Advisors trying to differentiate themselves may be doing themselves a disservice by tailoring the firm’s marketing around their fee-only approach, especially when appealing to an unfamiliar audience. A new study by Pershing shows the phrases “fee-only” and “no commission” are virtually interchangeable for investors.

“It comes down to education,” says Kim Dellarocca, managing director at Pershing. For investors, there was no strong reaction when asked to choose whether “fee-only” or “no commissions” was more preferable, according to the results of Pershing’s study on advisor value propositions.

The study showed those investors already using a fee-only advisor value the statement “we provide advice free from conflicts of interest because we take no commissions” more (64 percent), compared to the 39 percent of investors using a commission advisor. “It shows there’s still a great degree of confusion in the marketplace. Those using a fee-only advisor value it more. They’ve been educated already,” Dellarocca says.

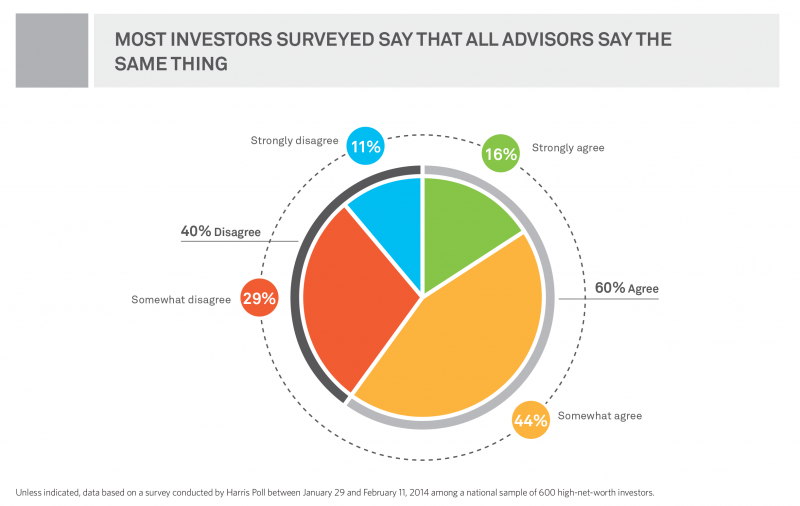

Moreover, 60 percent of investors believe all advisors are saying the same things, making it tricky to differentiate between them, according to a recent study by Pershing. "It's something that most of us in the industry had a hunch about, the lack of differentiation," Dellarocca says, adding now that hunch has been validated.

In the study, which first examined 84 available websites of the industry’s top financial advisors, Pershing found the most commonly used phrase is “develop solutions that meet your needs.” Meanwhile, the most mentioned selling point of a firm is “independence.”

But just because everyone uses key phrases like "act in the best interests of clients" and investors like them, doesn’t mean they differentiate advisors with potential clients. "That's what advisors are missing," Dellarocca says. While it's important for advisors to use these (in fact, if advisors don't say them, they risk being dropped from consideration), they need to find areas to highlight that set them apart. The study also found that plain language like “comprehensive” scored better with investors than “holistic” or “360-degree view.”

Advisors should also avoiding harping on their ability to simplify their clients’ financial lives. Many advisors’ websites focus on simplicity theme, but the 600 investors with more than $1 million in investable assets surveyed by Pershing said this was less important. Phrases like “simplify your life” are more appealing to younger and high-net-worth investors, but, overall, investors seem to think this aspect, while meant to be reassuring, is an oversimplification of their complex needs.

“Advisors tend to talk about how they can simplify their clients’ lives,” Dellarocca says. “But for the majority of investors, it doesn’t resonate so well. Most investors have already accepted that they have to take an active role in their finances.”

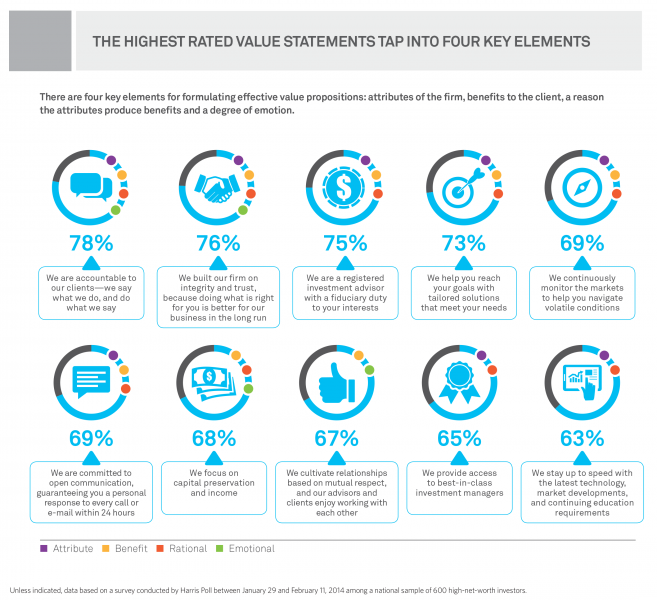

Rather than focus on simplicity, advisors’ websites should highlight a conservative approach and themes around trust, such as integrity and accountability, the study found. “We are accountable to our clients—we say what we do and do what we say,” was the highest rated statement by investors (78 percent of investors said the phrase was either extremely or very important to them).

When attempting to influence investors’ final decision whether or not to go with one advisor over another, there’s a few latent drivers that may carry more weight than investors realize, Pershing found. Giving that conservative approach more prominence may be key, with such phrases like “we focus on capital preservation and income” and “we take a conservative approach to help you live comfortably today and protect your legacy for the future” scoring well with investors. At the end of the day, knowing your audience is key, Dellarocca says.