Financial advisors see a disconnect between the economy and the stock market.

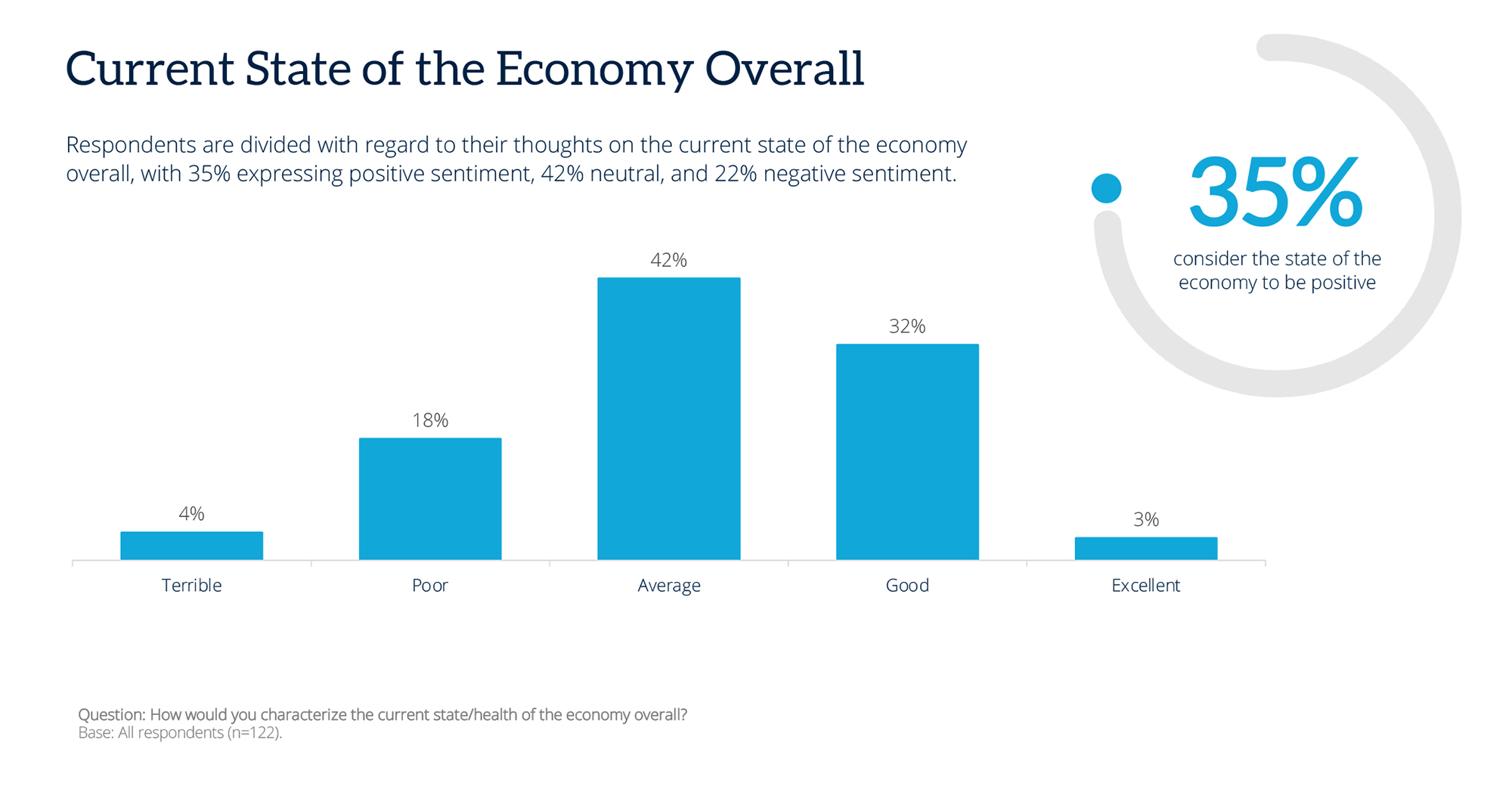

January’s RIA Edge Advisor Sentiment Index found only 35% of retail-facing financial advisors said they have a positive view of the current state of the economy. At the same time, almost twice that number—62% of advisors—said they have a positive view of the stock market.

