It should not come as a surprise that financial advisors made a few changes in the way they manage client portfolios and their own businesses following the near collapse of the financial services industry and the teetering stock market last year. In fact, many of them altered their asset allocation strategies, the kinds of fees they charge clients and their client asset minimums, and laid off support staff, according to preliminary data from Advisor Benchmarking’s tenth annual survey. The survey, conducted online from February to April, 2009, received responses from 561 RIA firms.

As traditional portfolio diversification strategies failed to protect portfolios last year against the collapse of almost every single asset class, some 56 percent of advisors adjusted their allocations to protect client assets. Steps taken by advisors included increasing their allocations to fixed income (30 percent) and alternatives (37 percent), using new lows in the market as buying opportunities (38 percent) and moving into cash (37 percent). Only 35 percent of respondents said they did not alter their approach to portfolio management at all.

“One of the main findings was that as advisors sought to insulate client portfolios from market volatility, they increased their allocations to alternative investments,” says Maya Ivanova, market research manager at Rydex Advisor Benchmarking. “We have seen this trend over the last many years, but in 2008, it was more significant. From our conversations with advisors and other research, we think that trend will stay.”

Despite a gradual shift towards tactical allocation over recent years, advisors did not seem to make big changes in this area last year, according to Advisor Benchmarking. In 2008, 49 percent of advisors considered themselves strategic investors, and 32 percent considered themselves tactical. In 2007, that split was 50 percent strategic and 35 percent tactical. (The remaining advisors consider themselves neither.)

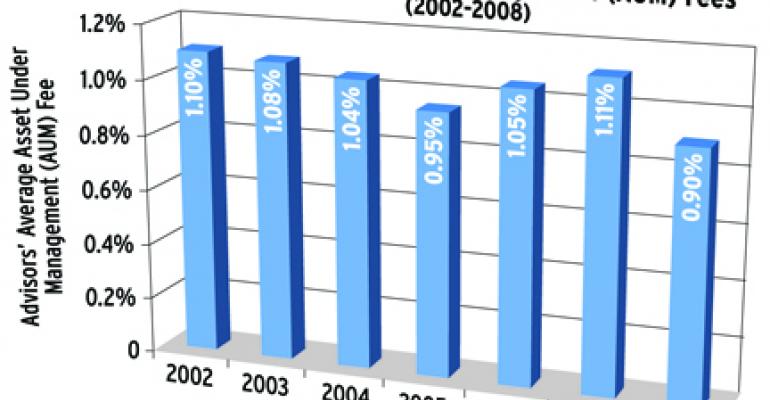

Fearful of losing clients distressed by the market to rivals, many advisors also reduced fees on assets in 2008, which fell to their lowest levels, on average, in at least ten years. In 2008, average fees on assets charged by RIA advisors sat at 0.90 percent, down from 1.11 percent in 2007. Average fees on assets declined between 2002 and 2005, falling to 0.95 percent from 1.10 percent, but bounced back in the following two years. “Obviously the market was very competitive, and in a tough environment, advisors want to hold onto their clients,” says Ivanova.

With fees on assets declining with the plummeting market, about 21 percent of advisors also said they had changed their fee structure in 2008, or planned to change it. About 9 percent said they had begun, or would begin, a retainer fee program, while 7 percent said they had or would implement an hourly fee program.

“Not many of them were doing that before,” says Ivanova. “It seems to me it’s hard for advisors, if they still have high [account] minimums, to accept new clients. So this is an additional way for them to work on a project basis with some clients. Instead of charging you for assets under management, they work with you on an hourly basis. It’s one of the ways to differentiate yourself with clients.”

The study also shows that, for the first time in seven years, advisors decreased their client account minimums, which fell 41 percent to $250,000, on average, from a 2007 high of $425,000. Meanwhile, passive referrals from existing clients were more than halved in 2008, accounting for 20 percent of clients versus 45 percent in 2007. Web sites, on the other hand, played a larger role in bringing in new accounts last year, with 10 percent of new advisor clients attributed to the web.

And finally, with revenues plummeting, many RIAs fired support staff in 2008, with the average number of administrative staff falling to one per average RIA firm, from three in 2007. The average number of customer service team members per RIA firm fell to three from four.