In the increasingly crowded marketplace of advisor technology, United Capital Financial Advisors has stood out with unique tools like its Money Mind analyzer, Honest Conversations exercise and client Guidebook.

It’s been so successful that the company is launching FinLife Partners, a white-labeled version of its software package that independent registered investment advisors can license directly from the firm. The product takes pressure off of United Capital to continue its strategy of growth through acquisitions, and also moves the RIA toward a new role as technology vendor.

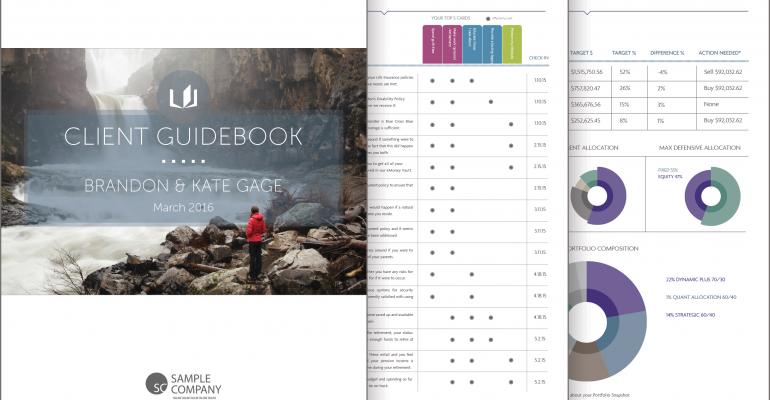

FinLife Partners allows firms to put their own branding on United Capital’s client experience tools, a financial planning and investment management system that were traditionally a part of its Financial Life Management platform. These are all integrated with a version of the Salesforce CRM custom-designed by United Capital to provide things like custodian feeds, e-signature, digital account opening and account aggregation all from a single portal. FinLife Partners is mobile-friendly and lets advisors communicate to clients through push notifications.

But the company doesn’t like to use the word TAMP (turnkey asset management platform). Mike Capelle, United Capital’s chief strategy officer, said it’s more accurate to call FinLife Partners a “turnkey advice and planning platform.”

“We are focused on financial guidance,” Capelle said. “What is it that clients want money to do for them? It’s fairly unique in the industry, what we’ve pulled together—that final mile of what goes in front of the client.”

As opposed to the more open-architecture approaches of other technology vendors, Capelle said United Capital is focused on middle-career advisors looking to respond to the changing industry with a complete package that is “built and ready to go.” After the initial investment, United Capital says it will manage the ongoing reinvestment and technology administration.

“There are a lot of advisors looking at how to navigate the new world order around expectations that clients have—the digitization of everything,” Capelle said. “With all of the technology solutions out there, they are struggling with how to pull that together and differentiate themselves in the marketplace.”

According to Capelle, most advisors have a net promoter score, which measures how likely a client is to recommend an advisor to a friend or colleague, in the 30s. Advisors using the full range of United Capital’s investment management, financial guidance and client experience tools are getting their scores into the 70s and 80s. He added that three-fourths of advisors using United Capital’s suite were able to increase wallet share to 75 percent, realized top revenue growth of nearly 30 percent and net new asset growth of 10 percent in the first 12 months.

“[Advisors] end up with a consolidation of assets and are able to provide financial guidance as an additional service that their client will pay for,” Capelle said. “It creates a new revenue for advisors.”

And that new revenue is critical in a time when robo advisors have commoditized asset allocation and regulators are pushing the industry towards providing fee-based advice. William Boland, a senior analyst at Aite Group’s wealth management team, said products like FinLife Partners can help advisors make that shift.

“This is something for that advisor who is in the middle of his [or her] career … and needs something more than performance and trying to beat the benchmark,” Boland said. “Planning is the next thing that every advisor needs to incorporate into their business.”

Boland added that the product makes sense from a business perspective as it adds increased diversification into United Capital’s revenue stream. The company will likely continue to grow through acquisitions, and allowing RIAs to incorporate some of the United Capital DNA into their business could even pave the road for future additions; but the short term goal is likely to squeeze more value from the investment United Capital has made in its technology.

Its success, Boland said, will depend on its pricing model and United Capital’s ability to get advisors on-boarded and using the technology.

Capelle said United Capital is still putting together its pricing model and wasn’t able yet to share to details, but has an entire digital training platform put together it’s calling “The Brain.” He said it includes quick help, self-service documents like guidebooks and presentation templates, and a digital walkthrough of Salesforce’s various features.

“Advisors can turn to this to dig in and find strategies that are pre-designed, pre-built for them for their clients,” Capelle said. “We make everything really turnkey—easy to use.”

FinLife Partners is currently in a pilot-testing phase with select RIA firms, and the company expects a general launch in the fourth quarter of 2016.