Wealth managers are maintaining only a tenuous grip on their client bases—and technology, or lack thereof, may be to blame.

A recent report by PricewaterhouseCoopers casts light on just how unsatisfied clients are, generally, with the advice they’re getting from advisors and draws contrast between high-net-worth clients’ enthusiastic adoption of technology and the overarching lack of tech literacy that plagues the wealth management industry as a whole. This dissonance, PwC believes, leaves the wealth management industry particularly vulnerable to disruption from FinTech innovators.

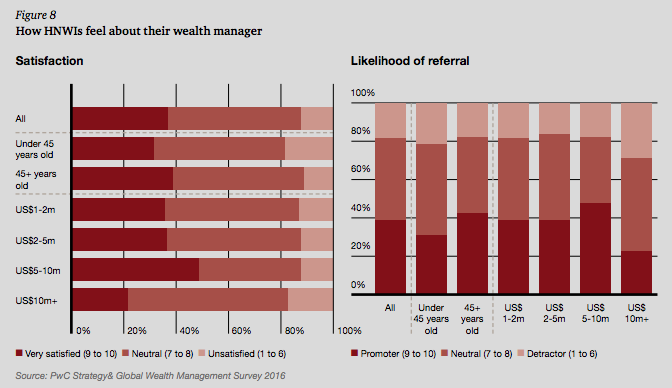

PwC’s quantitative research of over 1,000 high-net-worth individuals (defined as those with over $1 million in investable assets) offers some revealing insights into the minds of these clients. This group is among the most receptive to receiving professional financial advice, yet only 39 percent of respondents said they’d be likely to recommend their current wealth manager to others. That number falls to an even more dismal 23 percent among the wealthiest segment surveyed, those with over $10 million.

Insecurity seems to run rampant among HNW individuals as well, as less than 40 percent are confident in their abilities to achieve their life’s goals. Meanwhile, 55 percent worry about losing their money, and 52 percent worry about being taken advantage of. So, while this group is open to financial advice, their insecurities are legion, and their trust can be hard to earn. Investment returns are paramount. HNW individuals are willing to pay a professional to do a job better than they could do themselves. They do it in other aspects of their lives; 64 percent rely on professionals for non-financial advice of some kind, and expect the same level of service and results from their wealth managers.

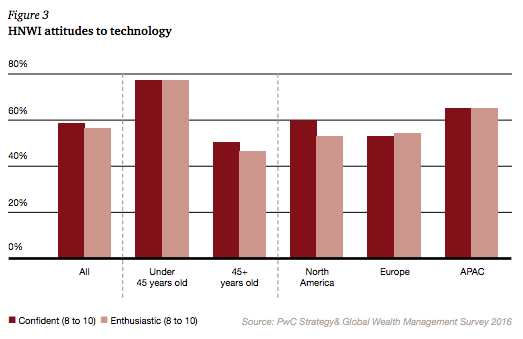

Technology is one of the primary areas where the wealth management industry is failing to live up to HNW expectations. Eighty-five percent of them use three or more digital devices, and 98 percent access the Internet on a daily basis. In terms of general attitudes towards technology, nearly 60 percent of HNW respondents answered “confident.” That number jumps to nearly 80 percent among those 45 and under.

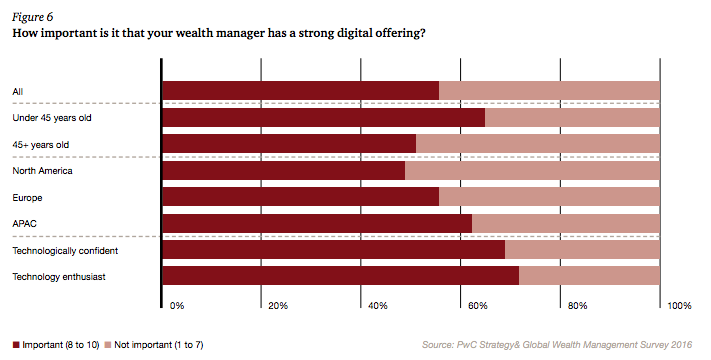

In terms of their finances, 69 percent make use of mobile or online banking, nearly 60 percent use digital means to communicate with their advisors and over 40 percent use online means to review and monitor their portfolios. Well over half say it’s important that a prospective wealth manager have a strong digital offering.

However, when asked what they value most about their current wealth advisor, respondents ranked “technical capabilities and digital offerings” eighth out of 11 possible options. Only about 25 percent of wealth managers currently offer digital services beyond banking. Many others consider their digital duty done simply by setting up a website. According to PwC, wealth advisors are missing the opportunity to add value where there is clearly demand.

Wealth management firms should acknowledge this reality and stop viewing digital services as red herrings and more as integral parts of their businesses.