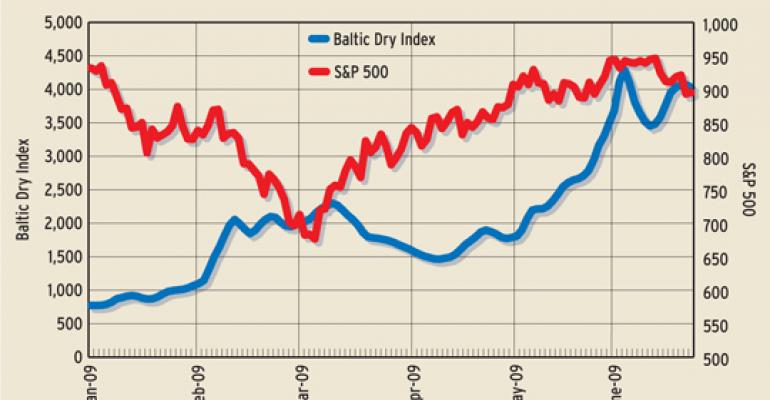

After collapsing 94 percent from its peak in June 2008, the Baltic Dry Index, which measures global daily prices for shipping raw materials, is up 427 percent year-to-date (through June 22). It still needs to climb another 189 percent in order to get back to its 2008 peak, but the BDI's general upward flight after so many down months should portend good things for the global economy. Perhaps not, however, for the stock market.

According to the Bespoke Investment Group, a research and investment management firm, since 1985 the S&P 500 and the Baltic Dry Index have had a positive correlation of 0.5 (1 is a perfect correlation; negative 1 equals a?perfect inverse?correlation). Early this year, that relationship changed dramatically: Between January and the beginning of April, the S&P 500 and the Baltic Dry Index were moving in nearly opposite directions, with a correlation for the period of negative 0.4.? The Baltic Dry Index declined in March, for instance, which marked the start of one of the strongest one-month rallies the S&P 500 has ever experienced.

Justin Walters, co-founder of Bespoke, said correlations between the BDI and S&P 500 have since turned positive again. But he wouldn't be surprised to see another reversal. “There have been a lot of divergences this year — oil and the market, the dollar and the market. It's tough to gauge direction on anything.”