A few years ago, a West Coast-based advisor who custodied with Schwab lost a $3 million client. The client left not because of anything the advisor had done, or didn’t do. Rather, it was because another advisor at a local Schwab retail branch told the client he could manage his account for free.

It’s unclear if that retail-branch advisor knew about the client’s current advisor or if the accounts were already at the firm. But for this advisor, who didn’t want to be named, it was a betrayal that still stings three years later. On top of that, his wife got a solicitation from Schwab in the mail inviting her to a retirement seminar at that same branch.

“I just don’t trust Schwab. I don’t feel they are a good partner. They do provide some decent services, but so does everybody else,” this advisor said.

Some level of competition between advisors and custodians has been around for years. After all, three of the four largest have the direct-to-consumer business baked into their corporate DNA. Still, some advisors feel recent events make the distinction between business partner and market competitor less clear. Fidelity purchased eMoney. Schwab is planning its own online automated investment platform. Both TD Ameritrade and Schwab offer “money-back guarantees” on their managed-account platforms. Fidelity and Schwab are putting more resources behind their own wealth-management services.

And these are the just the initiatives that have recently been announced. As technology continues to disrupt financial services, and these deep-pocketed firms can more seamlessly cater to the needs of affluent investors, some advisors fear what’s coming next.

“I really don’t like the trend, quite frankly, of custodians becoming more and more in competition with the RIAs that they’re supposed to be providing services to,” says Mark Stys, chief investment officer at WS Wealth Management. “They already know all your clients’ names, addresses, contact info and their assets under management.”

The fear is unwarranted, say the custodians. As far as Schwab soliciting advisors’ clients, Bernie Clark, head of Schwab Advisor Services, says that’s an old story and no longer an issue.

“We have lots of checks and balances in our system,” Clark says. “We’re very serious about making sure that we never solicit the client of an advisor. If it happens, it’s an error. An errant mailer or something like that might find its way to a client.”

But perhaps the battle won’t be over current clients, but future ones.

eMoney Advisor

In early February, Fidelity surprised the industry by paying a reported $250 million for eMoney Advisor, the widely used wealth planning software. Fidelity was building what it calls its “next generation” technology platform and realized eMoney already did a lot of what they were looking to create, says Mike Durbin, president of Fidelity Institutional Wealth Services. Those areas included better integrations with other tools, more ways to collaborate between advisors and clients, and data aggregation.

But some advisors who don’t custody with Fidelity worry that Fidelity will make eMoney free, or available at a steep discount, for its own advisors. That could put them at a disadvantage.

William Riley, CEO and chief compliance officer at Riley Wealth Management in Fort Worth, Texas, uses eMoney but says that if Fidelity advisors get a discount it would hurt his business. His costs, relative to his competitors, would effectively increase. “You’re getting a high-powered financial planning program like eMoney or EMX, then your costs of doing business goes up.” Also, he worries that if eMoney becomes more ubiquitous with Fidelity-affiliated advisors, the tool will no longer be a differentiator for his business.

Fidelity has promised that eMoney will maintain its independence under the firm’s ownership, and Durbin says the firm wants eMoney to continue licensing its technology to customers outside of Fidelity.

“We think there’s also tremendous upside for the licensees of eMoney who don’t choose to custody with us,” Durbin says. “As a firm, Fidelity, we want to continue and in fact accelerate the investment program that the eMoney management team has for their own product roadmap—new features and new markets to tap into.”

Advisors are worried that their ability to provide an advanced client portal won’t be considered unique. “Advisors will say, ‘I was winning clients from Fidelity because of this,’” says Tim Welsh, president and founder of Nexus Strategy. “‘Now I’m going to see it at the Fidelity branch office?’”

In the press release, Fidelity said the acquisition was “part of Fidelity’s larger vision to continue enhancing its digital solutions across its retail, workplace and institutional channels.” But this does not mean the software will be used in the firm’s retail branches, Durbin says.