The Advisor Sentiment Index is a monthly poll meant to gauge financial advisors’ current views on the state of the economy and the stock market and where they think both are headed—over the next six months, and at this time next year.

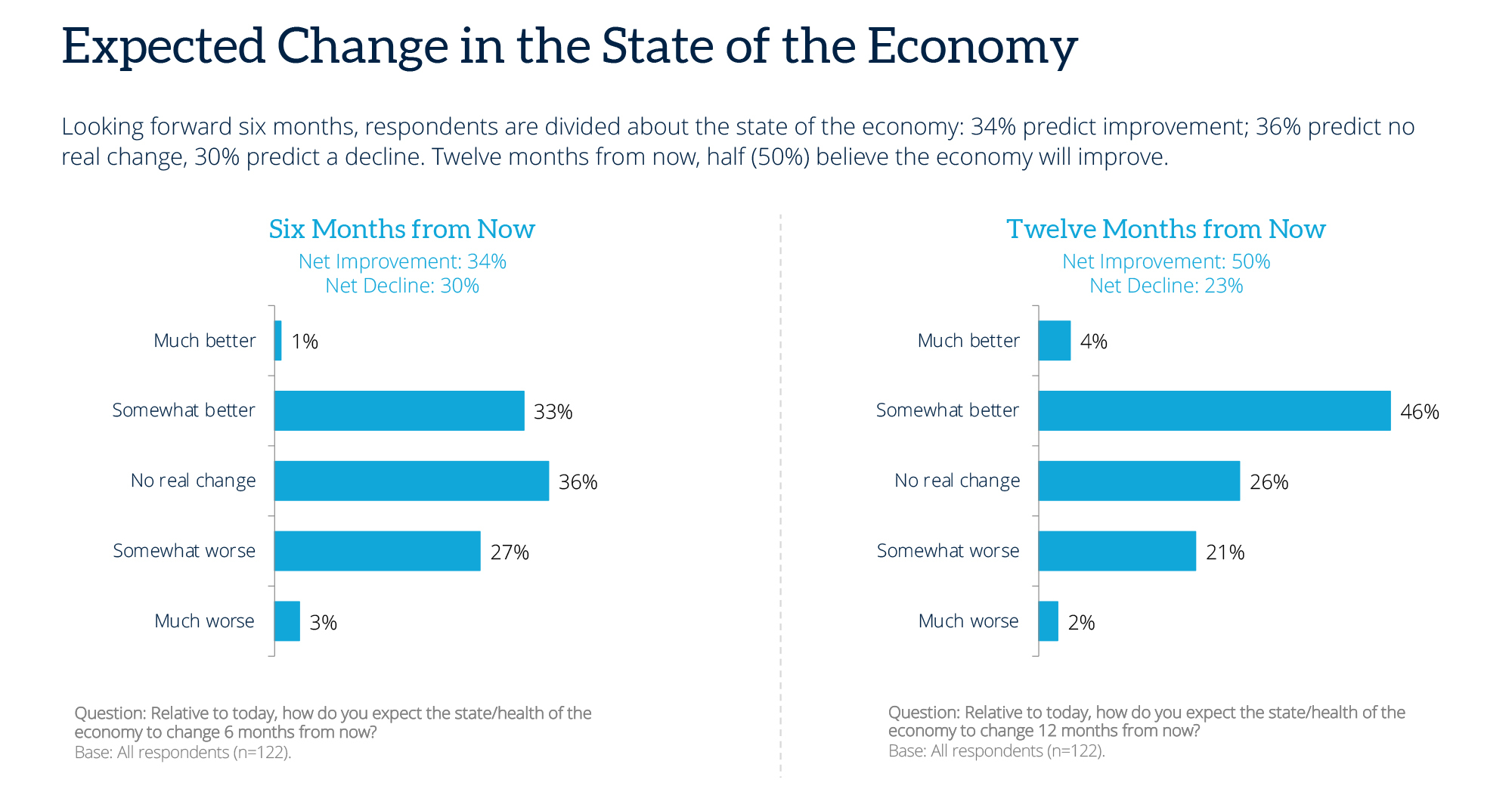

In January’s poll, most advisors seemed to suggest that the economy will eventually grow into the market: Over the next sixth months, advisors are evenly split between whether they see themselves as more, or less, optimistic about the economy.

