When balanced against the income tax treatment of a nonqualified portfolio of investments, post-death distributions from qualified plans and individual retirement accounts (retirement benefits) will generally produce a significantly inferior result. There are many reasons for this, including: (1) retirement benefits receive no step-up in income tax basis at the participant's or owner's death, (2) retirement benefits must be distributed post-death according to an established set of required minimum distribution (RMD) rules, whereas a nonqualified portfolio of investments includes no such post-death mandatory distribution requirement, and (3) retirement benefit distributions are taxed at ordinary income tax rates, as opposed to the now as little as one-half as high capital gain or dividend tax rates on distributions from nonqualified portfolios.1

Let's explore options for minimizing this disparate post-death income tax treatment. For illustrative purposes, let's work with an example of a male account owner, age 60 and in excellent health. He owns a taxable IRA account in which he's invested $500,000 and that has a current appreciated value of $1 million. Assume the account owner lives to his approximate life expectancy of age 80 and that all investments grow at a 5 percent (principal plus income) compound rate. Also assume a combined 40 percent federal and state ordinary income tax rate and a 20 percent combined capital gains tax rate. Finally, for simplicity purposes, assume an RMD each year (beginning at age 70 1/2) of 5 percent, or the same as the assumed total return rate, because 5 percent approximates the average annual RMD for individuals ages 70 through 80.

Alternative 1: Only Withdraw RMDs During Owner's Lifetime

This is probably the most prevalent retirement benefit withdrawal plan today, that is, to take only the RMDs during the owner's lifetime, at least for larger IRAs. But question: Is this the smartest financial plan? Assuming all after-tax RMDs beginning at age 70 1/2 (approximately $80,000 per year, gross and $48,000 per year, net of tax) are reinvested in a portfolio of securities producing no current taxable income but 5 percent overall growth, at age 80, the owner's original $1 million taxable IRA would look something like this:

As the above table indicates, approximately 73 percent of the of the owner's $2.2 million portfolio at age 80 would be growing at an eventual combined 40 percent federal and state income tax rate and wouldn't be eligible for basis step-up at death, while only 27 percent of his portfolio would be growing at the lower combined 20 percent federal and state capital gain tax rate and would be eligible for full basis step-up at death. There would be an income tax basis step-up of only $120,000 on the non-qualified portfolio if the owner were to die, while there would be no income tax basis step-up on the $1.6 million taxable IRA. RMDs would continue on the taxable IRA after the owner's death, but there would be no requirement to liquidate the smaller, nonqualified portion of the portfolio in the hands of the owner's spouse or other heirs.

Note that, under the above-described plan, the owner's original $500,000 investment in the IRA would have already been withdrawn, over ages 70 through 80, and appropriately taxed to him at ordinary income tax rates, because he received a deduction for a like amount off of ordinary income. An additional $300,000 would have also been withdrawn under the RMD rules, again all taxed at ordinary income rates, even though no prior income tax deduction was received for this amount and even though the IRA may have been invested entirely in the stock market. The after-tax reinvested sum (or $48,000 per year) would have grown, outside of the IRA, to $600,000 and would be properly eligible for income tax basis step-up at the owner's death.

The challenges presented are: (1) how can the IRA owner plan now to effectively avoid taxing all growth in his IRA at ordinary income tax rates as opposed to capital gain rates; (2) how can the IRA owner proceed at present to effectively achieve an income tax basis step-up for a portion of the IRA balance at his death; and (3) what actions can the IRA owner immediately take to effectively cause a portion of the IRA balance to be taxed, if at all, at the more favorable capital gains income tax rates to his heirs?

Alternative 2: Convert All or a Portion of the IRA to a Roth IRA

Converting the $1 million IRA at age 60 will obviously mean that the entire amount will be taxed at a higher combined federal and state income tax rate, which for our purposes we'll assume is 45 percent. This leaves $550,000 to grow inside of the Roth IRA, which, after 20 years at 5 percent compounded, will equal approximately $1.459 million.2

Although this plan arguably solves all of challenges (1) through (3), described above, it does so in a manner that, at age 80, actually leaves the owner and his family with slightly less than the after-tax value they would have received under Alternative 1 ($1.48 million, assuming the IRA was liquidated at the same 45 percent combined federal and state income tax rate and a step-up in income tax basis for the nonqualified portfolio). Thus, it appears that a complete Roth conversion isn't the answer to the issues we have with the unfair manner in which post-death IRA distributions are taxed.

Smaller and annual partial IRA conversions may provide a slightly better result than a complete conversion at age 60, primarily because of the lower income tax rate on the smaller withdrawals.3 For example, if at age 60, the owner were to begin withdrawing $50,000 from the taxable IRA each year and convert the net amount after 40 percent ordinary income taxes, or $30,000, into a Roth, the Roth account would grow to approximately $1 million by the time the owner reached age 80. Added to the after 45 percent tax rate value of the approximately $1 million still remaining in the taxable IRA, at age 80, the after-tax value of the owner's portfolio would be approximately $1.55 million, $70,000 more than the original result in Alternative 1, above.

