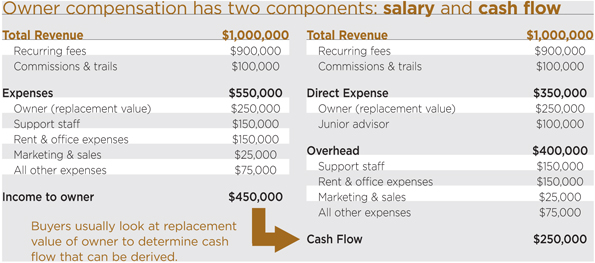

Recently an advisor was interested in selling his practice that he had built over the past several years. He was 69 years of age and wanted to be completely done working in the business within a year of closing the deal with his “ideal” buyer. The practice was a 100 percent fee-only business on about $125 million in assets, an attractive attribute. The practice was generating approximately $1 million in gross revenues and the advisor/owner was taking home about $550,000 each year in income. This certainly seems like a well-run business and a desirable acquisition candidate on the surface. When asked what he thought the practice was worth, the advisor responded, “about $2.2 million.” When asked how he came up with that number, he said, “It was fairly simple—2.2 times revenue and/or four times earnings.”

Naturally, the next question was, “Can you tell me more about your business?” Here is what was learned:

There are three loyal employees, two of which are client-facing, but not revenue-generating. The seller insisted that any buyer must agree to keep these three employees, which was a very noble gesture but negative to the valuation from the buyer’s perspective. The advisor was proud of the fact that each client of the firm receives a “team” to service their account. The team consists of the advisor (the owner) and one of the two other client-facing employees. When asked if either of the other employees could handle the client autonomously the answer was a blunt “no,” which also set off alarm bells. His average client was in their low 60s and many were already in retirement and beginning to draw on accounts—red flag number three.

After digesting this information, the advisor confirmed and reiterated that he felt his firm was worth $2.2 million. After hearing this story, would a buyer agree with this seller? Would the buyer feel comfortable buying a firm at that level, with the sole revenue producer wanting a quick exit, inheriting clients and revenue that will most certainly go down, and keep a team of employees that does not generate new revenue?

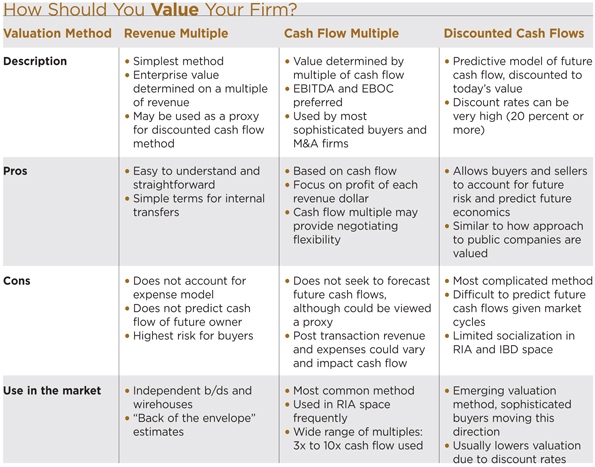

So what is this business really worth? There are many approaches one could take, but a buyer probably would not agree with the $2.2 million number. In reality, the business is probably worth anywhere from $800,000 to $1.2 million to an external buyer, maybe a little more to an internal buyer. But in this case, there was no potential internal buyer in place. Even if an external buyer was willing to pay his asking price, there would need to be severe changes to the firm’s cost structure. In that scenario, growth would likely be included in the deal terms and payments to the advisor would be deferred to offset the buyer’s risk.

Certainly the selling advisor didn’t agree, and hence our difference in value in this scenario amounts to roughly $1 million—that’s real money, obviously. But we need to examine and understand this further. This advisor’s practice is currently generating $550,000 for him each year. Unfortunately by his own admission, he is the main advice-giver and primary relationship manager with his clients. He does not want to remain working in the business for longer than one year after the close of the sale due to his age and a longing to travel and spend more time with his wife.

The big issue here (and very often in other deals, too) is to convince clients to remain after the sale and departure of their primary advisor; the buyer might be forced to hire an advisor of even greater quality and skill to replace the lost relationship when the seller is gone. The cost of this replacement will be a significant chunk of the $550,000 currently being realized by the selling advisor. If you assume this cost could be as high as $350,000 and at least $250,000, that leaves only $200,000 to $300,000 of free cash flow for the buyer. If you apply a multiple of four times to this free cash flow number, you arrive at a preliminary valuation of $800,000 to $1.2 million. Complicating things further is the age of the clients and the potential loss of clients after a transaction, and that does not even address the seller’s desire to leave the business nearly right away and keep all the employees intact (again, a noble but unreasonable expectation). The buyer will no doubt consider a further discount and insist that the post-transaction business must grow by adding newer, younger clients to refresh the business—an objective and terms of the transaction the buyer will want to put on the seller.

