The Institute for the Fiduciary Standard has advocated for a fiduciary standard since Knut Rostad helped found the organization in 2011, but it isn’t about to rest on its laurels now that the Department of Labor has introduced a fiduciary rule.

On Tuesday, the Institute launched the “Campaign for Investors” initiative to help put the fiduciary standard in context for investors by providing educational tools and resources. The goal is to inform investors on what to expect and insist on from a financial advisor, as well as help them find, screen and evaluate an advisor that fulfills those requirements.

The Campaign for Investors also aims to help advisors adjust their business to serve their clients’ interests and remain a valuable resource.

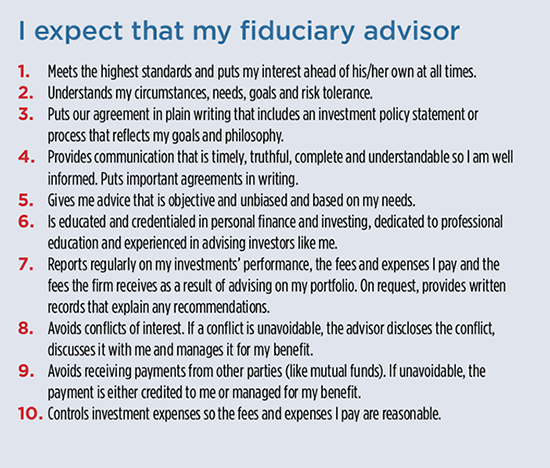

The campaign includes a new “Investor Bill of Rights,” which distils the Institute’s 11-page document on advisor best practices into a 10-point list.

“The principles that we’re talking about have inspired the leaders of this budding profession since its origin,” Rostad said at a kick-off event at the National Constitution Center in Philadelphia. “The campaign believes most of us have experienced the benefits of advice at some time in our lives, be it from a good friend, a family member or a trusted expert. Likewise, we believe investors can benefit from excellent financial advice.”

Rostad told WealthManagement.com what constitutes “best interest” will evolve before the rule is fully implemented in 2018, as financial services professionals have as many different definitions as health professionals have for “healthy diet.” But Rostad wants the Campaign for Investors to help advisors embrace the Investor Bill of Rights and help them implement best practices.

Mary Malgoire, the founder of a fee-only advisory firm and the former president of the National Association of Personal Financial Advisors, introduced the Campaign for Investors website, which investors can use to look for investor feedback about an advisor, or for any compliance infractions at both the state and federal levels.

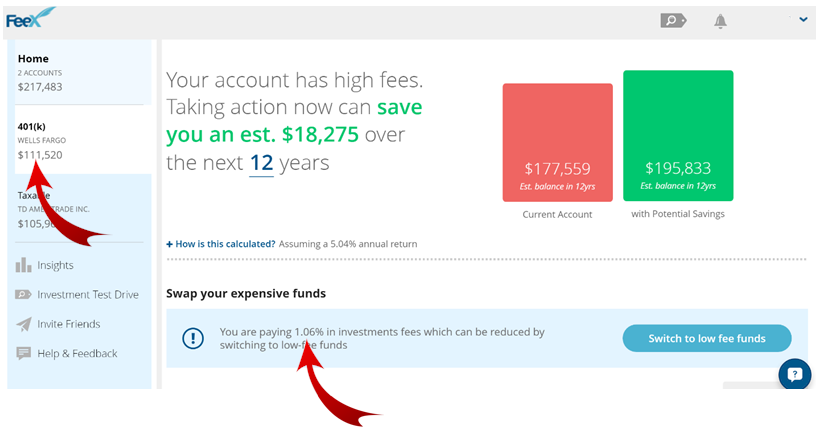

The Campaign for Investors also partnered with FeeX to provide a calculator for investors to see the total fees they pay, how they compare to other users receiving similar services, and how much the investor could save in each account over the long term by switching advisors.

The website can also recommend an advisor who best fits an investor’s needs, or help them understand if they even need to work with an advisor.

The Tuesday event also featured a speech by Vanguard founder John Bogle, who praised the DOL’s fiduciary rule as “the first step” towards a rule he’s been seeking since he wrote his senior thesis at Princeton University 65 years ago.

“This standard should be applied to every dollar invested,” Bogle said. “Put the investor first; it’s not that complicated.”

Personal Capital founder Bill Harris and Private Advisor Group’s managing director, Patrick Sullivan, shared their thoughts on how the DOL rule will affect investors and the industry. Phyllis Borzi, assistant secretary for the DOL’s Employee Benefits Security Administration, discussed how the rule was created and plans for enforcing it, which she admitted are still muddled.

“Consumers have to enforce the rules through state contract actions,” Borzi said. “We have to rely on all of you to act as private attorneys general.”

You can watch the full event below.