Betterment is adding asset location strategy to its automated investment advisor.

The New York–based robo advisor says the feature, called Tax-Coordinated Portfolio, can boost its investors’ after-tax returns by 0.48 percent each year, amounting to 15 percent over 30 years.

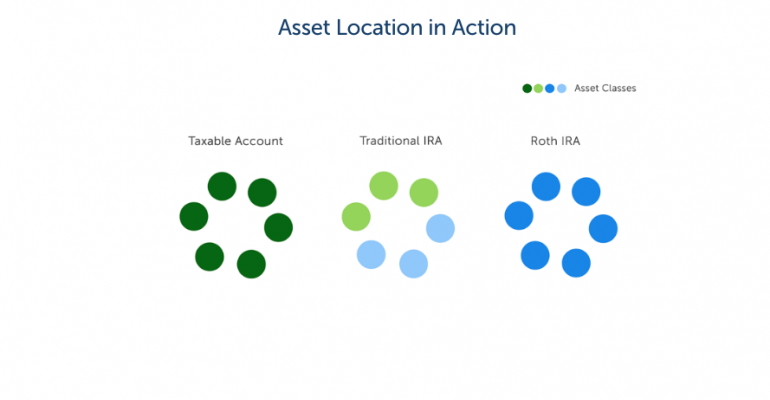

Like other robo advisor functionality, the underlying strategy (placing assets that are taxed more in less taxable accounts like IRAs while placing assets taxed less into taxable accounts, while maintaining the overall allocation) is nothing new. Advisors and sophisticated do-it-yourself investors have been using asset location to decrease tax drag on portfolios for as long as retirement and taxable accounts have existed side by side. But the process is traditionally time- and math-intensive, and relies on some “rule of thumb” wisdom.

Boris Khentov, a vice president of operations and legal counsel at Betterment, said that by automating the process, Tax-Coordinated Portfolio isn’t just a faster way to perform asset location strategies. A computer can squeeze more out of it than a human could, perform the process on a massive scale and rely on hard math instead of rules of thumb, Khentov said.

For example, many advisors stick with the conventional wisdom that bonds should go into IRAs while stocks go into taxable accounts.

“When you do the math, especially in a low-yield environment like we have today where bonds return very little, it doesn’t necessarily make sense to shelter the bonds,” Khentov said. “[With stocks], if you’re managing a diversified, global portfolio, there’s all kinds of considerations over international stocks, which are less tax-efficient than U.S. stocks.”

Khentov’s team of quants, experts and computer engineers worked on the feature for more than a year and said they’ve designed it to work on any set of accounts, regardless of asset size. The team also published a blog post and white paper detailing their theory, equations and code to ensure that their math is sound and allow experts to review their methodology.

“We fully expect when the industry experts look at this, they’re going to go through it and their reaction will be, ‘OK, these guys have thought through all of these complex things,’” Khentov said.

The feature is a first for a direct-to-consumer robo advisor, and Tax-Coordinated Portfolios will also be available on Betterment’s white-label product, Betterment for Advisors, and its 401(k) platform, Betterment for Business. Khentov believes investors using both Betterment’s 401(k) and retail product will see particularly huge benefits.

Michael Kitces, co-founder of the XY Planning Network and industry blogger, has written extensively on asset location strategies and believes it will eventually become table stakes for advisors, like tax loss harvesting.

“It’s a legitimate tax alpha opportunity, and since it’s purely mathematical and analytical (with sufficient data/inputs), it’s highly conducive to technology automation,” Kitces said. He also pointed out that these capabilities have been available to financial advisors for a number of years in rebalancing technologies like iRebal, Tamarac and TRX.

Benjamin Lupu, owner of Kensington Asset Management International and an investment advisor with 36 years of experience, agreed that asset location is where real results are produced for clients, even more so than selecting products, but he disagreed that technology was a good solution. It’s so important, he said, that those hours it takes per client are crucial and necessary to get it right, calling it a “small investment in order to properly manage the portfolio.”

Lupu added that robo advisors like Betterment are little more than a marketing gimmick, and pointed to Betterment’s reaction to Brexit as evidence that the one-size-fits-all model has already failed.

“If you have a small account and don’t want to bother with it, what they’re doing isn’t terrible. It’s OK. [But] they are using the same thing for everybody,” Lupu said. “They are offering nothing that isn’t already there.”

“This is a story about marketing, to me,” Lupu added. “I think for Betterment in particular, the marketing is very slick.”

Khentov says the goal with Tax-Coordinated Portfolios, as with all of Betterment’s functionality, is not designed to compete with advisors but rather offer more functionality for people that prefer the DIY approach. The company also hopes that by pushing others to introduce automated asset location, it can provide the industry with a better version of target date funds (TDFs) and, eventually, eliminate the need for TDFs altogether.

“The TDF has done great things: It’s simple, the good ones are cheap, and it basically does, more or less, what you need it to do,” Khentov said. “But it’s very limited this way. It can’t look outside the account it sits in. We can. We can look at all the accounts together and do the same thing [as a TDF] and get more after-tax benefits.”