But that number improves when looking to this time next year. Half of the advisors (50%) polled see the economy either somewhat (46%) or much (4%) better than it is currently.

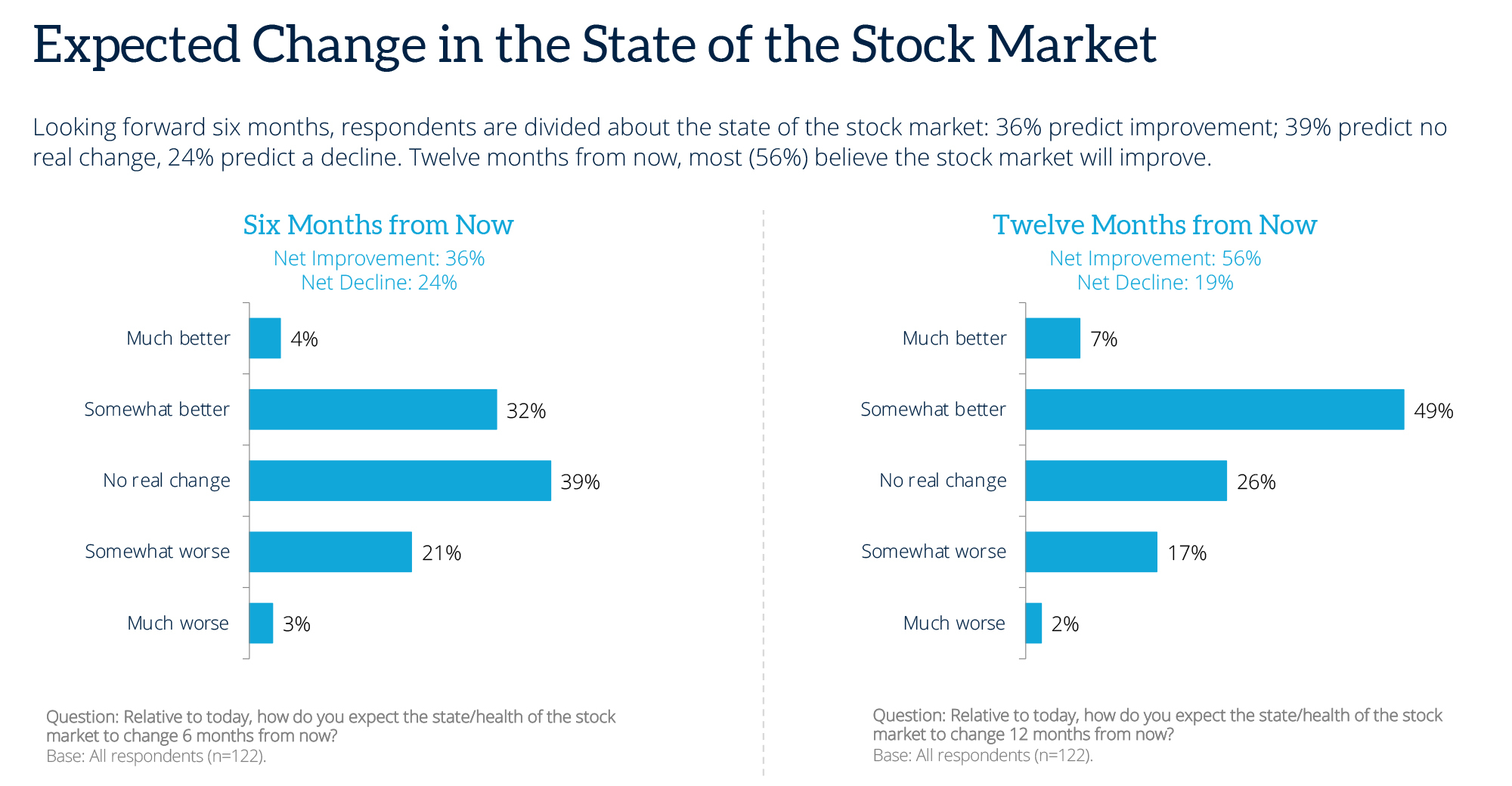

Likewise with the stock markets: Looking forward six months, respondents are divided: 36% predict improvement, 39% predict no real change and 24% predict a decline. Twelve months from now, most (56%) believe the stock market will improve.

