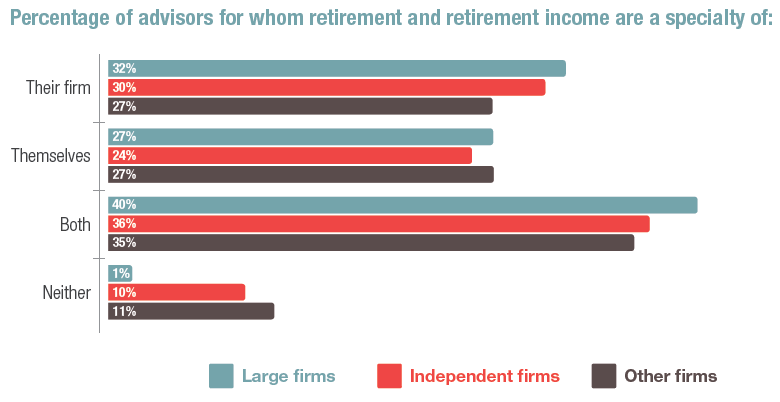

More than 9 in 10 advisors surveyed say that retirement in general and retirement income in particular is a specialty of their firm or one of their own specialties—or both. Advisors from large firms are more likely (99%) to claim this specialty for themselves or their firms (or both) than are advisors from independent firms (90%). This difference between channels is further supported by the fact that 78% of advisors from large firms say retirement is a very prominent theme at their firms, while just 69% of advisors from independent firms make the same claim.

This difference may indicate that advisors at large firms pursue retirement-related assets more aggressively than do independent advisors. Yet the assets under management numbers don’t appear to support this narrative: On average, advisors from large firms report that 58% of their AUM is tied to retirement investments, while advisors from independent firms report a slightly higher average of 61%. In essence, advisors from independent firms appear to rely more on retirement assets even as they claim it as less of a specialty.