But could eMoney help Fidelity enhance its own client-facing retail portal for its online investors? That would create another layer of competition for RIAs, which have differentiated themselves with eMoney’s powerful Mint.com-like client portal on the front end.

Building a Better Robot?

Silicon Valley sees a bright future for automated investment platforms aimed at consumers and have poured $290 million dollars into startups such as Wealthfront, Personal Capital, and SigFig, according to research firm CB Insights.

It would make sense that discount brokers and custodians see a similar opportunity; they already have the products, the scale and the back-office execution, says Alois Pirker, research director for Aite Group’s wealth management practice. Fidelity’s purchase of eMoney may aid in that step.

“What’s missing for them is that digital engagement level,” Pirker says. “The low price point is something that is perfectly aligned with custodians. They can do low price point because they own a lot of the back-office execution.

“The current goals are clearly to support institutional clients, and they’re going to give them a very neat platform to compete in the market,” Pirker says. “But again, you could’ve done that with a partnership. Given they put a significant amount of investment into this acquisition, I think the goals are higher.”

To build a robo, you need the content aspect, the client portal engagement, planning tools, rebalancing software, and the product side of things, Pirker says. eMoney may not have the rebalancing technology, but Fidelity has all the other requirements in place.

Vanguard sees an opportunity in robo-like services. Early last year, the firm opened its Personal Advisor Services program, offering basic indexing portfolios for clients with a $100,000 minimum at a 30 basis point fee of assets under management. (Management says the minimum will fall to $50,000 when the program is fully rolled out.) And in October, Charles Schwab said it would roll out an automated investment advisory service, Schwab Intelligent Portfolios, this quarter. Investors with as little as $5,000 will be able to obtain diversified portfolios with low-cost holdings, all without paying program management or advice fees.

“Right now, we’re differentiating ourselves, saying, ‘Look, we’re doing the financial planning for you; we’re helping with your cash-flow analysis; we’re helping you out on the tax side a little bit,” says Clint Walkner, co-owner of Walkner Condon Financial Advisors in Madison, Wis. “In the future, computers are going to be able to help with all that.

“If I had an online offering that gave me everything my financial advisor has, and I can do it in my underwear in my house without getting a sales pitch from somebody, that to me as a 38-year-old, that’s enticing. That’s the concern that I have as a financial advisor and business owner.”

At Fidelity, Durbin says eMoney is not considered the missing piece of some larger strategy at odds with current advisors. “If we’re going to adapt their technology to be more of a robo-advisor, for example, for the benefit of this business, Institutional Wealth Services, it won’t be any different than the alliances we struck with Betterment Institutional and LearnVest. We want to be able to use this digitization, which we think eMoney has done a really good job perfecting, ultimately to be out there available for advisors to use,” Durbin says.

Get Your Money Back

In late 2013, Schwab launched its Accountability Guarantee program, offering customers their money back on certain fee-based accounts from the previous quarter if they’re not happy with the service. TD Ameritrade followed suit in August of last year, providing fee rebates to Amerivest managed-account clients who experience two consecutive quarters of negative performance.

Tom Nally, president of TD Ameritrade Institutional, says it’s really a marketing tool aimed at getting people into the product.

“A lot of these people are actually, for the first time ever in their financial lifecycle, turning over any component of their assets to a manager, so we’re almost trying to ease that transition and make them feel comfortable with it,” Nally says.

Schwab’s Clark says the firm’s version is based not on performance, but rather the investor’s experience, and it’s a way to stand behind what they’re doing. He doubts it would impact the clients of advisors, who are seeking a committed relationship, not a trial basis.

But RIAs are prohibited from offering such fee rebates, and some advisors are concerned that the guarantees could raise questions from clients custodied at these firms.

“I see a real issue when a client sees on TV, ‘Hey, if the market’s down two quarters in a row, we will refund your fees,’” says Sheryl Rowling, principal of Rowling & Associates in San Diego, Calif. “RIAs cannot do that—either legally or from a business standpoint.”

