All too vividly, I remember a stroll down Fifth Avenue some years ago with a close friend of mine, and his outright laughter when we passed a computer retailer displaying a rather unpopular (back then) product: a Mac. Today, of course, we all want to appear (or claim to be) much smarter, having seen such a major trend develop right in front of our eyes. Yet, hardly anyone bought Apple stock (to my recollection) when it was really, really cheap. And here we go again: It’s time to rack our brains about how to anticipate the next big trend, and, consequently, load up on those new stock opportunities right at the get-go.

In stark contrast to our lighthearted stroll, a topic of increasing concern has been the devastating drought affecting parts of California (and other parts of the world). Yet, national media outlets continue to focus on the coverage of “cats being rescued from trees” rather than highlighting this potentially catastrophic development. Not that I wish to foolishly compare aspects of aspirational technology with life-impacting natural events, but disruptive situations can (and must) create change as well as opportunity, which is very much linked to our stated goal of finding new investment ideas.

As much as we like to bring fresh content to this forum, it may not always be necessary, especially when our ideas are carefully researched, and sound basis is given to capturing long-term investment trends.

In a previous post, Glass Half Full, I stated that, over the next 20 years, nearly $22 trillion (1.3 times U.S. GDP at current figures) will need to be invested in water-related infrastructure projects just to maintain the current status quo; in other words, it’s a significant investment, not even accounting for water scarcity developing around the world. If we pair this notion with the fact that most water-related companies (there are only about 100 of these publicly-listed globally) fall mainly within the “small-cap” category, we can add another aspect for consideration. As per our recent entry, Size Kind Of Matters, small-cap stocks will likely produce better results for investors who have a stomach for volatility and a long time-horizon. Also, investors can capture excess returns at the small-cap sector level when the accompanying large-cap sector is outperforming the broad market.

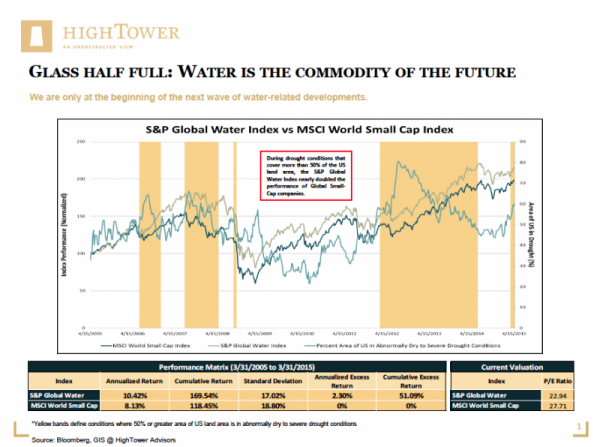

Analyzing drought conditions in the U.S. over the past 10 years, our findings show that during “drought periods,” the S&P Global Water Index (composed of 97 percent small cap stocks) has outperformed the MSCI World Small Cap Index by 85 percent. To the contrary, during “non-drought periods,” the S&P Global Water Index has underperformed by 38 percent; the difference between those two periods is close to 125 percent! The current spike in U.S. drought conditions is early in its onset (March 2015) and, based on past periods, could last up to nine months. Further, taking into account our trend assessment, water-related stocks should continue to outperform global small-caps (as measured in the MSCI World Small Cap Index).

Aside from a thoroughly executed financial plan to inform asset allocation choices, value and trend are key considerations to achieving investment success. To be fair, developments around “forces of nature” are certainly hard to verify and/or capture and our model may be oversimplifying the global challenge of addressing water scarcity. However, for investors that simply like water as a precious commodity (and at the same time want to forgo the detailed path to our findings), the picture remains attractive as well: Not only is the S&P Global Water Index about 20 percent cheaper on a P/E basis vs. global small-caps, but, over the past 10 years, water stocks have materially outperformed their non-water peers in absolute terms as well as on a risk-adjusted basis.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.