Most market observers continue to point to the absurdity of equity price levels and inherent valuations, but the truth of the matter is that the one truly expensive market, on an unprecedented and global scale, is fixed income (with a few exceptions).

A recent report published by S&P Global (Standard & Poor’s) now highlights the risk in corporate bond markets as a result of accommodative central bank policies, which are primarily focused on fueling economic progress through credit growth. In summary, S&P suggests that “monetary policy easing has thus far contributed to increased financial risk, with the growth of corporate borrowing far outpacing that of the global economy.” It is expected that corporate debt will increase by approximately 50 percent (from $51 to $75 trillion) between 2016 and 2020 to nearly 100 percent of global GDP (!)—and these figures only represent S&P’s base-case scenario. Just as concerning as the sheer volume is the underlying quality of this debt pool, with nearly half of all rated and unrated non-financial companies related to the aggregate issuance being highly levered when measured by two metrics: Funds-From-Operations (FFO)/Debt ratio (less than 12 percent) and EBITDA/Debt ratio (in excess of 5x).

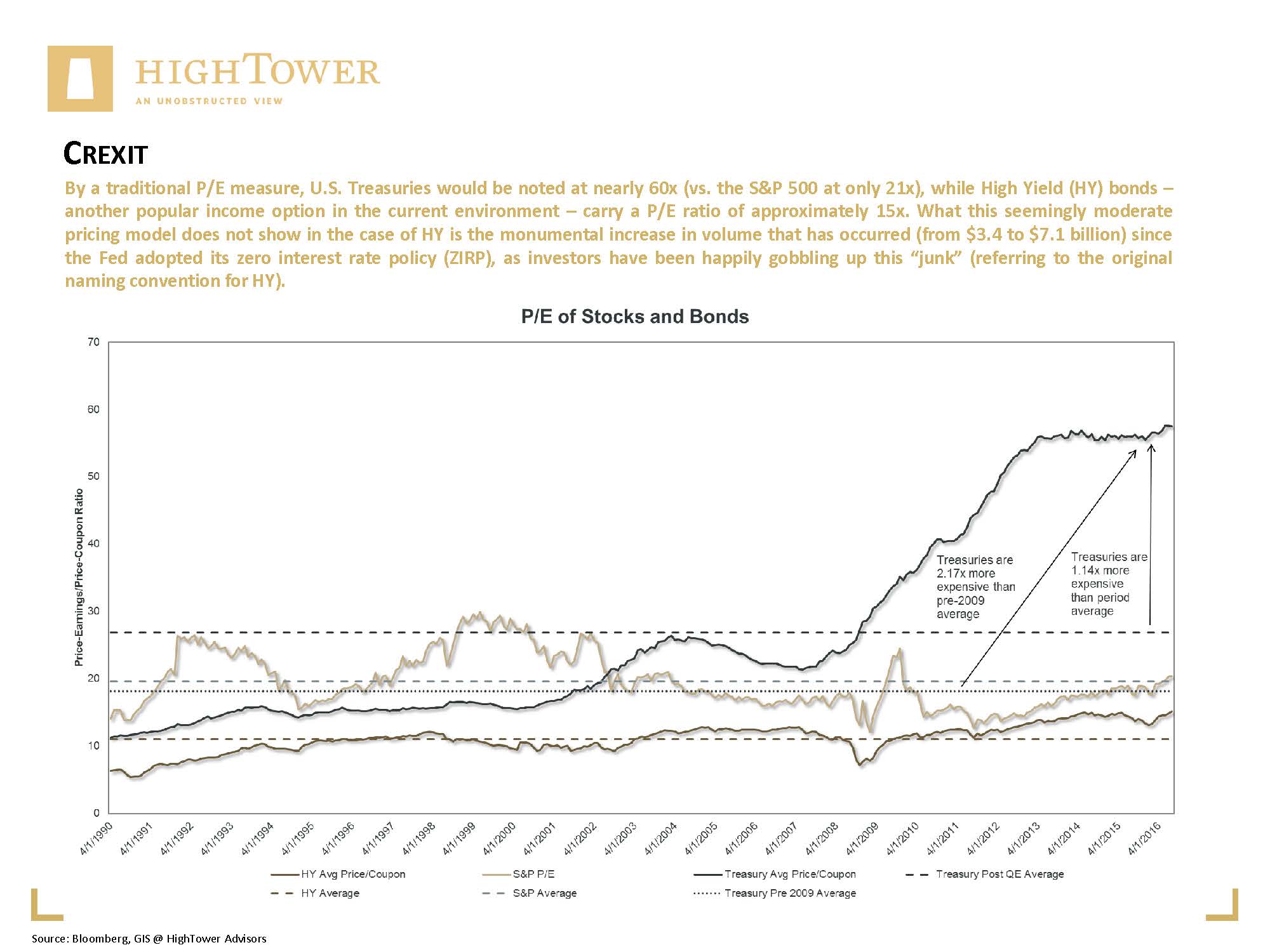

In support of S&P’s argument, our own work translates fixed income from the conventional yield perspective to the price/earnings (P/E) framework more commonly used to assess the value of equities. This approach shows that the U.S. 10-year Treasury bond is 100+ percent more expensive than the average observed over the past 25 years, and 200+ percent more expensive than the average observed before 2009, the year marking the onset of rampant financial stimulus provided by the Fed and other central banks.

By a traditional P/E measure, U.S. Treasurys would be noted at nearly 60x (versus the S&P 500 at only 21x), while High Yield (HY) bonds—another popular income option in the current environment—carry a P/E ratio of approximately 15x. What this seemingly moderate pricing model does not show in the case of HY is the monumental increase in volume that has occurred (from $3.4 to $7.1 billion) since the Fed adopted its zero interest rate policy (ZIRP), as investors have been happily gobbling up this “junk” (referring to the original naming convention for HY).

A related concern is the issuance of debt by particular countries and/or industry sectors. Of the total debt pool in corporate bonds, China’s ownership from actual outstanding debt (2015) plus projected demand (by 2020) is expected to increase from 25 percent to 43 percent. Citing specific industries, such as metals and mining; and oil, gas and inflammable fuels, leverage increased to 85 percent and 130 percent, respectively, between the years 2010 and 2015. A potential related fallout in these areas should not only impact bonds, but the equity structure of these investments as well.

To conclude on S&P’s analysis, it is a lack of critical review (or even lack of understanding, from an investor’s perspective) that may form one of the most underappreciated risks in the world today. Just as a change in appetite for risk triggered the pullback by lenders in real estate that predated the housing crisis of 2006 (ultimately resulting in the financial crisis of 2008–2009), the inconvenient truth is that, at one point, the quality of much (subpar) corporate debt could be questioned, potentially leading to a subsequent pullback in this segment—a likely disorderly event that S&P has dubbed the “Crexit.” Time to review bond holdings!

Matthias Paul Kuhlmey is a partner and head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to high net worth and ultra high net worth individuals, family offices and institutions.