While this isn’t 1765 with its Stamp Act, it sure feels like basis points are a tax levied on financial advisors without a commensurate increase in incremental value to justify the cost.

The most visible representation of how firms make a substantial amount of money off the success of their independent advisors is the program or platform fees (bps on assets) for asset management.

Breaking Down the Fees

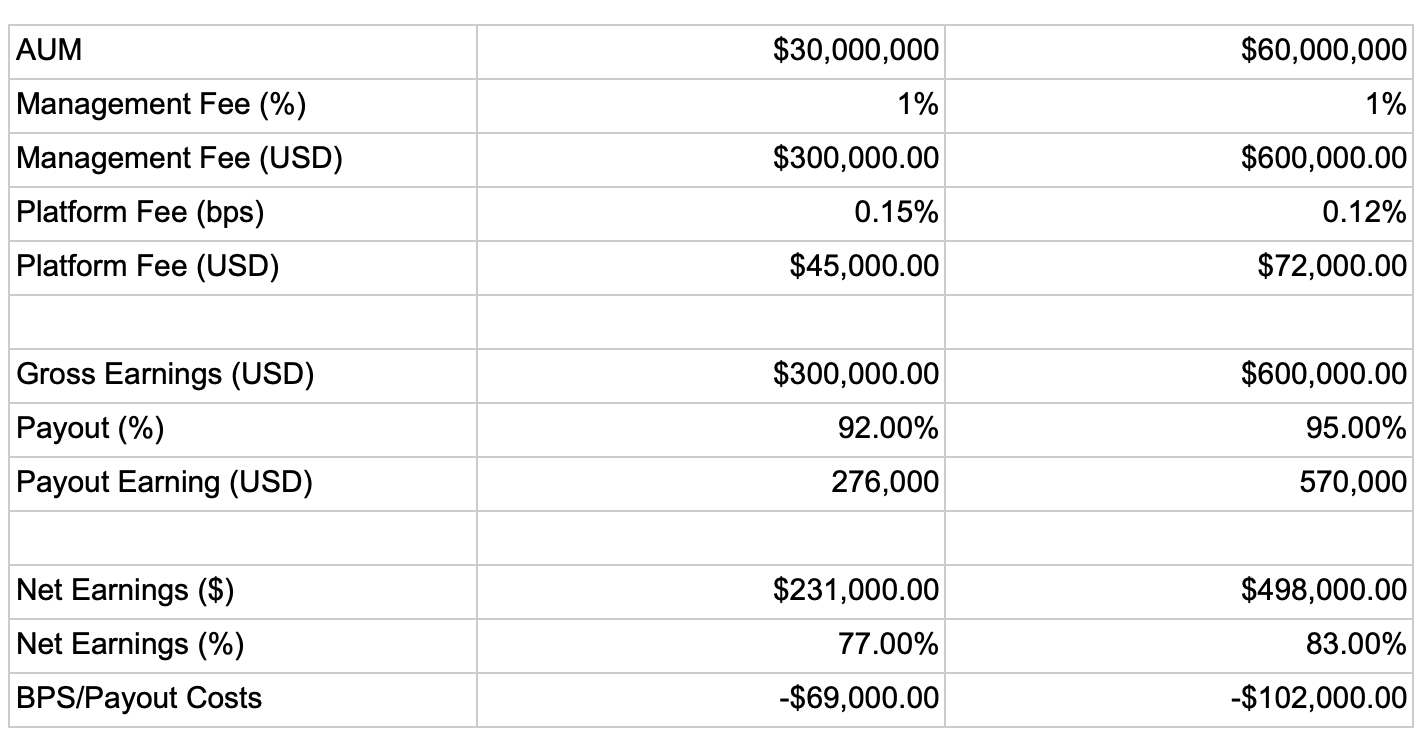

Take a simple advisory practice with $30 million in AUM and growing to $60 million, for example. This is basic and will not include all the additional costs, including tech fees, E&O, etc.

What is the value of $69,000 in the first example and then $102,000 in the second?

There’s no added value despite more fees being collected. The platform did not perform marketing or sales to increase the AUM. The main firm more than likely didn’t give the advisor a book of business to work out of thin air. Firms need to accurately justify these costs once an advisor moves their practice onto their platform.

Revenue-sharing models that include compliance costs are inherently unfair as they disproportionately burden higher-producing advisors. For instance, a $100,000 advisor pays a 10% “override” for compliance ($10,000), which aligns with the oversight cost. But a $1 million advisor paying $100,000 for the same services highlights the inefficiency. The compliance burden does not always grow proportionately with advisor production or AUM, meaning larger advisors are often subsidizing smaller ones under these models.

Advisors Should Know All Their Options

None of these fees—overrides, technology fees, platform/program fees, annual review fees, or E&O—alone are inherently bad. But in their sum total, advisors can lose sight of their profitability thanks to these taxes.

There are other ways for advisors to get the services and resources they need than to levy these taxes on them. Some emerging firms have removed bps and payouts in favor of a fixed or per-seat pricing model. It can be easier for advisors without those factors. In fact, it can even be less of a hassle for the platform.

Without bps and other fees, straightforward accounting can be used to run an organization.

Remove the Excess

In fact, by removing the bps tax, firms can also become more efficient. Rather than pay the salary of a full-time marketing, compliance or other service-providing team, fractional services can be utilized to eliminate excess capacity and lower costs.

Why are fees levied this way? Because they always have been. But is this really what the industry and investors deserve? No.

Advisors retain the ultimate authority to determine their capital spend and have access to the requisite information to make informed decisions. In the end, broker/dealers, hybrids, RIAs and other platforms will establish their most profitable fee structures.

Andrew J. Evans is the CEO of Rossby Financial, a tech-forward RIA.