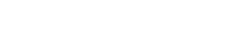

Financial advisors’ outlook on the state of the economy sank last month to its lowest point year-to-date, even as they hold a much more positive view of the near-term health of investment markets.

According to the monthly Advisor Sentiment Index, registered investment advisors’ view of the economy fell 7.4% and registered a “neutral” view of the current state of the economy. Less than half, or 44%, said the current state of the economy was “good” (39%) or “excellent” (5%).

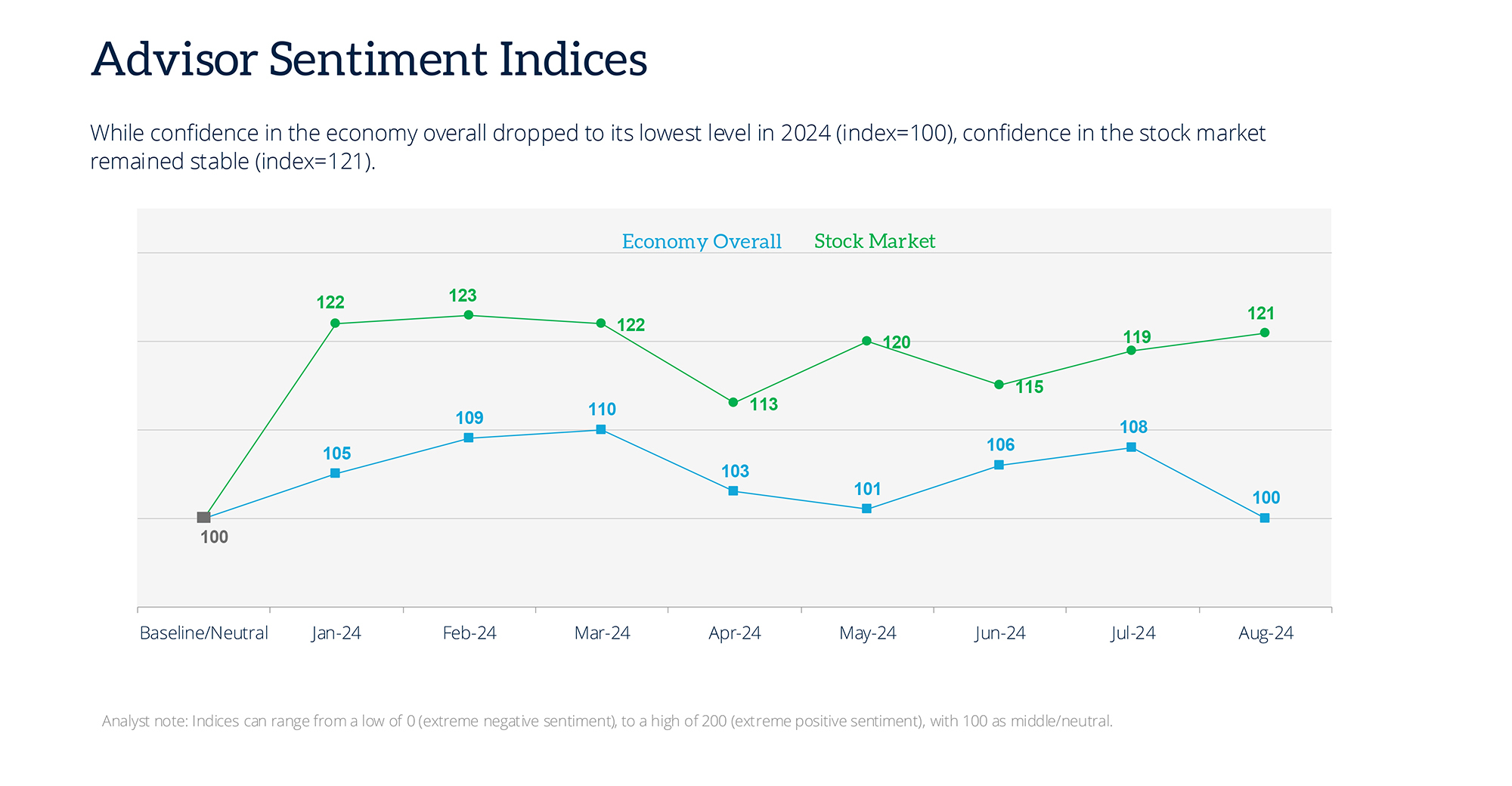

They expect the economy to get worse before it gets better. Four in 10 advisors expect the economy to worsen by the first quarter of next year, while another three in 10 expect no significant change. Many cited the uncertainty surrounding the upcoming presidential election, high levels of government debt and a still-distressed commercial real estate sector putting downward pressure on the economy overall.

The monthly survey was fielded before the Federal Reserve lowered interest rates by 50 basis points on Sept. 18, with expectations for further rate cuts ahead. Many advisors in the monthly survey cited the need for Fed action to boost economic activity, lower the inflation rate and ease the economy into a “soft landing.”

“Federal rate cuts will help the economy as it'll be cheaper to buy a home and get a car. I'm also optimistic since we are heading into retail season,” said one advisor surveyed.