“Certainly our existing clients understand that that’s not a possible way for us to do business,” says Laura Tarbox, president of The Tarbox Group in Newport Beach, Calif. “I worry a little bit with prospective clients. I think a lot of things [will] change when we get the next downturn, and that’s probably when that kind of pressure will hit us.”

If the rebates were to become accepted practice, Walkner says he would have to raise his fees. He currently charges 1 percent on assets under management.

“And then we’re going to have to just build up a war chest for when the market goes down,” Walkner says. “That would be hard.”

Going After the Bigger Fish

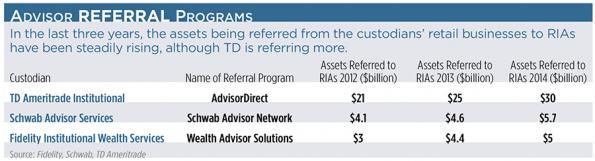

It used to be the case that custodians would only go after smaller investors with their online brokerage businesses. But that’s changing as many are rolling out offerings targeting more affluent investors, the kind that previously, perhaps, would get referred

to an RIA.

“Retail platforms are broken,” Welsh says. “How can you have all these branches and bricks and mortar and people and your core offering is a $9 online trade? You’ve got to step on those assets; you’ve got to put them into a packaged product.”

Schwab now has its private client group; ETF strategist Windhaven Investment Management; money manager ThomasPartners; and its managed account platform. Clark says the average client on the retail side has about $200,000, while most advisors have a minimum of $1 million.

Fidelity also has a private client group, in which an account executive will provide guidance on an investment portfolio. It’s aimed at clients with over $1 million in assets.

Durbin says the wealth management services are aimed at the firm’s existing wealthy households that have been made aware of the RIA referral program, but don’t want to leave Fidelity.

TD Ameritrade launched its managed-account platform, Amerivest, as a way to keep the client within TDA throughout their entire financial lifecycle, Nally says. The firm used to serve the do-it-yourselfer and then refer clients with complex needs to advisors; Amerivest offers something in between. Amerivest is a basic portfolio allocation tool, where Morningstar picks the funds clients get invested in. The average client on the platform has $54,000, versus $1.2 million for the average referral to one of the firm’s RIAs.

“What they’ll tell you is, ‘Well, we’re just going up against the wirehouses, trying to steal clients from the wirehouses,’ which is probably true,” Welsh says. “But the collateral damage that impacts advisors is real, because the brand [the advisor] uses as their custodian is now offering things that their own clients see, and it just raises questions. It makes business harder to deal with.”

That has happened to Tarbox. “We had somebody call us the other day that had $4 million in an account with Schwab,” she said. “We hadn’t seen that before. They think they’re getting similar advice to what we would give.”

Last year, Tarbox moved all of her $420 million in assets from Schwab to TD Ameritrade. She felt she wasn’t being treated as a partner anymore, but as a small fish in a larger sea, she says. Schwab also made it harder on the administrative side.

“We really kind of started to feel like the unwanted stepchild at Schwab on the institutional side more and more,” she says. She had been with Schwab for 25 years. “Then when I left, nobody even called to ask me why.”

“[The custodians] don’t want 300 clients with $10,000,” says Stys, who custodies with Pershing. “They want to go after $3 million clients. And sitting on their platforms are all these RIAs who have all the types of clients they really want. How do I know that they haven’t just pulled all that data at some point and used that to invite them to a Schwab event? Or a Fidelity event?”

Rowling recommends having a backup custodian, preferably one that is not in the retail business, in case the relationship goes sour. In fact, the portion of RIAs who use two or three custodians increased from 36 percent in 2013 to 42 percent in 2014, according to REP.’s 2014 RIA Trend Report.

“If something happens to your relationship with your custodian and you have every single client custodied there, you have to move all of your clients, which is a horrendous task,” she says. “At this point, I can’t say that I have lost any clients to a custodian. But who knows if I’ve lost prospective clients?”