In my commentary last month, I talked about the “Insurance Gap” and how many advisors are missing a significant opportunity in their practice by not including insurance as an integral part of their client’s financial plan.

This month, I’ll take a look at the breakaway advisor who is in the best possible positions to incorporate insurance into their firm with a proactive and well planned approach from the onset.

As the breakaway movement continues to gain momentum with wirehouse advisors moving into the independent space, the product and service solutions available are becoming more diverse and sophisticated. Compliance, marketing, and technology are well established and are on the top of most advisors’ checklist. However, insurance is still often viewed as an afterthought for many breakaways who often take a figure it out as I go approach. Unfortunately, these temporary ‘band aid’ type solutions seldom serve the firm or client’s best interest in the long run. As an example, one of our client’s solutions when initially launching their firm was to handle insurance internally until they figured out something better. Fast forward five years, and one of their two assistants was spending 60% of her time on insurance related issues, while insurance only accounted for 3% of their revenue. This scenario is not uncommon.

Furthermore, many wirehouse advisors are used to having internal departments to handle their clients’ insurance needs. Once moving into the independent model, the value of duplicating this service is often missed. Advisors who attempt to handle insurance internally, without the proper infrastructure, find themselves buried under a pile of paperwork and illustrations. The right insurance solution can save advisors time and money.

So, where and how does one begin planning to incorporate insurance in their new firm? Being aware and educated of the options available is a good first step in the process. I recommend one of two options, on the surface they may seem similar but they have distinct differences:

Insurance Experts or consultants work closely with your firm on all insurance matters, not just new policies. Consider them an “insourced” insurance department for your firm. They will review existing policies, provide ongoing service for all policies and oversee the new business process including preparing presentations, applications and the entire underwriting process. The expert may be brought in for client meetings to present analysis and recommendations that the advisor has reviewed and agreed to in advance.

This relationship has the benefits of control, oversight and having your clients interact with a professional whose primary goal is not to make a sale or drive commissions. It is similar to bringing in a trust and estates attorney or a CPA. They are experts who provide consultation for your clients in the areas of insurance. Meanwhile, the relationship adds no work to you or your team and assumes all the back office and servicing requirements for your client’s insurance policies. If you are licensed and wish to receive commission, a revenue share can be arranged.

Brokerage General Agency, generally referred as a BGA, can be an excellent solution for licensed advisors who simply need access to insurance information from carriers and underwriting support. Advisors working with a BGA will get 100% of the commission and overrides, but will be responsible for all interactions with the clients and servicing all policies. BGA’s provide varying levels of analyses and back office support including; complete analysis preparation, existing policy inquiries and analysis, recommendations, medical exam scheduling and underwriting. Greater service and back office support is generally offset by lower override payouts. For advisors who can handle the bulk of the insurance internally, a BGA with limited servicing and higher payouts might be a better fit.

When evaluating BGA’s you want to understand their support levels for underwriting, case management and how frequently they update you on case status. Compensation models will vary depending on levels of production and service and generally all comp models are negotiable.

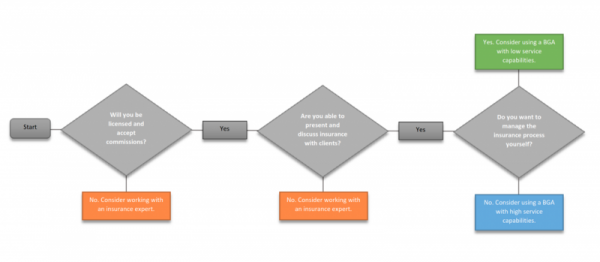

The matrix below will help you decide the likely best solutions for your firm.

To help you get started in properly integrating insurance into your new firm, here are 5 basic steps to consider:

- Determine the appropriate structure for your firm; working with an expert or BGA.

- Assess the various partners to determine who best shares similar insurance philosophies to you, your firm, and your clients.

- Develop a customized service and analysis process with the chosen partner that meets your firm’s need.

- Announce the new service to your clients in segmented groups of 10-20 (This allows you to assess the relationship overtime.)

- Incorporate insurance reviews as a standard operating procedure in all client review and prospect meetings.

As you set out to launch your new firm, make sure that you’ve considered insurance as part of your checklist. Advisors who research and plan for insurance as a key component to their practice can create a significant advantage in both differentiating their firm and better serving their clients.

Kellan Finley is Managing Director for Insurance Decisions www.in4fa.com, providing insurance resources for Registered Investment and Independent Advisors.