Clearly the seller in this example sees things differently than a potential buyer. The risk here is that the seller may be forced to continue working and not achieve his personal goal of spending more time with his family because of the personal attachment to his firm. The reality for the advisor: His options are limited. Why not just work two more years versus accepting a purchase price of about $1 million for his business? This might be a viable option in the immediate term, but in two years time, the advisor is 71 and the firm value may likely erode further. This is just one example, but it should provide advisors with pause and guard against overconfidence on what the value of their firms really are.

The valuation gap between buyer and seller is perhaps the single biggest reason that deals fall through, and it is not limited to advisors in the $125 million AUM category. This phenomenon exists at larger practice levels as well.

It is also a common assumption that because a firm has achieved a certain size or scale that the gap in valuation is automatically avoided. But this is not something that an advisory firm becomes immune to just because of its size. Just because a firm has grown to $500 or $750 million in AUM does not mean that an advisor will get the value he thinks his practice is worth. After all, practices that have owner-centric branding, not institutional branding, have unattractive revenue streams. Large firms may also have poor client demographics just as smaller firms do. It’s just that the perceived value gap between buyer and seller exists at a higher range. That same $1 million difference may lay between a seller firm’s asking price of $5 million and a sophisticated buyer’s offer of $4 million. The key is finding a way to bridge that gap or perhaps avoiding it altogether.

Bridging the Gap

Advisors need to start early to avoid the valuation gap. Similar to saving for retirement, waiting too long causes significantly more work and expenditure of effort down the line. Practice owners must continually and routinely focus on the right areas, the areas that drive value as opposed to those that detract from value.

First, it can’t be all about the primary owner/advisor. Taking one’s name off the front door is a great start. Advisors should choose a name other than their own for their businesses, and brand everything to that name.

Next, invest in the business. Start early and don’t take all the cash out of the business for personal use. Study normal market compensation numbers, adjust for cost of living in the area you live in and take a reasonable bonus. But leave the excess cash in the business for investment.

If an advisor is the primary relationship manager with the clients in the firm, then the risk to the buyer is greater. Carefully invest in people and groom them to be confident client-facing advisors. Be sure the clients all have multiple touch points within the firm beyond the primary advisor. It is a good thing for a potential buyer to regard these employees as revenue-generators/supporters, as opposed to cost centers. This may be counterintuitive, but to the extent the advisory firm owner can distribute responsibility for revenue and client relationships, the potential for higher valuation exists.

Grow. Consistent growth will provide the additional cash flow to invest in the business, but it also signals to the buyer that the brand is strong and the people in the organization are forward-looking contributors and the buyer can expect an increase in future cash flows. Growth also can refresh the client base and lower the age of the average client, as well as diversify revenue streams and improve overall client demographics.

Advisors should start the sale process years before they want to actually exit the business for good. The sale of a business and the terms of the deal are all about the allocation of risk. If a seller is willing to stay for three to five years after the close of the sale, this gives the buyer much more comfort that the clients (and fees they generate) will remain.

The final approach to eliminating the valuation gap is to find a partner or find additional scale (outsourcing is acceptable). There are opportunities for advisors to partner with larger advisory firms and establish a predetermined succession plan that both eliminates the uncertainty inherent in the valuation gap’s existence, but also allows them to keep all of the things they enjoyed about being an independent advisor and owning their own business, while shedding many of those things they do not enjoy.

It is important for advisors to understand the factors in play during any transaction that cause buyer and seller to remain at odds, and can frustrate both parties and in some cases shock and demoralize a business owner who has worked so hard to get to this end point. After all, every advisor will have to address sales planning and succession planning at some point. RIAs are excellent at giving financial and business advice, but they too need a guide to understanding their options when it comes time to sell their practices or exit the business. Taking important steps now to avoid the disappointment that can rear its head later is a must for any advisor no matter the size of your business today. Consult with professionals, network with your peers, implement enterprise value creating changes, and you will have a better chance at avoiding some of the pitfalls that so many succumb to.

John Furey is the principal and founder of Advisor Growth Strategies, a practice management consultancy, and the managing member of the Alliance for RIAs (aRIA), a think tank and study group composed of some of the most successful advisory firms in the industry. www.advisorgrowthllc.com. Matt Cooper is president of private client services and co-founder of Beacon Pointe Advisors. Beacon Pointe is an aRIA member firm. www.bpwealthadvisors.com