Sometimes it’s a good idea to keep track of ETF prices even you have no inclination to buy them. Why? Because they give you clues about investor sentiment.

Take the new generation of beta-tilted funds as an example. One of the most popular since its 2011 debut has been the PowerShares S&P 500 Low Volatility ETF (NYSE Arca: SPLV) which tracks the 100 least volatile stocks in the S&P 500. As you might imagine, risk-averse investors who want equity upside like SPLV.

On the other side of the fence are buyers of the PowerShares S&P 500 High Beta ETF (NYSE Arca: SPHB). SPHB’s portfolio is comprised of the 100 most volatile S&P 500 components. SPHB investors embrace, even crave, risk.

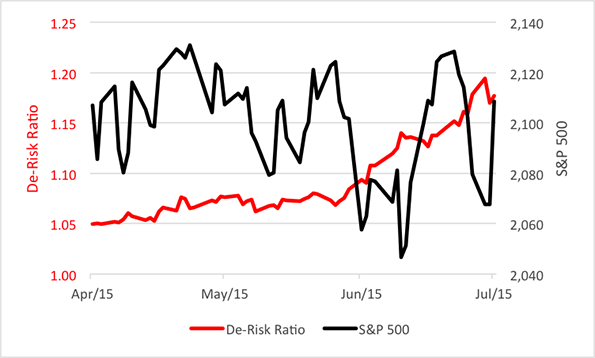

You can get a sense of equity investors’ risk appetite by tracking the SPLV/SPHB price ratio. The low-vol ETF now trades at the $38 level while the high-beta product’s worth $32 or so, yielding a 1.18 ratio (SPLV over SPHB).

The ratio by itself won’t tell you much until you put some context around it. Just three months ago, the ratio was 1.05, 12 percent lower than it is now. And the S&P 500? What’s happened to the broad market? Well, nothing really. The blue chip index has churned a bit, but it’s at the same level as it was at the end of April.

Diagnosis? Stocks have stalled as investors de-risked.

Stock Investors Shying From Risk

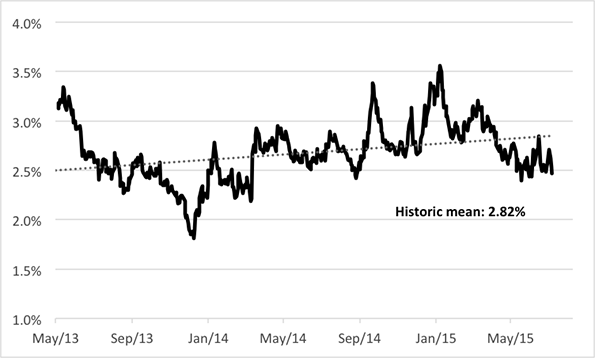

If you don’t care about ETF ratios, you’ll find a similar scenario played out in the equity risk premium. The ERP, the difference between the S&P 500’s earnings yield and the ten-year T-note yield, represents the excess return demanded by investors for taking on the higher risk associated with stocks.

Historically, the ERP has averaged 2.82 percent, but has varied mightily over its 140-year history. Right now, blue-chip stocks command a 2.47 percent premium. At the end of April, the ERP was smack dab on its average at 2.82 percent, 12 percent higher.

Equity Risk Premium Below Trend

A 12 percent rise in the de-risk ratio versus a 12 percent decline in the equity risk premium. That’s no coincidence.

No matter which way you measure it, equity investors have become gunshy. And until they decide to pull the trigger, stocks aren’t likely make new highs.