Even so, advisors from independent firms identify prospecting for retirement clients as the area in which they most need help. Advisors were asked to rate potential areas where they would like guidance on a scale of 1 to 10, with 10 meaning an advisor most needs guidance. Healthcare costs received the highest average rating among independent advisors (6.5). Meanwhile, prospecting for retirement clients and income generation were both rated 6.2—a close third behind longevity concerns (6.3). Advisors across all channels shared the same priorities, suggesting that even as advisors from independent firms are less likely to claim retirement as a major theme or as a specialty, they are as equally concerned as other advisor groups with prospecting for this type of client.

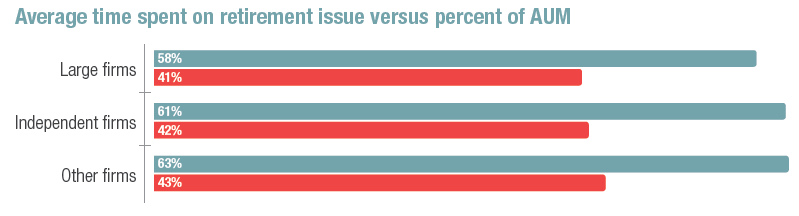

One potential reason for this trend: On average, advisors spend 42% of their time on retirement-related issues. Yet more than $6 of every $10 of assets under management, on average, are tied to retirement investments. So even when retirement isn’t a stated focus or specialty, advisors undoubtedly see the value in managing assets that require less time and effort on a proportional basis.