Attracted by fast-growing economies, investors have poured money into the emerging markets in recent years. But lately some of the hot performers have cooled. The returns have been particularly disappointing in the largest emerging markets—Brazil, Russia, India, and China (the BRICs).

This year through June 7, iShares MSCI Emerging Markets ETF (EEM) lost 8.3 percent, while the S&P 500 gained 16.3 percent over that period, according to Morningstar. Over that same period, iShares MSCI Russia (ERUS) was down 14.8 percent, and iShares FTSE China 25 (FXI) declined 11.8 percent.

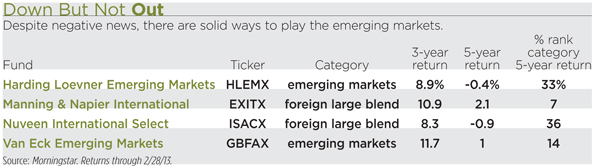

Responding to the bad news, investors have started dumping emerging markets funds. Should you join the exodus? Not necessarily. But the recent downturn should serve as a wake-up call that conditions in the emerging markets are changing. In the past, investors could get strong returns by buying ETFs and index funds that had big weightings in the BRICs. In coming years, the BRICs may not lead. To get the best returns, investors should prefer ETFs and actively managed funds that can provide exposure to smaller countries.

The BRICs captured attention during a gigantic rally that began in 2003 and lasted for four years. During that period, the iShares MSCI Emerging Markets ETF—which has 40 percent of its assets in BRICs—returned more than 37 percent annually. The gains occurred as China and other countries recorded double-digit growth. But since then the BRICs have slowed. China’s growth rate dropped from 10 percent in 2010 to 8 percent in 2012. India’s rate dropped from 11 percent to 4 percent. While the BRICs stumbled, smaller countries accelerated. In the Philippines, GDP growth reached 6.6 percent in 2012, up from about 4 percent the year before. Helped by the gains, iShares MSCI Philippines (EPHE) gained 9.3 percent this year.

The Fall of the BRICs

Fund managers argue that the BRICs are not likely to retake the lead any time soon. The big countries are becoming slow-growing mature economies, while many small emerging markets are entering new growth phases. David Semple, portfolio manager of Van Eck Emerging Markets (GBFAX), said that the BRIC stock markets are dominated by big cyclical companies, including banks, manufacturers, and commodity producers. Many of the businesses have large government ownership and sell to sluggish markets in the developed world. “Among the mega caps in the emerging markets, there is an overrepresentation of cyclical plays that are not particularly well managed,” he said.

China could prove particularly disappointing, said James Upton, a portfolio manager for Morgan Stanley. Upton said that healthy emerging markets should spend 25 percent to 35 percent of their GDP on infrastructure projects and other investments. But China has been spending 48 percent on investments, an amount that is unsustainable. Recognizing that it no longer needs to invest so heavily on high-speed trains and state-of-the-art airports, the Beijing government is reducing expenditures, which will slow the economy. While the Chinese regime struggles to control growth, other governments are liberalizing rules and encouraging the private sector, said Upton. He urges investors to overweight countries such as Thailand and the Philippines, which have been attracting foreign investors by streamlining regulations. “When governments make genuine improvements, they create a virtuous circle that attracts foreign direct investment,” he said at a recent investment conference.

Smaller Plays

For exposure to the emerging markets, consider actively managed funds that have the flexibility to diverge from the benchmarks and invest in smaller companies and countries. A top choice is Van Eck Emerging Markets. Semple favors consumer businesses that can benefit from booming local markets. “People will increasingly want to own the domestic demand plays in the emerging markets,” he said.

A holding is Dogus Otomotiv, which distributes Volkswagens in Turkey. Despite recent political problems in the country, consumers have continued shopping for cars. The company has been increasing its market share and making plans to expand in the Middle East.

Another solid fund is Harding Loevner Emerging Markets (HLEMX). Portfolio manager Richard Schmidt steers away from Chinese banks that are burdened by government control and heavy debt. Instead, he looks for companies with good management teams and strong domestic franchises. His top choices have healthy balance sheets and the ability to grow for long periods. Such stocks are not always cheap. “On average, our portfolio is more expensive than the market,” he said. “We pay a higher price because we are getting better quality.”

A holding is Natura, which sells cosmetics door-to-door in Brazil. Schmidt said that cosmetics sales have been climbing as Brazilian women become more prosperous. With strong ties to customers, Natura has been able to fend off a challenge from Avon.

Funds with Some Exposure

For diversification, some clients may prefer broad international funds that put some assets into the emerging markets. A top choice is Manning & Napier International (EXITX), which has about 15 percent of assets in the emerging economies of Asia and Latin America. In 2011, portfolio manager Marc Tommasi lowered his allocation to the emerging markets, fearing that shares had become rich. As prices have plummeted, he started shopping again.

Tommasi often invests according to themes. When Japan began stimulating its economy, he bought a basket of companies that stood to benefit from a stronger Tokyo stock market. Lately he has been focusing on companies that can profit from the growing wealth of consumers in the emerging markets. One holding is Charoen Pokphand Foods, a Thai producer of meat and animal feed. Tommasi remains wary of exporters. “We have little interest in companies that are selling to developed markets with anemic economies,” he said.

Another strong performer is Nuveen International Select (ISACX), which has 21 percent of assets in emerging markets. Nuveen employs three subadvisors, including two who specialize in the developed world and one that focuses on the emerging markets. While the subadvisors pick individual stocks, in-house Nuveen managers use futures and ETFs to tilt the portfolio toward attractive countries and industries. Since shares have tumbled, the portfolio managers have shifted to a slight overweight in emerging markets. But they remain underweight China. “The new government is opposed to providing stimulus that would lead to short-term improvements in the growth environment,” said Nuveen portfolio manager Keith Hembre.