Still other advisors pointed to high debt levels and overvalued assets, suggesting a “hard landing” is still on the horizon.

“Stocks are currently overvalued and the rate hikes by the Fed are going to eventually cause a recession,” said another surveyed advisor.

Advisors are more optimistic on the longer-term view of the economy, with almost half (45%) expecting improvement. Another 23% expect no change one year out, while 32% expect a net decline.

Continuing a trend, advisors still register a disconnect between the underlying economy and the stock market. Optimism in the state of the financial markets jumped 1.6% over the month.

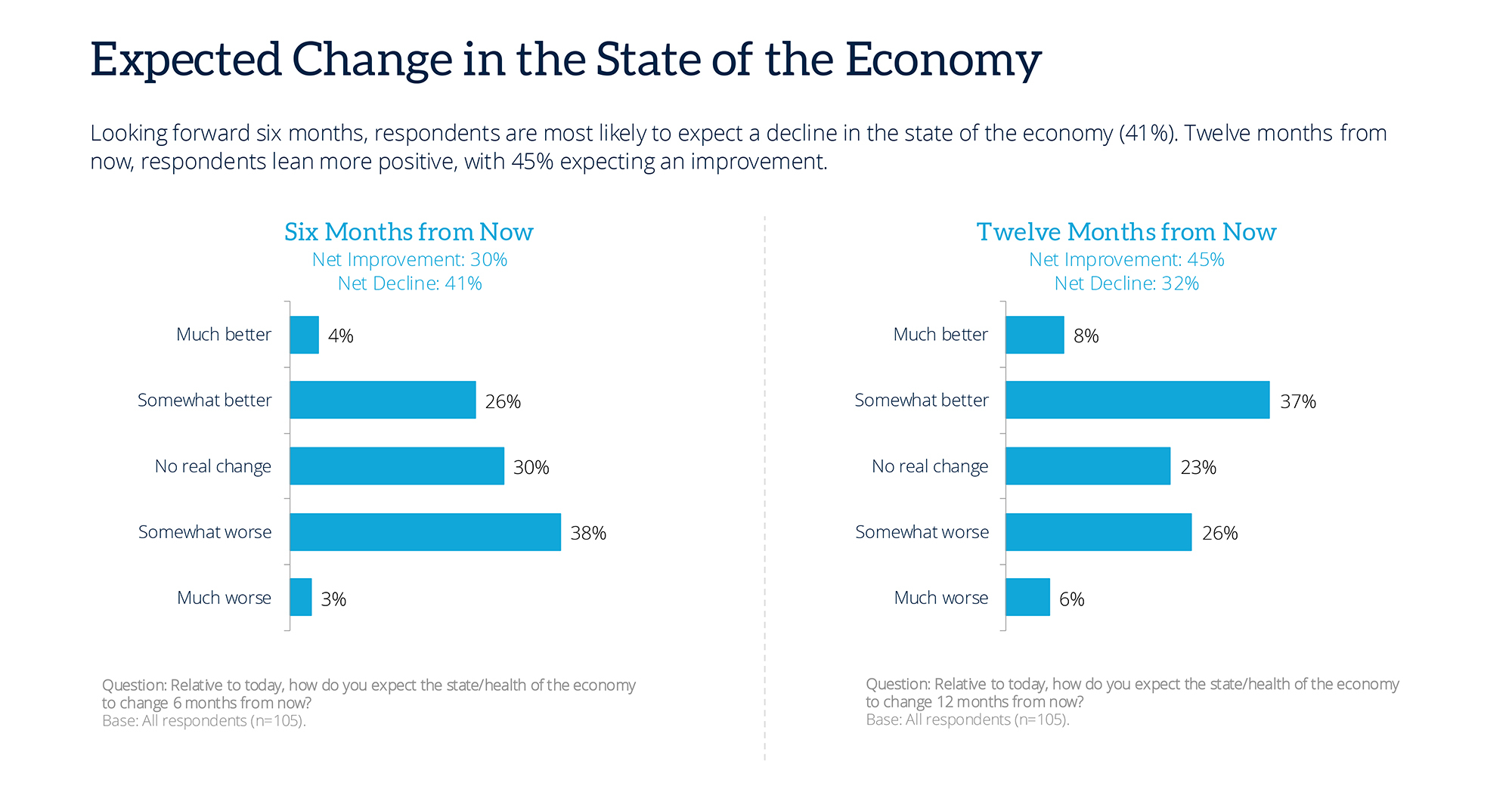

In the survey, 63% have a positive view of the current state of the markets. Yet only three in 10 (30%) see the markets improving over the next six months, with slightly more (37%) expecting a net decline—suggesting advisors see some frothiness in current valuations and expect uncertainty around the upcoming presidential election to dampen market activity.

Higher optimism prevails when advisors look one-year out: 42% expect markets to be “somewhat better” while 8% say they will be “much better”. Only 30% expect a market decline over the coming year.

“Right now, growth is priced at extreme levels. Forward earnings will have to be perfect moving forward,” said one advisor.

“Underlying metrics are good and positive, albeit slowing down but once an interest rate cut takes effect it should take off,” said another.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.