Millions of successful business owners are contemplating the next chapter in their company and personal legacies. This comes just as the generous estate and gift tax exemption limits are on the cusp of being slashed. Prudent gift and estate tax planning can be the difference between creating generational wealth and squandering it. Gifting privately held business interests to children can be an effective and tax-efficient way for your clients to maximize wealth transfer and achieve their legacy planning goals.

Unfortunately, many business owners are unaware of the benefits of gifting interests in their businesses rather than cash.

Appreciation

Business interests have the potential to appreciate over time, especially if the business is well managed and successful. By gifting shares of a business that’s expected to increase in value, your client can transfer more wealth to their heirs while using less of their lifetime estate tax exemption. In contrast, gifting cash or other non-appreciating assets may not provide them with the same long-term value.

This gifting strategy works based on the components of how federal gift and estate tax is calculated:

Gift and Estate Tax = (Fair Market Value (FMV) of Lifetime Gifts and Estate – Exemption) × 40%

Gifts are valued as of the date of the gift, while the remaining estate is valued as of the date of death. By targeting appreciating assets, your client can essentially “lock-in” a lower value than would be included in a client’s estate. Here are three examples of how this works:

Example 1: Bob, 60, is unmarried with one child, Roberta. Bob owns 100% of ABC Co., a small but growing manufacturing company with a FMV of $10 million in 2023 and no debt. Bob actively runs the company as CEO. He’s debating between transferring cash or an interest in ABC Co. to his daughter as part of his estate planning.

Let’s assume the federal estate exemption for singles is $13.61 million today (none of which Bob has used to date) and the exemption amount is raised by 2.5% annually for inflation. So, 10 years later, that exemption would be approximately $17.4 million. (Note: This is for illustrative purposes and will likely not be the case under current laws, more on this in a minute.) The remainder of Bob’s estate consists solely of a bank account with $10 million, which remains constant over the 10-year period. Also, let’s assume ABC Co. appreciates in value at a rate of 5% annually.

Bob elects to gift $10 million in cash to Roberta in 2023. He pays nothing in gift tax on that transfer because of his unused exemption. When he passes away 10 years later, his exemption will be $7.4 million ($17.4 million - $10 million used), and his taxable estate will be $16.3 million (ABC Co. as appreciated). Bob’s estate will then owe $3.6 million in federal estate tax (40% times his estate in excess of his remaining exemption).

Use It or Lose It

Appreciation is a perennial fact pattern in estate tax planning; however, we’re currently faced with an ephemeral opportunity.

The current lifetime estate tax exemption is historically high. As you know, it’s set to expire at the end of 2025 and may be subject to change. But the Internal Revenue Service has indicated it will honor gifts made prior to 2026 using the elevated exemption amount going forward even after the exemption amount is lowered.

By gifting now, clients can effectively “use it” before they “lose it” post-2025 with their lifetime estate tax exemption. This potentially reduces a client’s overall estate tax liability substantially. Barring new legislation, at the end of 2025, those thresholds will be cut in half (indexed for inflation). So, we’re talking approximately $7 million per individual and $14 million for a married couple, depending on inflation. These thresholds are similar to pre-2017 levels.

Example #2: Let’s go back to Bob’s estate plan. We projected $3.6 million in tax savings by gifting 100% of ABC Co. to his daughter today instead of a cash gifting strategy. However, if the exemption limit is halved as expected on Jan. 1, 2026, then the numbers are very different. Bob will have no exemption left at his date of death and, therefore, the full $16.3 million estate will be exposed to estate tax of $6.5 million.

Minority Discounts

While we’ve discussed the concept of appreciation and the looming exemption decrease, there are other factors to consider.

When gifting shares of a business, your client may take advantage of minority discounts. These discounts reflect the fact that a minority interest in a business is typically less valuable than a controlling interest in a business, due to the lack of control and marketability. By applying a minority discount to the value of the gifted shares, a client can effectively transfer more wealth to their heirs without using as much of their lifetime estate tax exemption.

A gifting strategy should consider all factors with a deep understanding of valuation and tax issues at play. Example 3 shows an effective strategy for Bob:

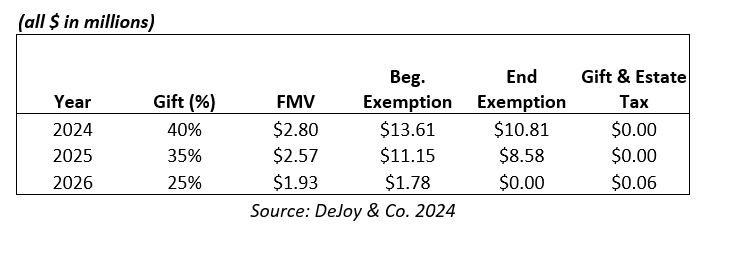

Example #3: Going back to Bob and ABC Co., again, let’s assume nothing has changed regarding Bob’s starting situation. But this time Bob elects a more nuanced gifting strategy in which he transfers his interest in ABC Co. to Roberta in minority blocks as follows:

By using this gifting strategy, Bob accomplished three important things:

- He effectively deployed about 90% of his use-it or lose-it exemption (approximate tax savings of $4.9 million).

- He targeted minority gifts effectively to use discounts (approximate tax savings of $1.3 million).

- He reduced his potential estate tax (approximate tax savings between $1.6 and $2.8 million, depending on a range of factors).

Bob accomplished all of this while incurring only $60,000 in gift tax.

Time is of the Essence

By gifting appreciating assets, owners can lock in lower valuations for gift tax purposes while allowing the remaining assets to grow outside of their taxable estate. This is particularly advantageous with the current high estate tax exemption limits set to be cut roughly in half after 2025. A well-planned gifting strategy that considers minority interest discounts, the timing of gifts and anticipated appreciation can save business owners millions of dollars in taxes. However, this type of planning requires a strategic, long-term approach guided by experienced valuation professionals.

Anthony Venette, CPA/ABV is a senior manager, business valuation & advisory, with DeJoy & Co., a BDO Alliance firm based in Rochester, N.Y. He provides business valuation and advisory services to corporate and individual clients of DeJoy.