When Envestnet announced plans to purchase data aggregation company Yodlee in August for $590 million, the big question everyone seemed to have was, “why?” Why would Envestnet spend a half billion-plus dollars on a tech company that had never been profitable, recently came under media scrutiny for a side-hustle that involved selling user data, and didn’t seem to be a cultural fit?

Or as Envestnet CEO Jud Bergman put it, “if you need a quart of milk, why did you buy the cow?” His “cross-sale synergy” answer didn’t please investors and shares of Envestnet almost immediately dipped 35 percent upon the announcement and haven’t yet recovered.

The companies finally pulled the curtain back a bit on their plans Thursday before markets opened, revealing what they believe to be an $1.3 billion opportunity.

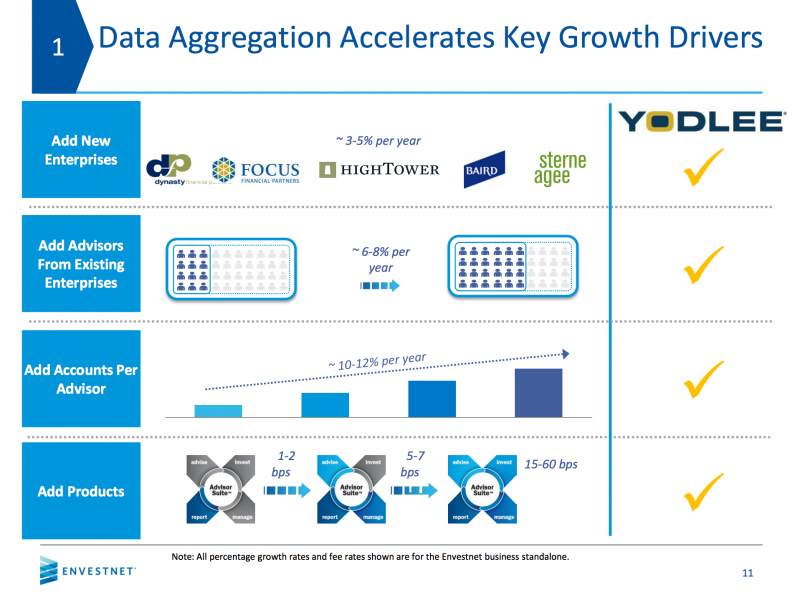

Envestnet will sell Yodlee's aggregation-driven products to advisors and Yodlee will sell Envestnet’s products to its customers, who include banks and asset managers. The companies also want to sell data analytics and research to money managers.

“The decision to acquire Yodlee is opening up another new world of opportunities, and that’s all about data," Bergman added. "We believe there are going to be opportunities that are afforded by this trove of data that we can't even imagine today.”

Yodlee CEO Anil Anora said data insights and analytics have been the fastest growing part of the business and that there’s “no question” that it will be a key part of the future of financial technology.

Based on how much Yodlee currently charges for analytics, Envestnet thinks it can make $200,000 per year from money managers. Envestnet also believes Yodlee can help it expand to international markets.

Bergman said if Envestnet can achieve one-third market penetration by 2020, it would exceed the required rate of return on the Yodlee investment and increase revenue for advisors by 15 percent.

Bergman added that Yodlee’s data would help improve its current products to win new customers and increase advisor adoption with existing firms. With a more holistic view of clients’ finances, advisors can gather more assets and provide more comprehensive management, leading to higher revenue.

“The transaction fundamentally bolsters all our current strategies for growth,” Bergman said. “We believe data aggregation is becoming mission critical in that it enhances the wealth advisors practice, enables them to do deeper into the relationships and serve them better and more completely.”

Michael Kitces, industry blogger and co-founder of the XY Planning Network, said the acquisition of Yodlee was the last missing piece for Envestnet to build a fully-integrated, one-stop-shop for advisors at a wide range of broker-dealers, insurance companies and independent firms. Such a platform can automate much of the advisor's workflow and give a better understanding of the entire practice.

"Once that's there, now you can service clients more effectively. You can give better advice," Kitces said.

Bergman dismissed the notion that Envestnet overpaid for Yodlee, citing the company’s track of successful growth despite acquisitions. But some analysts fear even these deals were too expensive, such as its Tamarac acquisition in 2012. Bergman said Yodlee’s financial profile was very attractive and the transaction was structured to create financial benefit and increase the stock's value for shareholders. Envestnet expects Yodlee to add at least 100 basis points to 2016 revenue.

Envestnet did not say if Yodlee will increase the costs of its products, and Timothy Welsh, president of Nexus Strategy, wondered if raising prices for advisors is part of Envestnet's plan for revenue.

"When PFM owns aggregation, it brings up potential for monopolistic power," Welsh said. "Advisors' choices are being limited."