You hear time and time again that when it comes to investing in actively managed funds, the past is no guarantee of the future, and investors should never chase performance, because last year's best managers often underwhelm in the following years.

Morningstar just released some research which further validates those claims, even at the extreme ends of the performance range. They found that an investor has as good a chance of choosing a future winning fund from the pool of the recent worst performers as they do from the best when looking at returns over three-, five- and ten-year periods.

“You do need to go beyond past performance to find an active manager that has a good shot of outperforming going forward,” said Alex Bryan, manager research analyst at Morningstar and the study’s lead author.

Bryan looked at fund performance relative to Morningstar category peers, and compared funds from the best-performing 20 percent with those from the worst-performing 20 percent, to find how many ended up in the top half of their peer group in the same subsequent time period.

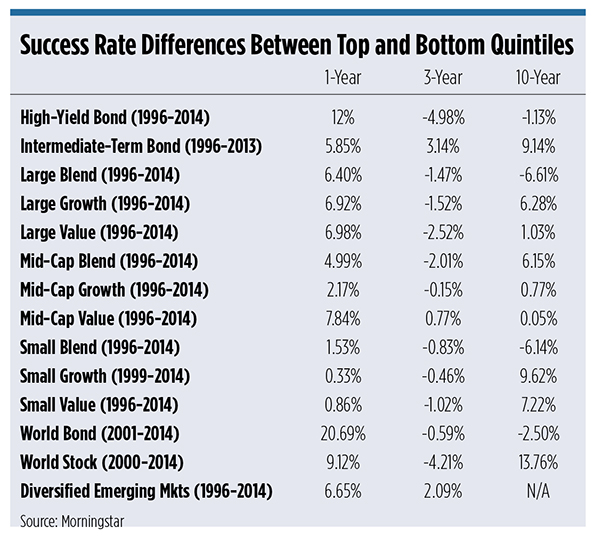

The success rate differences between the top and bottom quintile funds for the two-, three-, four-, five- and 10-year periods were low, and in many cases negative. For example, of the top performing large-blend funds over the previous 10 years, 36 percent went on to land in the top half of their surviving peers in the next 10-year periods compared to 43 percent of the bottom quintile funds that did the same (a success rate differential of -6.61 percent, according to the Morningstar data.)

“This suggests that it is difficult to pick funds that will outperform over the long term based on their prior records alone,” the report said.

Funds that aren't limited by style mandates and have a wider universe of securities to choose from tend to be the exception, Bryan said. The world stock category, for example, had the highest 10-year success rate differential; just over 50 percent of the funds in the top quintile at the beginning of the time period ended up in the top half of the category at the end of the subsequent time period, while just under 40 percent of the bottom quintile funds did so, for a success rate differential of 14 percent.

While performance doesn’t persist over longer horizons, Bryan found persistence over shorter periods. Looking at one-year time periods, funds in the top quintile outperformed funds in the bottom quintile in every category, a fact Bryan attributes to their exposure to momentum stocks.

“Funds that have outperformed over the past year, they hold a higher portion of stocks that have outperformed over the past year—no surprise there,” he said. “But those stocks often continue to outperform over the next several months.”

The differences in performance could also be related to the style or sector exposures of a particular portfolio. For example, top-performing managers in 2009 and 2010 may have been more heavily weighted toward technology and consumer cyclical stocks, which tend to bounce back more but don’t do as well in market downturns, Bryan said. In 2015, the healthcare sector did really well, while energy did poorly.

“Sometimes it’s being in the right place at the right time, and it’s not reasonable to expect those things to persist,” Bryan added.

That’s why investors have to go one step further than just looking at past performance when selecting fund managers, Bryan said. He recommends looking at a fund’s investment process, the rigorousness of that process, whether they have a competitive edge, pricing, and stewardship. Investors should also look at the people running the funds in terms of their background, the fund’s turnover, how much money the managers’ have invested in their funds, and how they’ve applied similar strategies in other funds.