Mobile technology use is advancing rapidly among investors and their advisors, but the pace is more uneven with RIA custodians.

In April tech consultant Celent predicted that smartphones will grow 35 percent in North America to 664 million this year, and tablets up 89 percent to 115 million. The advisory industry was on board: Last year data aggregator ByAllAccounts found that more than 40 percent of financial advisors were using tablets, and 86 percent were using smartphones.

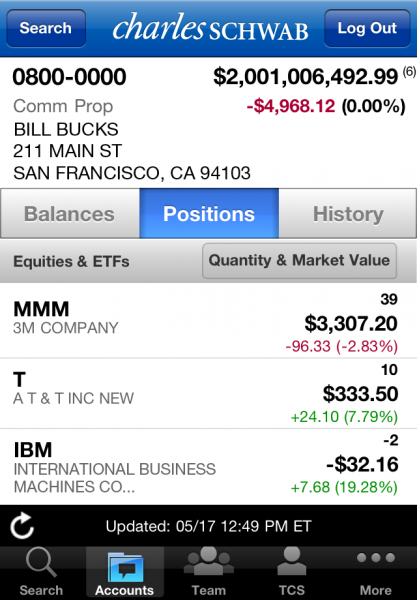

Adoption within the custodian industry is a different matter. Yesterday the largest custodian, Charles Schwab, announced it was releasing a free app (below right) that would allow advisors to use their iPhones to access client account balances, positions, and transactions.

Schwab, which has about 7,000 registered investment advisors who custody with Schwab Advisor Services, said it expects to have an iPad app available before the end of the year.

Schwab is late to the party. Fidelity Investments launched an iPhone app for advisors using its WealthCentral platform in February 2011, and an iPad app for WealthCentral was released in January. TD Ameritrade Institutional developed an iPad app for its Veo platform in the spring of 2011; last April it upgraded the app to allow trading and streaming CNBC.

“Custodial competitors have already updated their existing apps to include things like trading, streaming financial news and interactive charting,” Bill Winterberg, principal of FPPad.com, a technology consulting firm, said in an e-mail. “So the bar has been set fairly high for Schwab.”

Steve Hirsch, Schwab’s vice president for institutional web services, said the iPhone app was in pilot testing for four to six weeks. The firm was methodical in its approach

“We wanted to take the time to really understand at a much deeper level what our clients were looking for,” Hirsch says. “And we’re not in the mode of racing just because Client A does something. We take our time to make sure we’re adding value and responding to the real needs as we understand them.”

Celent says that mobile advisor apps will grow in importance as more firms serve them up, but it doesn’t see their availability as a driver of assets to or from a particular wealth management platform. Apple’s iOS operating system will remain dominant in the market “for the foreseeable future.”

Graphics will improve, driving advisor demand for tablets as presentation tools, Celent predicted. Smartphone apps also will continue to develop as advisors upgrade from handsets; alert delivery systems are important in this segment because smartphone owners take their devices with them everywhere, Celent added.

“Many clients, especially in the high-net-worth space, already own smart devices,” Celent said. “They expect their advisors to have access to the same devices, especially tablets. Access to devices can also help the advisor reinforce their value-add to their clients.”

David Drucker, financial advisor and editor of the Technology Tools for Today newsletter, says the adoption of mobile devices in the advisor market is huge.

“I go to conferences now and it seems everyone has an iPad and is using it to follow conference agendas, take notes, etc.,” Drucker said in an e-mail. “Advisors talk confidently about the value iPads bring to client relationships as many now carry only iPads (no longer paper) into client meetings, reviewing critical documents and findings directly on the iPad with the client.”

The relationships between clients and advisors also are driving the demand for mobile tech. Simon D. Gray, a CPA and financial advisor with offices in Boston and Atlanta, finds himself working with busy professional clients outside of regular business hours.

He uses Fuze Meeting, a program compatible Apple and Android systems, to conduct remote conference with clients.

“It’s as if they’re sitting next to me and I’m just flipping through this presentation that they’re used to with an advisor that shows how they’ve done,” Gray says. “No one necessarily comes to our office anymore. … We typically don’t have the 80- or 70-year-old clients. We usually have young doctors, attorneys, professionals that get it . They do not want to drive somewhere and sit in an office when all this stuff can be done at 8 o’clock at night when they put the kids away to bed.”