Advisors are now on the clock to implement changes necessary to comply with the Department of Labor's fiduciary rule.

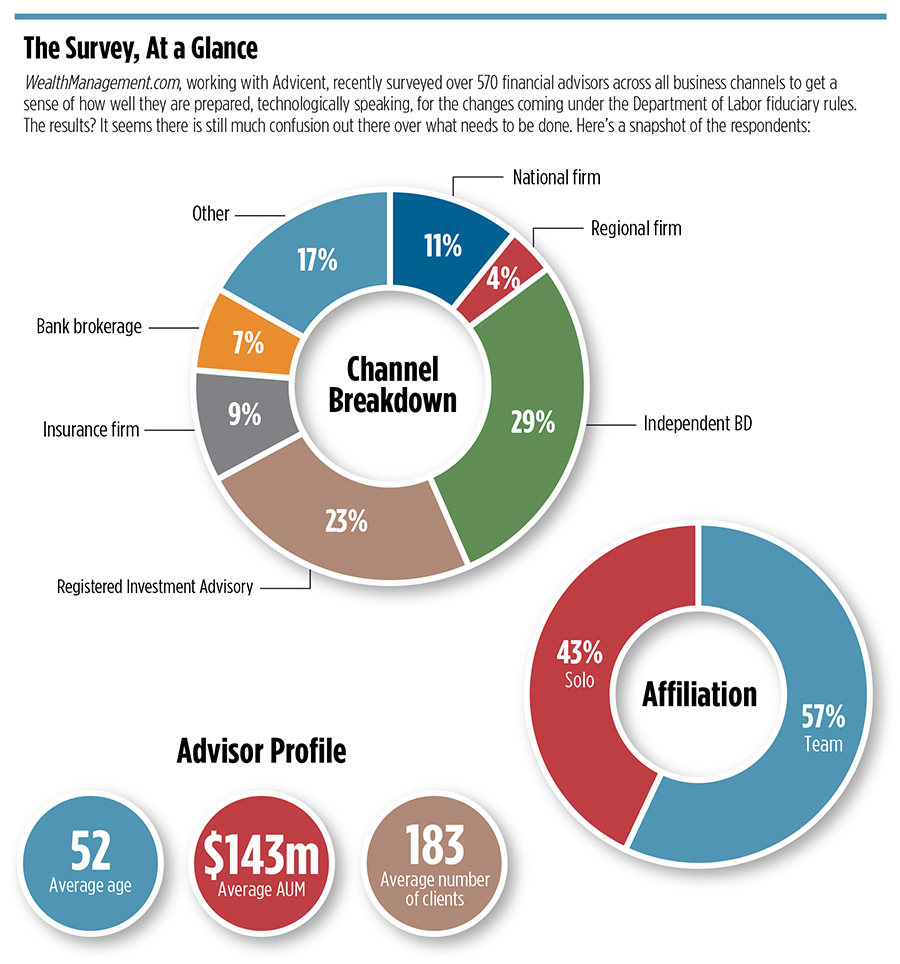

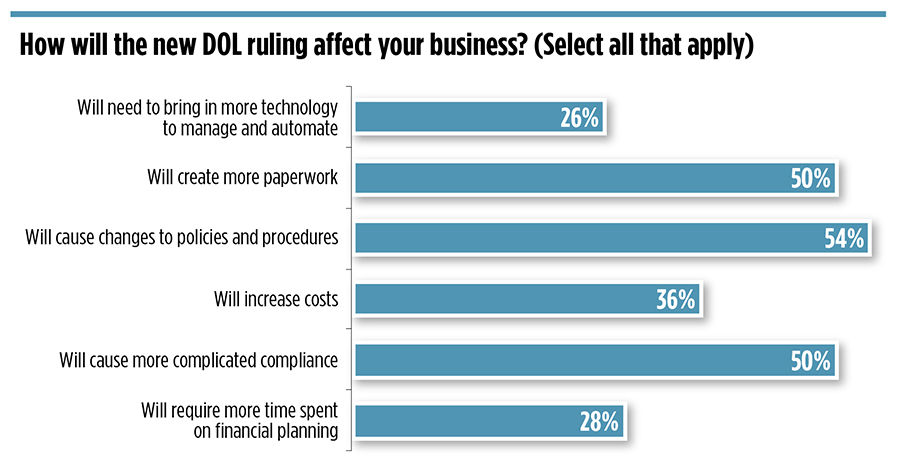

According to a recent survey conducted by WealthManagement.com and Advicent, half of advisors expect the ruling will force them to change their policies and procedures, complicate compliance and create more paperwork.