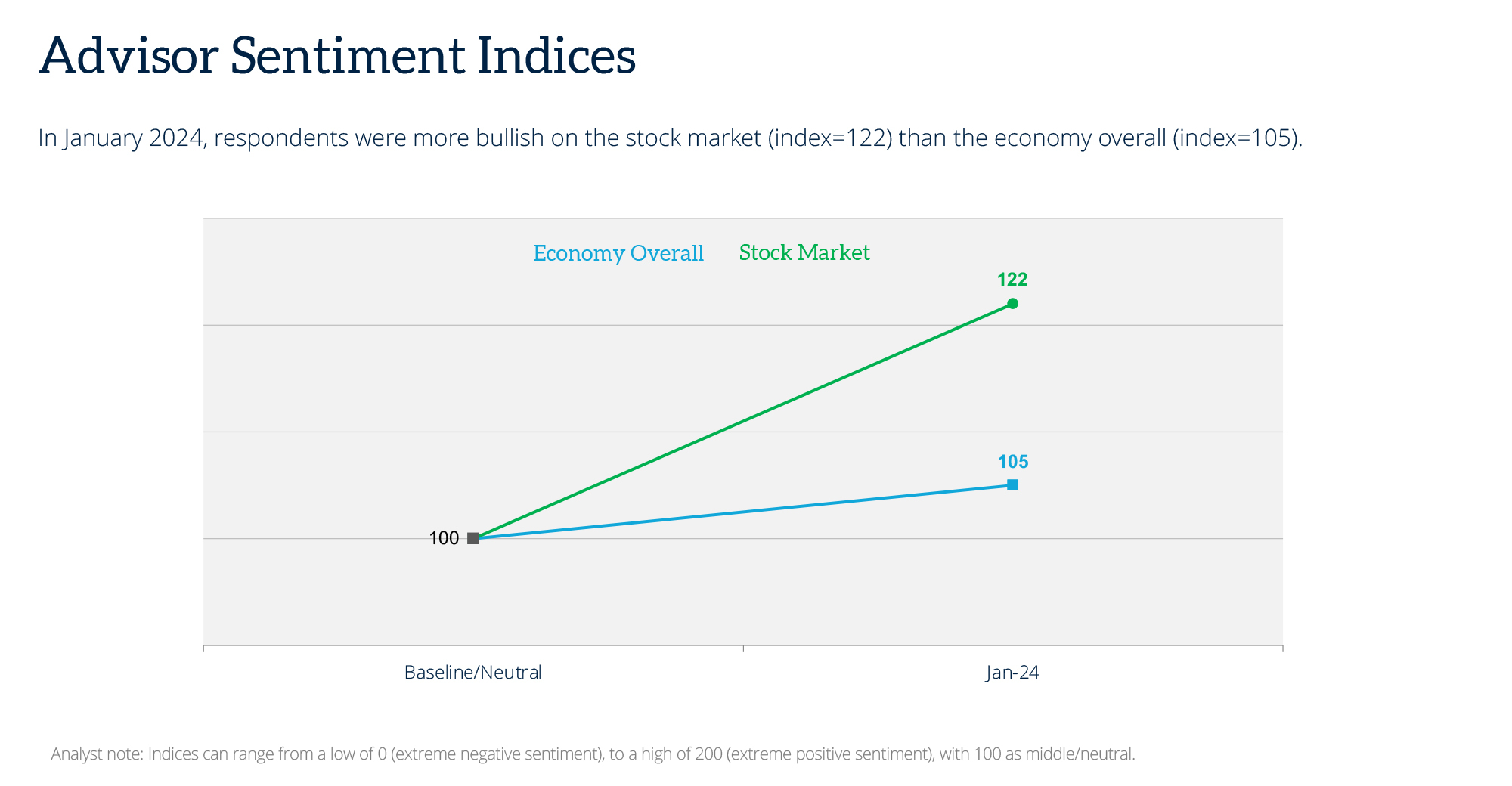

When responses are weighted and placed on a spectrum from 0 (extreme negative sentiment) to 200 (extreme positive sentiment) with 100 being neutral, the Advisor Sentiment Index registered at 122 for the state of the stock market, considerably optimistic, versus 105 for the economy, or barely over neutral.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Data collected January 22-29, 2024. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.