is that we will no longer run into the user experiences shown in the below screenshot.

Adding fuel to the fire, U.S. monetary policy could also play a supporting role in the attractiveness of DeFI lending, staking and restaking. Should interest rates continue to ease along the short end of the yield curve, capital seeking yield-generating opportunities will naturally flow into DeFi protocols, offering real rates of dollar-denominated returns not available through traditional financial outlets.

2. Private Markets Will be Driven by Infrastructure; Liquid Markets Will Experience Declining Volatility

While evidence points to the crypto bull market accelerating, we see few parallels to the hype-fueled mania of 2021. Rather, we will witness a more deliberate, sustained period of growth with early-stage investment opportunities analogous to those of the mid-1990s. At Hack VC, we envision a sustained rally underpinned by real and transformative Web3 infrastructure developments and early applications leveraging these new technological paradigms.

While any valuation based on technological innovation will involve growth assumptions, we feel that we are entering into a period that will be driven by production capital as opposed to more speculative financial capital. Builders who have spent the past several years laying the groundwork for a Web3 future will finally see their efforts materialize. From decentralized storage networks to new blockchain interoperability solutions, 2025 will be the year that the Web3 infrastructure layer begins to take shape. More specifically, we are hyper-focused on the coming opportunities across modular infrastructure, financial infrastructure and AI infrastructure.

Simultaneously, the growing convergence of crypto and artificial intelligence will continue to be one of the most compelling narratives of the year. Just as mobile and cloud computing defined the technology bull market of the past 15 years, blockchain and AI will fuel new paradigms for how data, computation and incentives are organized in the digital economy. This period will later be considered the true beginning of a Web3 and AI revolution where the future ubiquitous business models will be established.

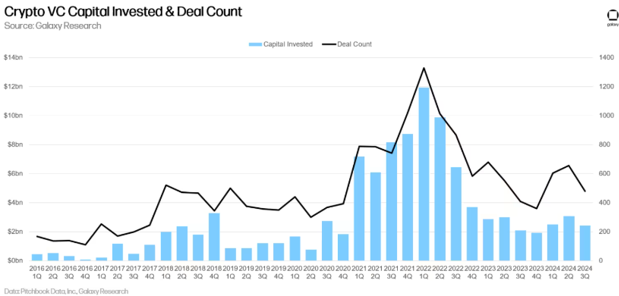

While Hack VC has historically found success deploying capital countercyclically, we expect the market to catch up to our thesis eventually. We foresee Web3 venture funding to approach the highs of 4Q 2021 and early 2022 and to significantly exceed those levels in the subsequent years. In 2025, this is simply a function of the market bouncing off of a low base, not of hype or froth. As with all large technological shifts, the Web3 transition will take time. We believe that we will first experience integrations of Web3 use cases into Web2 business models in order to natively serve that user base.

Ultimately, long-term success will be realized when participation in a Web3 world will be indistinguishable to the average person. Yes, there will be increased utility and effectiveness of applications, but the technology with which these advancements are delivered to the consumer has been, and will continue to be, cases of TMI—it just needs to work.

3. More Opportunities for Founders and Investors Across a More Rational Market

The crypto bull market will usher in a wave of new founders, driving a surge in deal flow for early-stage venture capital investors. While competition for the most promising deals will always be inevitable, the hard-earned lessons from the recent crypto winter will remain top of mind for both entrepreneurs and investors. While valuations typically expand in bull markets, we expect this expansion to be healthy and sustainable as a result of the previously discussed market dynamics. As a result, the landscape will present a particularly compelling environment for early-stage investments, where innovation and infrastructure alignment present the most attractive opportunities.

The best and most experienced venture investors will take an active role in structuring deals in order to support the long-term success of the projects and ecosystems they back. This shift reflects a growing understanding that sustainable growth—rather than short-term hype—is the key to maximizing value creation in crypto. Deals will increasingly include mechanisms to stabilize token economics, align incentives, and foster robust communities, ensuring that both founders and investors can thrive in a more measured and rational market. This is a topic that HackVC has a strong opinion on and one that we have discussed at length in the past.

On the liquid investing side, we can expect continued ETF-driven inflows into marquee assets like Bitcoin, Ethereum, and Solana. The introduction and normalization of crypto ETFs have broadened access to digital assets for traditional investors, fueling both institutional and retail inflows. However, this growth will also create further dispersion in the market. Leading assets with strong fundamentals and ETF accessibility are likely to see more sustained interest. Meanwhile, tokens with impending supply unlocks and/or extreme valuations could face downward pressure as market participants weigh these dynamics more critically.

These trends are also likely to impact overall market volatility. The fact that segments of the institutional markets now have a vehicle in which they can access BTC and ETH should serve to temper much of the reactionary retail-driven volatility that we’ve experienced in previous cycles. The market has matured significantly, and participants have come to anticipate sharp reactions to supply unlocks or speculative overreach. This heightened awareness, coupled with improved liquidity and more sophisticated hedging strategies, will lead to a more balanced market environment.

Conclusion: A Transformative Year Ahead

As we stand at the start of 2025, the digital asset market is poised for a period of meaningful transformation. The combination of favorable regulatory shifts, deliberate infrastructure building, and the maturation of market dynamics signals that the crypto industry is entering its most promising chapter of sustainable growth.

DeFi is set to unlock new opportunities for both capital and user participation under a more innovation-friendly administration. The improvement in market sentiment will drive domestic innovation and investment in Web3 infrastructure fueled by advancements in modularity, financial systems, and AI, laying the groundwork for a new era of growth. At the same time, a more rational market environment will empower both founders and early-stage investors to focus on sustainable value rather than speculative excess.

2025 will be remembered as the year the crypto industry truly turned a corner—a year when foundational investments, thoughtful regulation, and technological convergence began shaping the future of a decentralized, interconnected global economy. An economy that we at Hack VC are excited to play a role in building.

Peter Hans is a Partner and Global Head of Business Development at Hack VC.

About the Author

You May Also Like