Alternative 3: Immediately Begin Taking Small Distributions from the IRA and Invest the After-Tax Amount into Life Insurance

This plan is similar to the annual Roth conversions option discussed under Alternative 2, but instead of transferring the $30,000 net amount into a Roth IRA each year, the net amount is used to purchase as much face value life insurance as possible. To preserve some of the IRA for the owner's lifetime needs, the premiums are intentionally kept smaller and only paid for 10 years.4

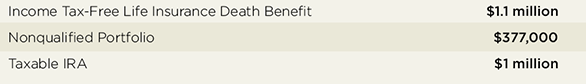

Under the plan, at age 80, the owner's financial situation is projected as: 5

Assuming a 45 percent combined federal and state income tax rate if the taxable IRA were liquidated in full and a stepped-up income tax basis on the owner's nonqualified portfolio, the after-tax value of the owner's portfolio, if he were to die at age 80, would be approximately $2.027 million or $477,000 (approximately 31 percent) more than the best of the two Roth conversion options described in Alternative 2, above ($1.55 million) and $547,000 (approximately 37 percent) more than the original result in Alternative 1 ($1.48 million). What's potentially even more significant, under Alternative 3, the owner's family would have $1.477 million growing at capital gain tax rates (or at no tax, to the extent the assets are not sold during life), compared to only $600,000 growing in this favorable tax environment under Alternative 1.

In taxable estate situations, Alternative 3 presents the additional possibility of having the income tax-exempt life insurance policy held inside an irrevocable life insurance trust (ILIT), which, unlike a taxable IRA or Roth IRA, would render the proceeds estate tax-exempt. If access to the policy's cash surrender value is deemed necessary (which would be unlikely, in today's high federal estate tax exemption environment), the ILIT can be structured as a spousal access trust or as a wealth, retirement and asset protection trust.6

One potential disadvantage of Alternative 3 is that, during the owner's lifetime, he'll have less available funds to spend. For example, when the owner reaches age 80, the cash value of the life insurance product assumed in this article is projected to be only approximately $200,000. This amount, when added to the remaining after-tax value of the IRA (assuming the maximum 45 percent combined tax rate) and the after capital gain tax value of the nonqualified portfolio, would equal approximately $1.1 million, whereas under Alternative 1, the owner would have approximately $1.45 million available to spend at age 80, after taxes. If this lifetime use issue is a significant concern to the owner, he may elect to structure the life insurance policy so that it will produce a larger cash value, but a lower projected death benefit.

Another potential disadvantage to Alternative 3 is that the owner may live substantially beyond age 80, in which case an unchanging face amount life insurance policy may not keep pace with the value of otherwise available investments. To address this concern, the universal policy can be structured to provide an increasing death benefit, rather than a stagnant $1.1 million face amount.

The Advisor's Marching Orders

Whether the tax advisor looks to the Roth IRA solution, the life insurance solution or some other solution or combination of solutions, the disparity in the post-death income tax treatment of nonqualified portfolios of investments versus qualified portfolios must be addressed. While it's fair and proper to eventually tax the owner's pre-tax contributions to a qualified plan or IRA at ordinary income tax rates, taxing all growth in the same at the ordinary income tax rates can't be justified, especially when juxtaposed against the much more favorable income tax treatment of nonqualified portfolios. The planner's goal should be to use all resources at her disposal to achieve post-death tax results that mirror as closely as possible the capital gain tax rates and income tax basis step-up available generally for nonqualified portfolios.

Endnotes

- In certain situations the alternative minimum tax (AMT) may come into play to alter this tax rate disparity somewhat. To simplify the comparative analysis contained in this article, the AMT will be ignored.

- Note that transferring less than the entire distributed amount to a Roth individual retirement account wouldn't be advisable prior to the owner's attaining the age of 59 1/2, due to the imposition of the 10 percent excise tax on the portion that's not rolled to the Roth IRA.

- But see the discussion ibid.

- Note that although this plan will generally only be advisable if the owner has attained age 59 1/2 due to the 10 percent excise tax on early IRA distributions – it may be possible to use other funds to pay the life insurance premiums until the owner has attained age 59 1/2. It may also be possible to use the Internal Revenue Code Section 72(t) exception for a "series of equal payments." See IRC Section 72(t)(2)(A)(iv) and Natalie Choate, Life and Death Planning for Retirement Benefits ¶9.2 (7th ed. 2011).

- Based on the guaranteed results under John Hancock's Protection UL policy; other companies' policies produce substantially similar results.

- See James Blase, "The WRAP Trust" Journal of the American Society of CLU & ChFC, Vol. LI, No. 5, at p. 92 (September 1997).