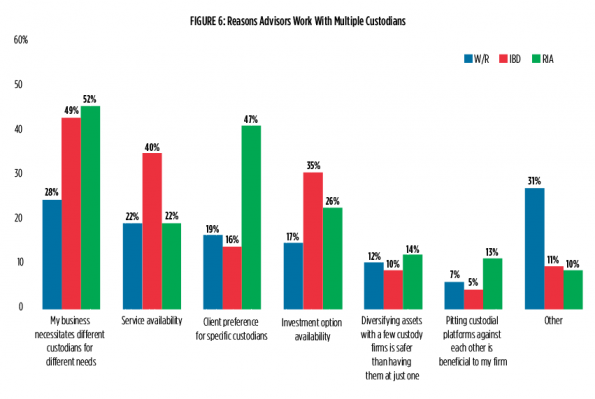

The availability of investment options and services provides an incentive for advisors to utilize multiple custodians, as does the competitive environment such arrangements induce. Therefore, it is not surprising to see a relatively diverse set of reasons for which advisors say they utilize different custodians. Idiosyncratic business needs, service availability, client preferences for specific custodians and investment option availability all register strong responses from at least one channel. The most popular responses for RIA and IBD advisors are business needs, but the second most important reason varies; for IBDs it is service availability and for RIAs it is client preference. For the W/R channel the responses are more muted, which is likely a function of the high percentage that report self-clearing. Diversifying assets across firms for safety and pitting custodians against each other were relatively minor considerations for advisors in any channel. However, the overall data indicate that advisors continue to recognize the value of certain firms for different types of custodian roles, whether technology-, research- or practice management-related.

Next Part 7 of 7: Written Plans and Procedures