Fund shareholders pay about $308 million a year for the printing and mailing of shareholder reports, the Investment Company Institute estimates. But a Securities and Exchange Commission proposal allowing the e-delivery of such reports was expected to bring those costs way down - until now.

The ICI submitted a letter to the SEC Monday arguing that third-party processing fees could make the electronic delivery shareholder reports even more costly for fund managers than paper delivery. Broadridge Financial Solutions, in particular, told the ICI that it would interpret New York Stock Exchange rules regarding processing fees in such a way that funds would pay more for not delivering paper reports than they currently pay for print.

The NYSE sets the maximum for these processing fees, which brokers charge funds for shareholder report delivery.

"Under those conditions, ICI asserted that funds are unlikely to use the optional new delivery mechanism, thwarting the SEC's goal in proposing rule 30e-3," the organization said.

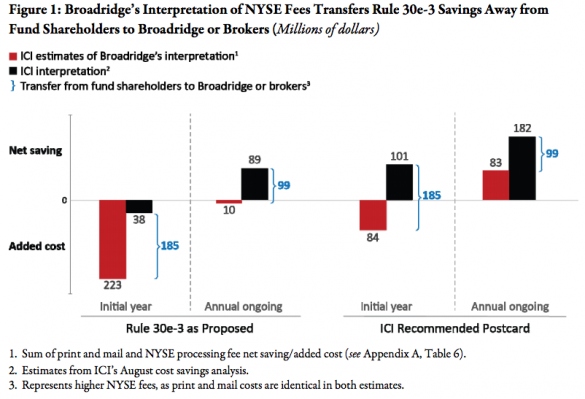

In August, the ICI estimated that the proposed e-delivery rule could save investors $89 million a year after the first year. Those cost savings could be even greater, the ICI contends, if the SEC implements the group's postcard recommendation, where funds would send out a postcard notice indicating the website where a report is available online. This approach would result in savings of $101 million in the first year and $182 million per year after that, the ICI says.

"Our cost savings estimate relied in part on reasonable assumptions about the amount of certain NYSE-sanctioned processing fees that will apply to delivery of mutual fund shareholder reports to broker-held accounts," said Paul Schott Stevens, president and CEO of the ICI, in the letter.

If Broadridge's interpretation of the rule goes through, e-delivery would instead cost funds $223 million more in the first year than the current framework and impose $10 million in extra costs in each subsequent year, the ICI estimates.

Why do ICI's estimates of those fees differ so much from Broadridge's? ICI originally estimated that the $0.15 interim report fee would only apply to mailed shareholder reports, while Broadridge plans to apply the fee to all accounts, whether the reports are mailed or suppressed. In addition, the group initially estimated a blended "notice and access" fee of $0.07 for funds that rely on the rule. But Broadridge estimates a blended average "notice and access" fee of $0.15, and again, this fee would be applied to suppressed accounts, which ICI did not account for.

"Broadridge remains fully committed to working with the industry to reduce printing and postage costs," said Chuck Callan, senior vice president regulatory affairs at Broadridge, in a statement. "Broadridge believes e-delivery continues to be the best solution among all the alternatives discussed."

The ICI believes the SEC should create a separate, specially tailored fee schedule for processing costs associated with the delivery of fund materials, and that the Financial Industry Regulatory Authority should be responsible for developing and administering that fee schedule.

Brokers, after all, are obligated to deliver shareholder materials provided by the fund, but the vast majority of them use one vendor to handle it for them - Broadridge, said David Blass, ICI's general counsel. But this can lead to abusive practices, such as broker kickbacks. Brokers can charge funds the maximum fee allowed under the NYSE rules, negotiate a lower fee with the vendor, and then pocket the difference.

"FINRA is the only appropriate self-regulatory organization for developing and scrutinizing these fees, as investor protection is integral to its mandate," Stevens writes.

"We're stuck in a paper format, which stifles innovation in how we go about communicating with our customers," Blass told Wealthmanagement.com. "Funds don't have the negotiating ability to change how this vendor does its business because the vendor is not our vendor; it's really the broker/dealer's."

Click to Enlarge

Click to Enlarge