We could just as well have titled this blog “Lessons in Absurdity.” It is unnecessary to fully repeat our message of previous weeks, but, in synopsis, traditional measures to assess investment opportunities have been heavily influenced by accommodative central bank policy (low rates) and a consequent “massaging” of risky outcomes over the past six years (and going strong).

Last Friday, domestic markets nearly traded at their October 2014 lows (1862 for the S&P 500), an important mark of the recent correction (and one that may have provided support in the current downtrend), before “staging” a complete turnaround. The rather significant move was not because facts had improved; in fact, they had materially worsened, with the publishing of the jobs report. Far from engaging in logical fallacies, serious market participants are, once again, left scratching their heads. Bad news for the economy continues to be considered good news for the market, as expectations around the Fed further supporting the system seem to be validated.

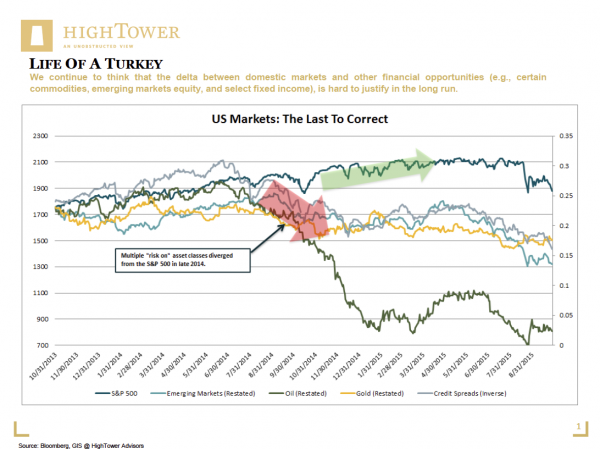

The most important guidance, as always, is provided by the market itself. As passionate students, we suggested in our July post, Canary in the Coalmine, that all asset classes would have to adjust to more realistic, historical levels (measured by volatility), and that the time had come for investors to adopt a rigorous financial planning framework, recognize the relationship between risk and reward, and adhere to a standard of global diversification. Let’s now look under the hood and reveal what provides basis to our concerns: Since 2014, numerous risk assets have diverged from the S&P 500, following a nearly identical path in their consolidation—except for oil, which has had a more violent adjustment to the downside (please see our chart).

We continue to think that the delta between domestic markets and other financial opportunities (e.g., certain commodities, emerging markets equity, and select fixed income), is hard to justify in the long run. This notion allows for at least two possible investment themes: 1) price dislocations, as a result of corrections that have occurred, offer ample opportunities outside the U.S., mainly in emerging market equities (also to diversify away from a richly priced market at home); and, 2) this is an environment to be selective and adhere to stock selection, rather than passive index plays.

My team at HighTower knows that I only like to quote if absolutely necessary and, if so, only from serious sources or thought leaders. With this in mind, I leave you with a paragraph from Taleb and Blyth’s excellent essay, The Black Swan of Cairo—a tale about risk and how suppressing volatility can lead to adverse outcomes:

“The life of a turkey before Thanksgiving is illustrative: the turkey is fed for 1,000 days and every day seems to confirm that the farmer cares for it—until the last day, when confidence is maximal. The ‘turkey problem’ occurs when a naive analysis of stability is derived from the absence of past variations. Likewise, confidence in stability was maximal at the onset of the financial crisis in 2007.”

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.