For wealth management technology vendors, the fiduciary rule looks like a watershed moment to finally prove their value to tech-averse advisors. The pitch is that firms can remain profitable as fiduciaries by delegating business practices to digital tools.

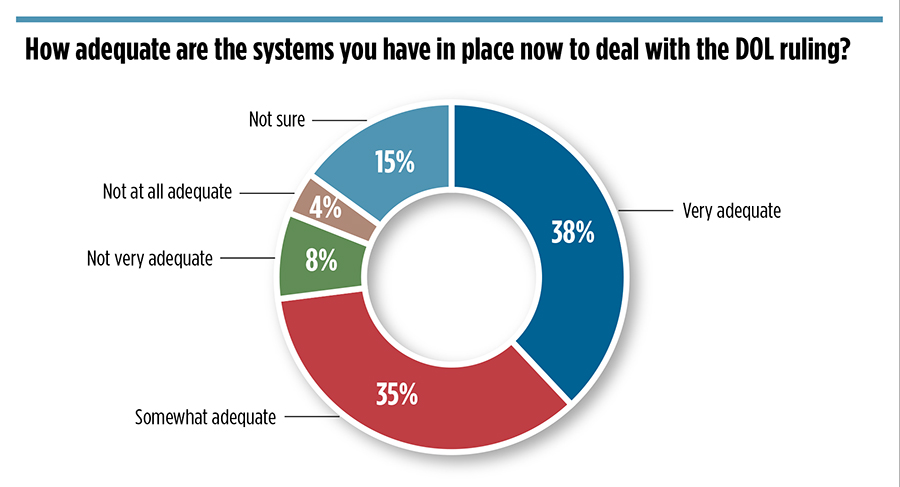

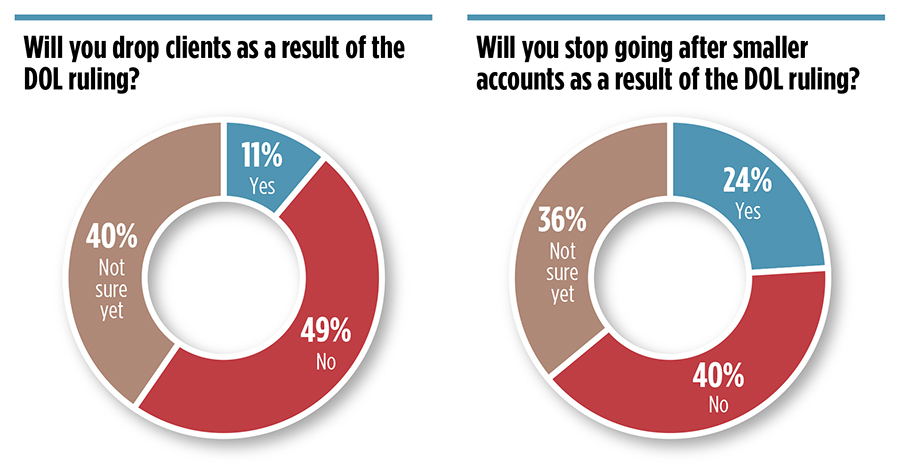

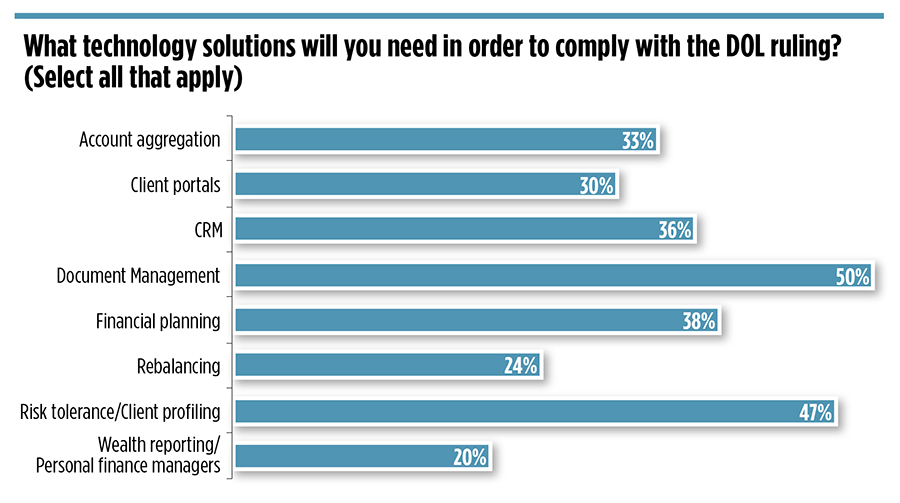

But the demand for wealthtech may not be there. Only a quarter of the advisors surveyed said they would need to bring in more technology, and 73 percent said the current systems they have in place are either "very adequate" or "somewhat adequate" to deal with the DOL's ruling. When asked about individual technology solutions, most advisors indicated they already use account aggregation, client portals, compliance software, CRM, document management, financial planning tools, portfolio management, rebalancing and risk tolerance software.

The only tools not used by the majority of the nearly 600 advisors surveyed were wealth reporting and personal finance managers, but few respondents indicated that these would help them comply with the fiduciary rule.

The demand for new technology is even smaller in the registered investment advisor and regional channels. The technology firms seem to know this already and are focusing their attention on the channel perhaps most impacted by the DOL's rule: independent broker/dealers.

"Broker/dealers are trying to figure out what the effects [of the fiduciary rule] are. It's still early," says David Mehlhorn, the director of sales at Redtail Technology, a firm that creates CRM technology tailored to wealth management. More than independent RIAs, many of whom already operate as fiduciaries, Mehlhorn says advisors at IBDs are worried about having to defend their actions and investment decisions. "There's a new emphasis on making sure they cross their t's and dot their i's."

The data supports that, with 30 percent of broker/dealer advisors indicating they need additional technology because of the DOL ruling, compared to just 17 percent of RIAs and regional advisors.

