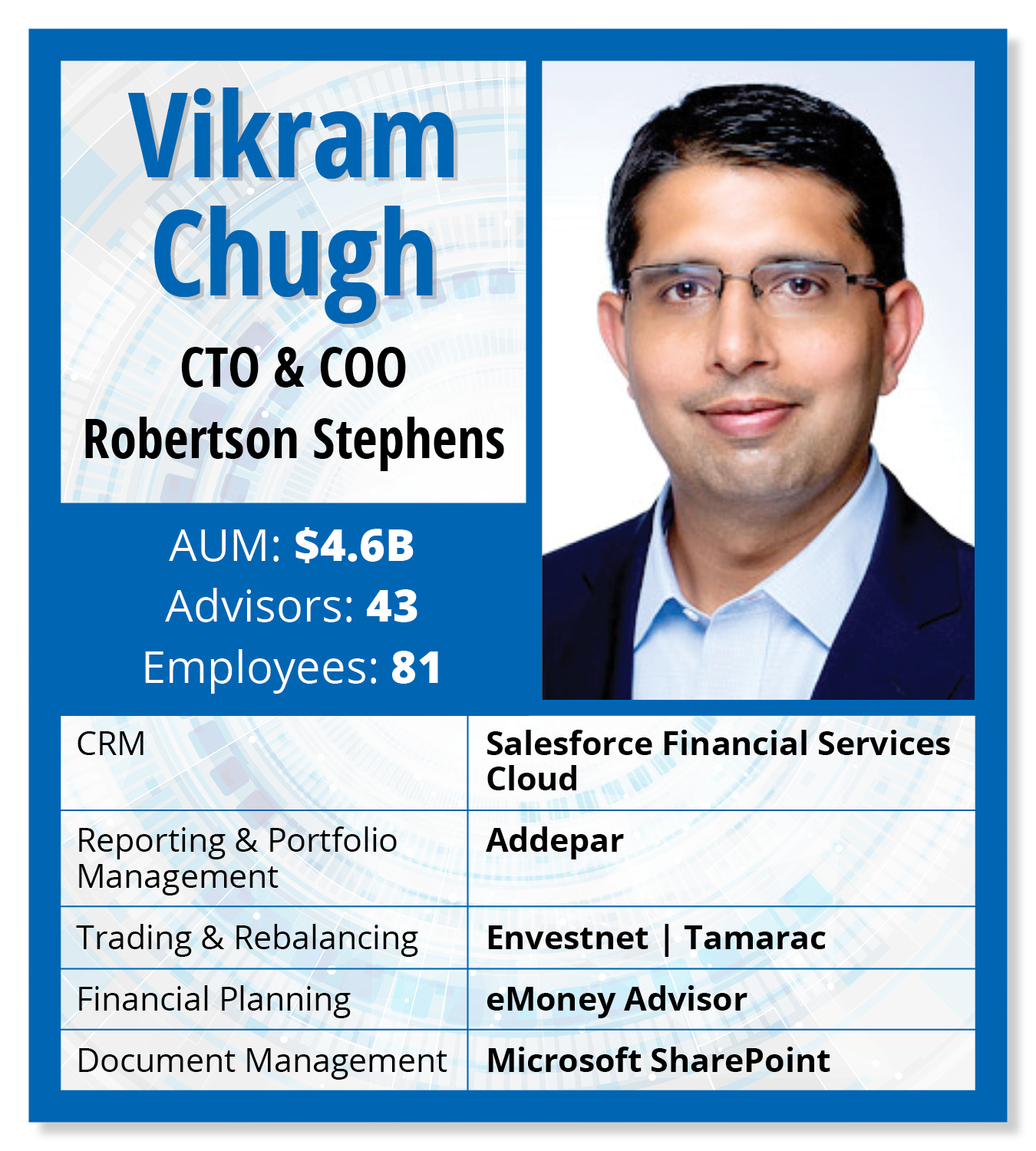

We’ve built an end-to-end technology stack from scratch, one piece at a time. We started as a very small RIA with two advisor teams in one office location. Since then, we’ve grown to 20 advisor teams in 18 locations.

You can build an integrated system leveraging these individual components with modern software. That gives you much flexibility if you own the integration across these different systems. If a newer system comes along, you can replace that while keeping the rest of the tech stack the same.

We’ve invested a lot in building integrations. We do integrations where it makes the most sense. We’ve given thought to the advisor’s workflow. We’ve put the advisor in the center of our entire tech stack. We thought about their interactions across the board as we built out.

We’ve invested a lot in building integrations. We do integrations where it makes the most sense. We’ve given thought to the advisor’s workflow. We’ve put the advisor in the center of our entire tech stack. We thought about their interactions across the board as we built out.

CRM/Marketing/Workflows: Salesforce Financial Services Cloud

For CRM, we’ve always had Salesforce. We went into it knowing it would take us some time to get the most out of that system. We are getting there now.

We are focusing on investing in it and building out our workflows and integrations with third-party systems. We feel good about how we’ve built various integrations into our CRM system. Advisors should spend most of their time in CRM.

We spent a lot of time building out our marketing capability in Salesforce. We can track any interactions we’ve had with prospects and clients and any email communications. We’ve integrated Salesforce into Zoom, our meetings and phone system.

Anytime we call a client or a prospective client through our Zoom system, it captures the call in Salesforce. We can go in there and update our notes from the conversation. We are building out an entire ecosystem.

We score on any interaction we’ve had with a client. We track if they open a particular link in an email and how much time they spend on an article. We are trying to capture aggregate engagement scores across these prospects and clients, which helps us become more thoughtful about how to market to them.

We’ve also been using Salesforce as a workflow system. Any time there is an advisor request for our operations, wealth planning or investments teams, it all originates through Salesforce. Anytime an advisor wants to set up a new client account, those activities are captured within Salesforce. We are building out newer workflows daily based on our requirements.

Portfolio Management/Reporting: Addepar

We have also always had Addepar. Its systems are built with a robust data architecture. It helps us capture data from the custodians that we use, as well as held-away assets. It helps us capture information on alternative investments and products we want to report on in our client’s portfolio.

We spent much time building our data reporting and analysis capabilities, especially for high-net-worth and ultra-high-net-worth clients.

Financial Planning: eMoney

We pull the Addepar data into the eMoney platform. It’s built as a wealth planning tool. Beyond the custodian data you’re pulling from Addepar into eMoney, you can also capture information across the board on a client, including their insurance and trusts and estate planning. We also like the cash flow modeling capabilities within eMoney and use that a lot with our clients.

We pull the Addepar data into the eMoney platform. It’s built as a wealth planning tool. Beyond the custodian data you’re pulling from Addepar into eMoney, you can also capture information across the board on a client, including their insurance and trusts and estate planning. We also like the cash flow modeling capabilities within eMoney and use that a lot with our clients.

Trading/Rebalancing: Envestnet | Tamarac

We used Blaze Portfolio initially, but we switched to Envestnet | Tamarac. It was more about the degree of freedom around managing portfolios. Most new clients come to us with existing portfolios.

If you take somebody’s existing portfolio and try to map it to a new asset allocation or asset class schema, you must map their holdings versus your recommendations. To be able to do that effectively and consider any friction related to the transition, tax costs, trading costs or anything else that comes with the transition, you need a system with multiple degrees of freedom.

You must have the ability to capture numerous variables and be able to do it in the most effective way for the client. The system gives us the ability to manage the client’s journey. That’s why we made that transition.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what's in your wealthstack? Contact Rob Burgess at [email protected].