Stocks are at record highs and fear – at least as measured by Wall Street’s favorite barometer, the CBOE VIX – is at a 10-year low. So times are good, right?

You’d certainly think so. You’d figure “risk-on” indicators would be flashing all over the place. And you’d be right. Mostly. There’s more than one gauge, however, signaling investors’ risk appetite is actually waning.

VIX measures the volatility expectation embedded in near-term S&P 500 Index options. Volatility tends to spike higher on market declines. And in anticipation of declines. The opposite is true of our risk appetite indicator. It tends to swing lower ahead of significant declines in the S&P.

The indicator is really nothing more than a ratio of the PowerShares S&P 500 High Beta ETF (NYSE Arca: SPHB) price over that of the PowerShares S&P 500 Low Volatility ETF (NYSE Arca: SPLV).

SPHB tracks 100 components of the S&P 500 with the highest beta coefficients. You might say these are the blue chip index’s riskiest stocks. SPLV takes the opposite tack. It’s made up of 100 components of the S&P 500 exhibiting the lowest volatility.

At the top of the year, the ratio was .90; it’s since stair-stepped lower to the .85 level as the S&P 500 lurched higher. What’s it mean? Just this: Investors are girding themselves against volatility by shunning riskier stocks. That doesn’t sound like irrational exuberance. In fact, it seems downright defensive.

A couple of other indicators are flashing fear signals. One, oddly enough, comes from the option marketplace.

The CBOE Put/Call Ratio still leans heavily in the put direction, meaning investors are more inclined to buy puts – a bearish play – than calls. Chalk up another point for fear.

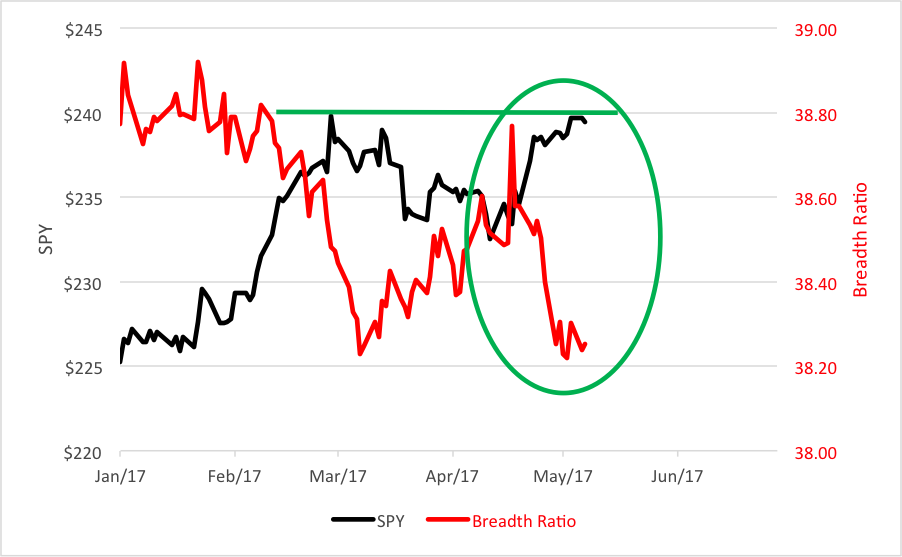

Then there’s market breadth or, rather, lack of breadth. Normally, sustainable uptrends are propelled by broad participation. Most recently, though, involvement in the market record has narrowed. At least as measured by another of our ETF metrics.

We put the Guggenheim S&P 500 Equal Weight ETF (NYSE Arca: RSP) up against the SPDR S&P 500 ETF (NYSE Arca: SPY) to gauge the involvement of smaller stocks in market trends. RSP’s methodology allows the least-capitalized issues in the S&P 500 greater expression. As you can see, the breadth ratio has been plunging since mid-April. If that’s not another chalk mark for fear, it’s at least a tick in the “caution” column.

The bottom line? Volatility may be presently low but won’t stay low. When it eventually spikes upward, beta players – those invested in capitalization-weighted exposures to the broad market – are likely to take direct hits. Finding ways to hedge against volatility’s ill wind seems prudent.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.