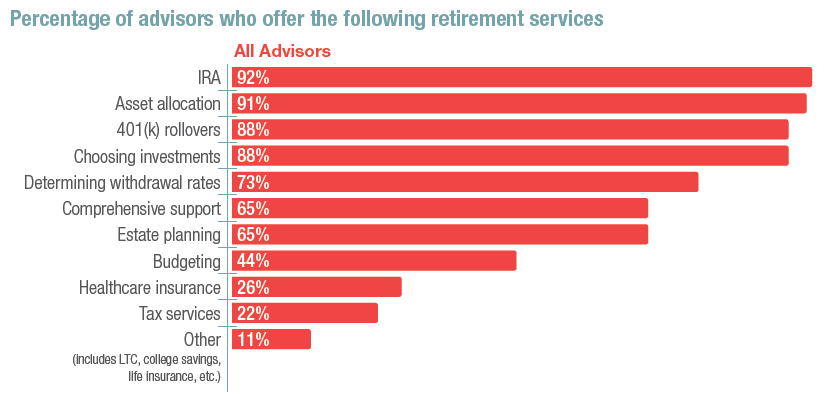

The most common retirement services offered by advisors include IRAs (92%), asset allocation assistance (91%), 401(k) rollovers and choosing investments (the latter two at 88% each). These four services were cited across all industry channels. Perhaps not surprisingly in light of their other responses, advisors from large firms were more likely to offer each of the four services, relative to other advisor groups.

A majority of advisors (57%) offer the above services as solo practitioners, as opposed to doing so as part of partnership. This result is consistent across all channels. However, this trend may have less to do with a desire to remain solo than it does with a lack of the necessary relationships to form effective partnerships. For instance, when advisors do work with partners, those partners are typically CPAs and accountants (71%) and tax or estate attorneys (64%). Relatively few advisors seek out partnerships with healthcare experts (19%), though healthcare is the number one area in which advisors say they need guidance.