Of the solutions on the market, b/d advisors named risk tolerance and client profiling tools as the software they need to comply with the fiduciary rule. Aaron Klein, the CEO of Riskalyze, says tools like his, which assigns each client an algorithmically calculated "risk number," help firms prove that their investment decisions were made in a client's best interest.

Klein says that when you tie risk tolerance and financial objectives to investing, advisors can demonstrate objectively that decisions were made in a client's best interests. "You can't just swap them all into the same portfolio at the same fee," he says.

Across all channels, risk tolerance was the second most popular technology needed to comply with the rule. Document management was the first, with half of advisors saying they need it to be compliant. Klein says this probably has less to do with actually managing pieces of paper or digital PDFs, and more about documenting every step of the wealth management process to justify decisions whenever a regulator comes knocking.

"Even if you take away commission products, which get all the headlines, you still have the challenge of documenting that you're acting in the [clients'] best interests," Klein says. "Instead of worrying about managing imaginary sheets of paper being stored in a computer, an enterprise solution can just search through anything they've ever done in the cloud."

Tim Nissen, the marketing manager for IntelliChief, an enterprise content management system, says his company has gotten a lot of demand for what he calls the "data lifecycle protection," which is everything automatically documenting every step of the client-advisor interaction from prospecting to investing.

Linda Ding, the vertical marketing manager and strategist at Laserfiche, another enterprise content management firm, says that firms are also looking for ways to improve internal information retention and automate compliance workflows.

"You will see a lot more advisors embracing technology as a core strategy for building a viable business moving forward," Ding says. "It's the dawn of a new era for wealth management."