Broker/dealers and large RIAs face a unique set of challenges when it comes to technology. Representatives and regulators demand more, margins get squeezed, and executives worry about not only what software to invest in but how to implement it.

To answer those questions and more, Joel Bruckenstein started T3 Enterprise, an event aimed decision-makers at larger firms to help them learn more about technology available on the market today. Several of these technology providers took the stage Tuesday in Ft. Lauderdale, Fla., to demonstrate their newest products, updates and hint at future products still under wraps.

Real-Time Riskalyze

The conference kicked off with a presentation from Aaron Klein, the CEO of Riskalyze, who made a case for making a quantitative assessment of a client’s risk tolerance a cornerstone of wealth management.

Technology, Klein said, can help advisors avoid assumptions around client risk tolerance and increase asset growth through both scale and increased engagement. With that in mind, he introduced Real-Time Wealth Management Enterprise, a suite of software tools to help RIAs, broker/dealers, banks and other institutions easily deploy technology across the business.

Real-Time Wealth Management provides a single dashboard that incorporates Riskalyze for risk-aligned portfolio creation and fiduciary review (including integrations with FolioDynamix, Orion, TrustCompany of America and TD Ameritrade); an enterprise version of Autopilot for account opening, e-signature and asset migration; and a new integration with Compliance Cloud to automatically scan entire books of business for compliance issues.

“The future of advice will be human driven; technology assisted,” Klein said, adding that Real-Time Wealth Management is designed to be deployed across a business in just 75 days.

MoneyGuidePro: The Next Generation

Almost three out of four Americans are scared to engage with a financial advisor, MoneyGuidePro’s CEO Bob Curtis told the audience during his presentation. “Do you think anyone is afraid to go online at home and engage with a computer?” Curtis said in reference to emergence of automated investment services. “It is easy and fast. It is unintimidating.”

Advisors need to be just as accessible, but also deliver the quality of plans that algorithm cannot. To that end, Curtis teased the next generation of MoneyGuidePro’s platform, which is scheduled to launch in the first quarter of 2016.

The new edition allows clients to add in more data themselves to increase engagement, and separates financial goals from expectations and concerns. Curtis showed off a new, visual way to demonstrate Monte Carlo predictions, and a better way for advisors to explain strategies to clients.

As promised, no live chickens this year… just an epic Monty Python themed presentation! #T32015 @MoneyGuidePro pic.twitter.com/fcQzl1hsb7

— MoneyGuidePro (@MoneyGuidePro) November 3, 2015

Curtis' presentation also touched on the new MyMoneyGuide labs—an educational tool for investors that can also be used as a prospecting tool for advisors—and teased a new product he called Codename Shrubbery (in keeping with the Monty Python theme of the presentation). The new project appeared to be an interactive mobile app to bolster client engagement, but no further details were given.

Additionally, Curtis took some time to “set the record straight” regarding a number of rumors surrounding his company.

“Number one, we are not going to buy Fidelity,” Curtis joked in reference to a rumor that the recent partnership between eMoney advisor and MoneyGuidePro paved the way for a Fidelity acquisition. “Number two, nobody is going to buy us. So all the VC people, don’t call me.

"Number three, somebody got a rumor that I’m going to retire in three years… No way. That ain’t happening either.”

eMoney Setting the Record Straight

Curtis wasn’t the only person to do some record straightening, as eMoney Advisor’s head of sales, Drew DiMarino, also took the stage to address a few lingering rumors about this company.

“eMoney Advisor will remain independent company, period,” DiMarino said, adding Fidelity is legally prohibited from looking at client data from independent advisors. He also shut down rumors that eMoney will lose its culture of innovation by stating that it plans to hire 60 percent more developers.

During his presentation, DiMarino revealed a new client portal eMoney plans to release in the first quarter of 2016. The portal will have a new look, enhanced organizer, a vault, easy client onboarding and self-registration, which RIAs can easily style to match their personal brand.

.@eMoneyAdvisor to add self-registration to advisor websites, coming q1. #T32015 pic.twitter.com/693vLxetks

— Ryan W. Neal (@ryanWneal) November 3, 2015

A sneak peek at the new @eMoneyAdvisor client experience. #T32015 pic.twitter.com/ynFFsm80sj

— Bill Winterberg CFP® (@BillWinterberg) November 3, 2015

The company also plans a new management dashboard to help with oversight, compliance, and management-level analytics. DiMarino says eMoney is looking at unbundling its product offerings for the end user and offering new pricing options for enterprise firms, bringing the emX platform to the entire office. Advisors can expect more integrations over the year, as eMoney plans to work closer with more firms in addition to Fidelity.

The Best of the Rest

Junxure Cloud kicked off the afternoon sessions with some impressive statistics: that it holds a 98 percent client satisfaction rate and 95 percent client retention among its 12,000 users. Junxure also discussed a new, customizable business analytic dashboard to track client trends and the ClientFirst initiative to monitor tasks and activities so managers can be sure advisors are following up on client promises. The company also revealed the Junxure Store, a digital market place for third parties to sells add-on software that uses Junxure data.

Vanare COO Lex Sokolin dazzled the crowd with a speech about the future of wealth management, touching on everything from wearable technology and image recognition to natural language processing, digital currency and blockchain. The company also released Synapse, a white-label API that lets financial services firms create their own robo advisor experience within an existing website.

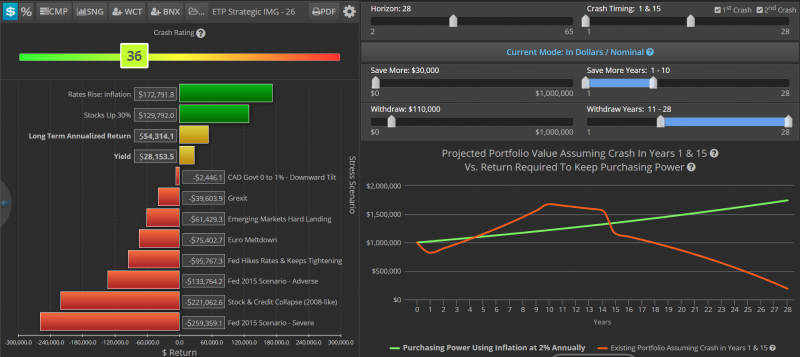

Morningstar announced a new integration with RiXtrema that allows clients of both companies to pull any account or portfolio from Morningstar OfficeSM directly to RiXtrema’s Portfolio Crash Testing software. The integration eliminates the need for manual document or data uploading.

RetireUp also announced that Questar Capital would provide its retirement planning technology to 700 registered representatives to help grow their business. In a statement, RetireUp CEO Dan Santner said the tools helps advisors make retirement income the focus of client discussions by illustrating the risks found in retirement and within a client’s portfolio.