A few weeks ago there was a lot of hand wringing among pundits about a precipitous spike in the gold/oil ratio. The ratio, derived by dividing the per-ounce price of spot bullion by the barrel cost of WTI crude oil, is widely believed to be a predictor of economic booms and busts. On its face, the ratio simply tells you how many barrels of oil you can buy with one ounce of gold.

Realistically, the ratio has some predictive value but not in the way many observers think.

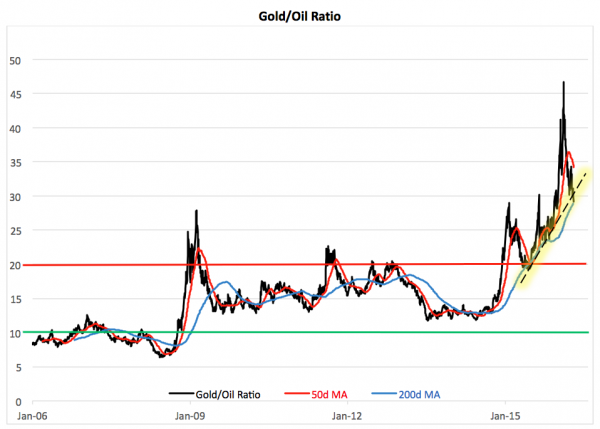

All the recent fretting arose when the ratio shot up to record highs amid a glut of crude. At its peak in February, the ratio topped 47-to-1 (47 barrels of crude vs one ounce of gold). To put this into perspective, take a look at the chart below. Over the past decade, counting all the peaks and valleys, the average ratio’s been 15-to-1, so a 47 print was, indeed, news.

But as you can see, the ratio’s been running hot for more than a year, most recently bolstered by a resurgent gold price.

Dire predictions of economic catastrophe ensued. In some quarters, a ratio of higher than 20-to-1 heralds a crisis. There’s some historical basis for this contention, counting the LatAm and Asian currency crunches of the 1990s, the 2008 financial crisis and the more recent emerging market blowup.

But what does the even more recent falloff in the ratio portend? Just last week, at 29-to-1, the ratio slipped under its uptrend support level, threatening to pierce a 200-day moving average.

The ratio’s ability to predict booms and busts is debatable. We can say with more certainty that the ratio spikes around financial crises because oil prices tend to plummet, and gold tends to soar, when economic growth weakens.

So, here’s the real deal. The more it costs to buy oil in gold terms the more likely crude is overvalued and vice versa. Savvy investors often play on these relative mispricings.

Historically, after each peak in the ratio – when oil is undervalued relative to gold – oil outperforms. And not by a little bit.

For the long term, it’s more likely a time to buy oil, or oil proxies like the U.S. 12-Month Oil Fund (NYSE Arca: USL), rather than gold.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.